The bullish development stays intact, however Ethereum is in a vital consolidation vary. A profitable retest of $2.8k might ignite the subsequent wave of over $300,000.

Technical Evaluation

Shayan Market

Every day Charts

ETH has just lately seen a noticeable inflow of buy stress, surpassing the important thing $2.8k resistance that has served as a sustained barrier in latest months. This breakout results in the formation of upper costs, indicating a shift in the direction of bullish market constructions in every day time frames.

Nonetheless, we’ve seen that Ethereum is at the moment buying and selling inside a major vary of between 2.8k and three.33 million. The higher restrict of this vary can be in keeping with the bearish order block, suggesting potential provide and gross sales pressures at this degree.

If Ethereum succeeds in exceeding $3.3,000 in resistance, the subsequent bullish goal might be the psychological threshold of 4K, and the primary technical and psychological degree.

4-hour chart

Within the decrease time-frame, Eth's impulsive gatherings have been stopped close to the $3K degree as momentum cooled. The two.8k zone, which was beforehand sturdy resistance, is now being retested as help. A correct pullback to this area will aid you validate your breakout and set up a stronger base to your subsequent leg up.

0.5-0.618 Fibonacci retracement ranges additionally function a possible goal for this steady revision, offering convergence with short-term demand zones.

Within the coming days, Ethereum is predicted to consolidate and repair, setting the stage for an additional bullish rally in the direction of a possible $3.3,000 resistance.

Emotional evaluation

Shayan Market

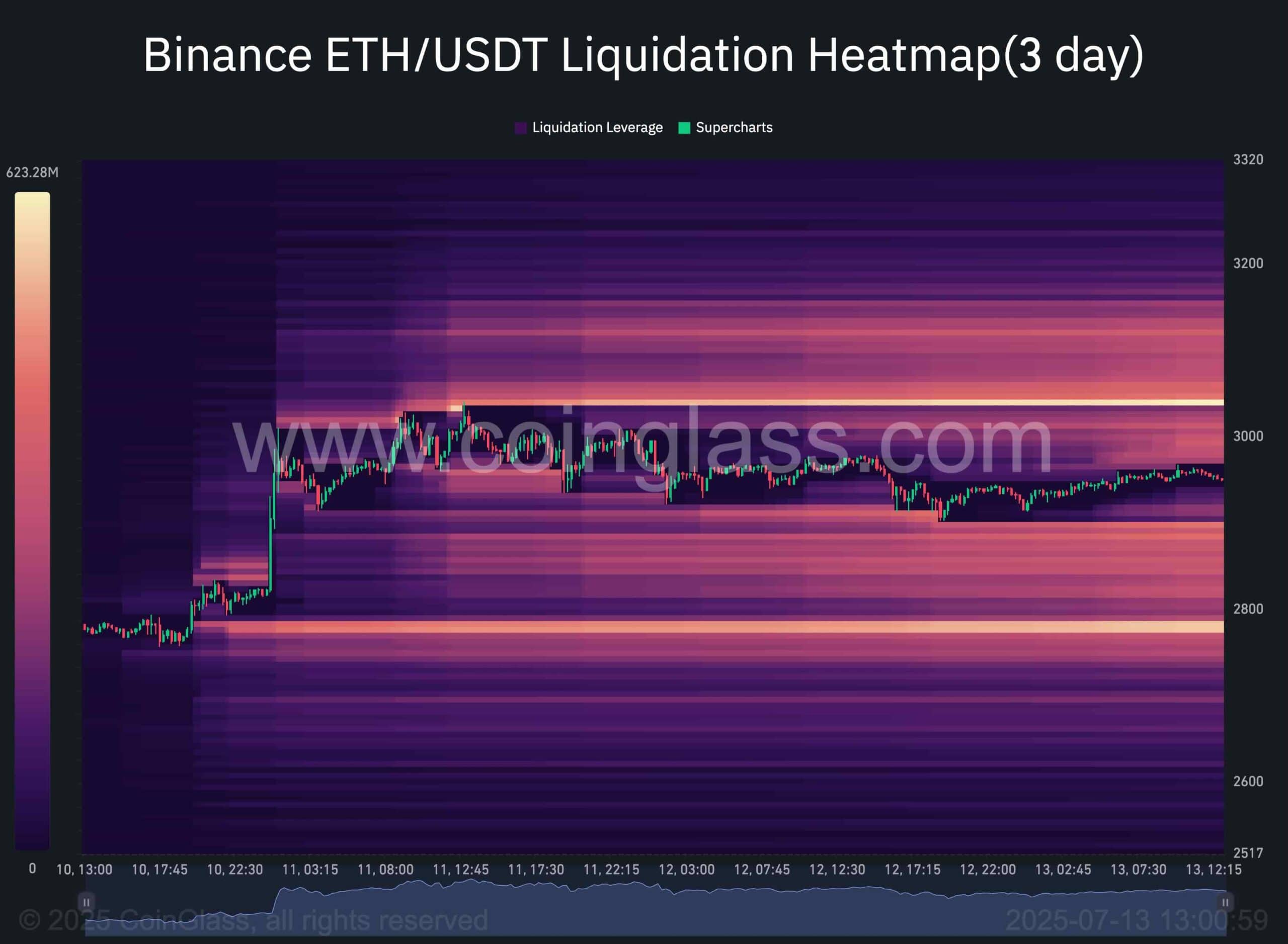

This chart visualizes a binance clearing heatmap that identifies zones the place essential clearing occasions are prone to be unfolded. These areas usually act as flowable magnets and appeal to value motion resulting from focus of leveraged positions. In such a state of affairs, giant gamers or “whales” are likely to reap the benefits of these zones to effectively put out or shut trades.

At the moment, the distinguished liquidation cluster is slightly below the $2.8,000 mark, that means that Ethereum costs are prone to appeal to this degree. If this state of affairs is performed, ETH might full a pullback to this vital help, rekindling bullish momentum and setting the rally's stage in the direction of a $3.3,000 resistance.

Conversely, one other reasonably huge liquidity pool is above the $3K degree, indicating that following the pullback, Ethereum might transfer excessive within the quick time period to faucet this zone, doubtlessly inflicting quick syeeze and much more gas.