ETH continues to consolidate about $2,800 underneath main resistance ranges and struggles with larger intrusions after a robust rally in early Could.

The Bulls maintain larger lows within the brief time period, however repeated rejections from the identical stage elevate questions on patrons' convictions at these highs.

Technical Evaluation

Each day Charts

At the moment, Ethereum has consolidated its main resistance at $2,800, in keeping with its 200-day transferring common. The uptrend, which started at almost $1,500, has paused, reflecting a slight drop in RSI beneath 70, reflecting a weaker bullish momentum.

Nonetheless, costs exceed the 100-day MA and former breakout zone of almost $2,200. A clear breakout of over $2,800 paves the best way to a provide zone of between $3,400 and $3,600. In any other case, it may set off a retest of a $2,200 demand block.

4-hour chart

The 4H chart exhibits that the worth fashioned a transparent rising triangle between a $2,800 resistance and a help of about $2,500. This construction resembles a possible distribution stage, following two robust accumulation zones beneath $1,850 earlier this month. ETH continues to set larger lows, however repeated rejections at highs are starting to weigh short-term outlook.

The RSI additionally hovered close to 47, suggesting a impartial momentum shift. The breaks beneath $2,500 and the sample's decrease boundary present a bearish reversal to $2,100, whereas a confirmed breakout of greater than $2,800 negates the concept of distribution and helps a rising upward development.

Emotional evaluation

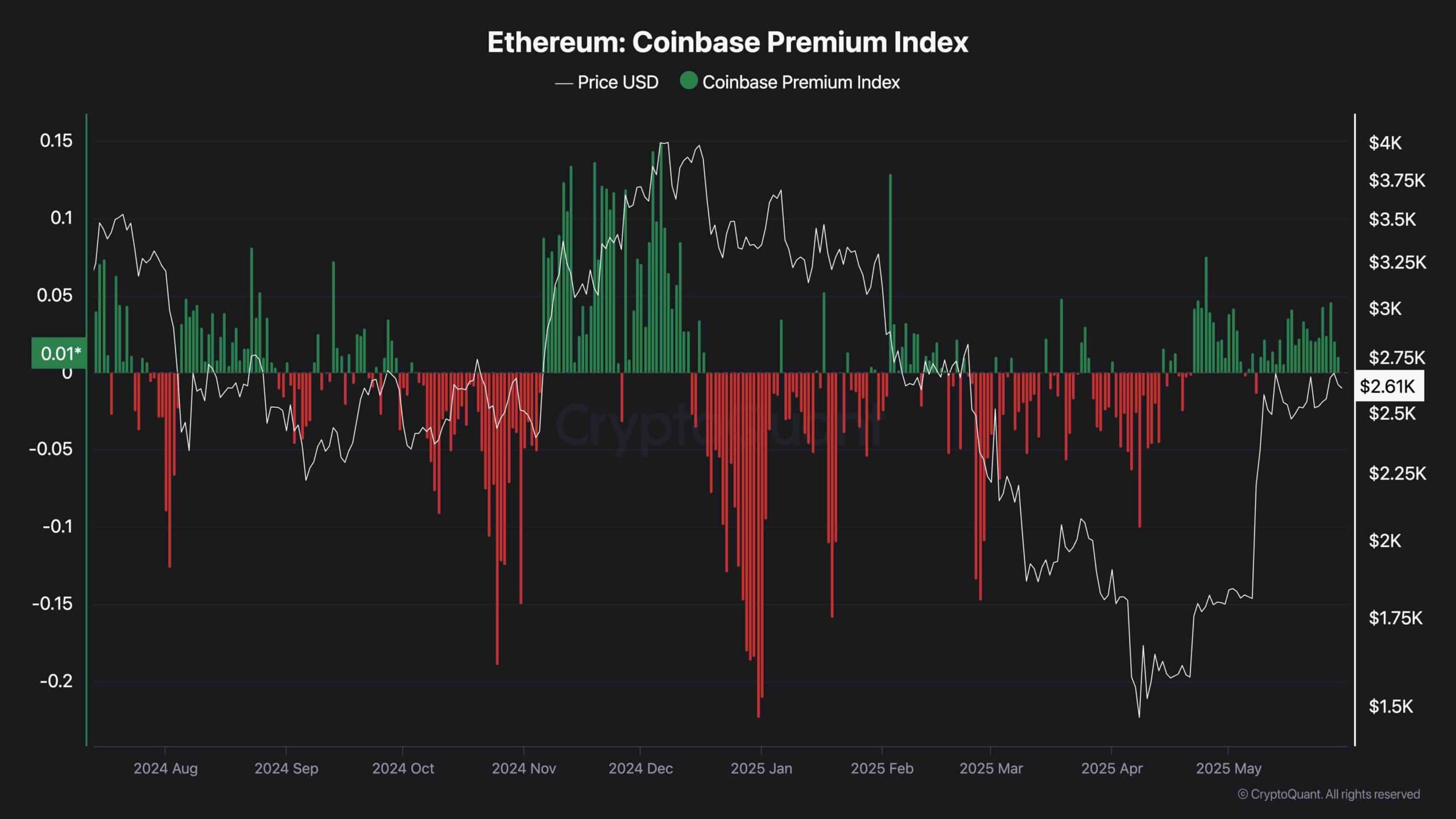

The Coinbase Premium Index is at the moment simply above zero, indicating reasonable spot demand from US-based traders. Traditionally, rising premiums have preceded a robust bullish development pushed by Coinbase institutional or huge retail patrons. Though the present stage will not be aggressively excessive, it displays the elemental energy of the spot market and its willingness to pay barely in opposition to ETH on US exchanges.

As this premium begins to broaden whereas ETH is approaching resistance once more, it may present the forefront of up to date confidence and breakouts. Alternatively, if premiums fade or grow to be damaging, it may point out a decline in curiosity and potential for short-term tops.

Subsequently, if demand from the US drops, it’s seemingly that ETH will enter the revision part once more.