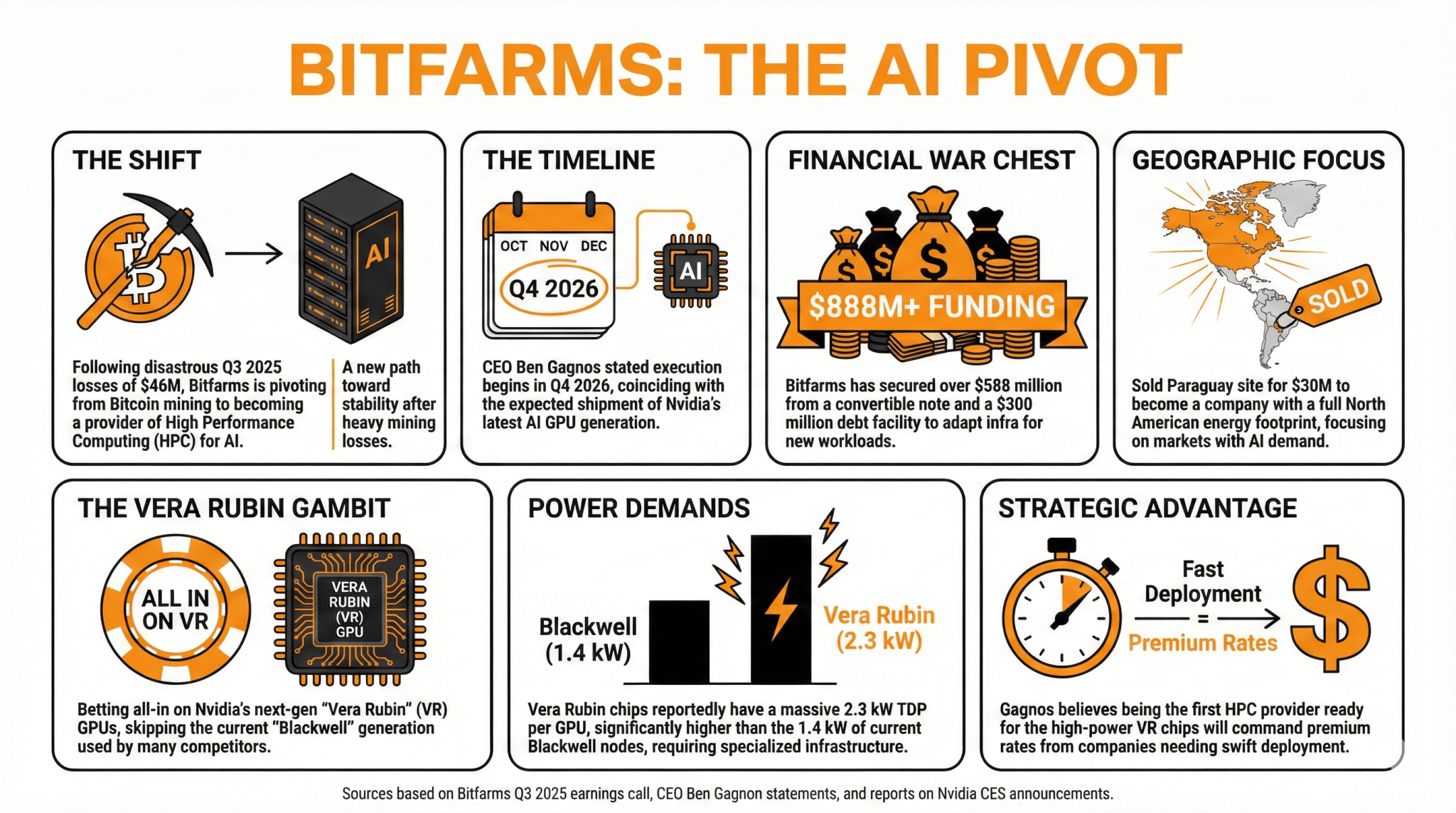

Bitfarms, one of many largest publicly traded Bitcoin miners, has determined to desert its roots and pivot to the HPC market, abandoning its Latin American base and turning into an organization with a totally North American vitality footprint. Will this transfer work for the corporate?

Bitfarms: From Bitcoin mining to AI HPC

Bitfarms, one of many high publicly traded Bitcoin mining corporations within the US, is now shifting its focus to turning into a supplier of excessive efficiency computing (HPC) providers for AI (synthetic intelligence) corporations.

After reporting disastrous losses amounting to as much as $46 million within the third quarter of 2025, the corporate introduced that it will pivot to those new actions as a way to search a brand new path in direction of stability and shift all efforts to realize this process as quickly as doable.

In the identical earnings name, Bitfarms CEO Ben Gagnos stated he expects this pivot to be accomplished by the fourth quarter of 2026, as Nvidia's newest AI GPU (codenamed Vera Rubin) is scheduled to ship across the identical time.

To attain this goal, BitFarms has allotted over $588 million in conflict chest from a convertible observe difficulty and $300 million in debt amenities to start the work essential to adapt its infrastructure to those new workloads.

Moreover, Bitfarms not too long ago organized the sale of its final Latin American website in Paraguay for $30 million, remodeling it into an organization centered on markets with demand for AI workloads and absolutely leveraging North American vitality.

Vera Rubin's technique

That's in distinction to different corporations which might be betting on adapting their gear to the present technology of Nvidia GPUs, code-named Blackwell, which most corporations within the AI trade, together with OpenAI, are utilizing.

Bitfarms has determined to focus all its efforts on Vera Rubin (VR), a brand new infrastructure that Nvidia CEO Jensen Huang introduced on the current Client Electronics Present (CES) as already in manufacturing.

Latest unconfirmed stories point out that these chips have a thermal design energy (TDP) of two.3 kW per GPU, which is on the threshold for present information facilities serving Blackwell hundreds. Second-generation Blackwell chips devour a complete of 1.4 kW, and adapting new information facilities to this energy envelope takes time and funding.

Bitfarms is working to be the primary supplier to allow VR chips, with the corporate's Washington website being the first hub for this rollout, as Gagnon says it has “the potential to generate extra internet working earnings than we've ever generated from Bitcoin mining, offering a powerful money circulation basis for the corporate.”

Throughout Bitfarm's Q3 2025 earnings name, Gagnon identified that merely having this infrastructure prepared on the proper time might be an enormous benefit as it should entice corporations seeking to shortly deploy these chips.

“Lots of the infrastructure that's being constructed right now is just not going to be appropriate with the following technology, and with corporations allocating all this cash to those Vera Rubin GPUs, there's going to be a variety of financial incentive to deploy them,” he stated.

Moreover, Gagnon is betting that AI gamers might be incentivized to deploy these belongings shortly and be prepared to pay increased charges to get operational earlier than different gamers. “Do you simply use GPUs with out deploying them? Or do you pay increased infrastructure prices to deploy GPUs and begin monetizing your belongings?” he requested.

Whether or not Gagnon's predictions are correct stays to be seen, however Bitfarms might be one of many first corporations to supply information heart assist to Vera Rubin, and its providers are gaining demand.

learn extra: BitFarms withdraws from Latin America following sale of Paraguay website

Steadily requested questions ❓

- What main modifications is Bitfarms making in its enterprise focus? Bitfarms is pivoting from Bitcoin mining to offering excessive efficiency computing (HPC) providers for synthetic intelligence corporations.

- Why is Bitfarms shifting focus now? After going through important losses, $46 million Looking forward to the third quarter of 2025, the corporate is pursuing new income sources to stabilize its operations.

- What monetary sources is Bitfarms leveraging for this transition? The corporate has secured greater than $588 million convertible banknotes and 300 million {dollars} Debt amenities to assist adapt your infrastructure to HPC providers.

- How is Bitfarms positioning itself in relation to Nvidia's new GPU technology? Bitfarms goals to be the primary supplier to assist Nvidia's providers vera rubin The chip is anticipated to enhance effectivity for AI workloads in comparison with the present Blackwell technology.