Bitcoin mining is on the verge of a significant transformation in 2025, together with the Trump household's partnership with Hat8, together with Tether's ambition to grow to be the world's largest mining firm by the tip of the 12 months.

This can reshape the Bitcoin mining sector and open up the prospects for robust development in 2025. Nevertheless, success is determined by know-how, coverage, and skill to adapt to market fluctuations.

Bitcoin mining will attain new heights in 2025

Within the newest growth, Tether CEO Paolo Ardoino declares plans to deploy 450 MW of mining capability by the tip of the 12 months, protecting 1% of the world's hashrate. This aim is supported by the USDT Monetary Basis, with a market capitalization of USD157 billion. Beforehand, the corporate had deliberate to launch Bitcoin Mining OS (MO) as open supply software program by the fourth quarter of 2025.

“Additionally, many small/medium-sized corporations that produce electrical energy (photo voltaic, …) will quickly begin mining in extra. MOs make their lives simpler,” shared by Paolo Ardoino.

The Tether announcement comes as Bitcoin hashrate sinks to its eight-month low of 684.48 EH/s, the bottom since October 2024. In response to Coinwaltz, mining difficulties are anticipated to fall to 9.5% on June 29, 2025. The disruption in Bitcoin mining coincides with US navy actions in Iran.

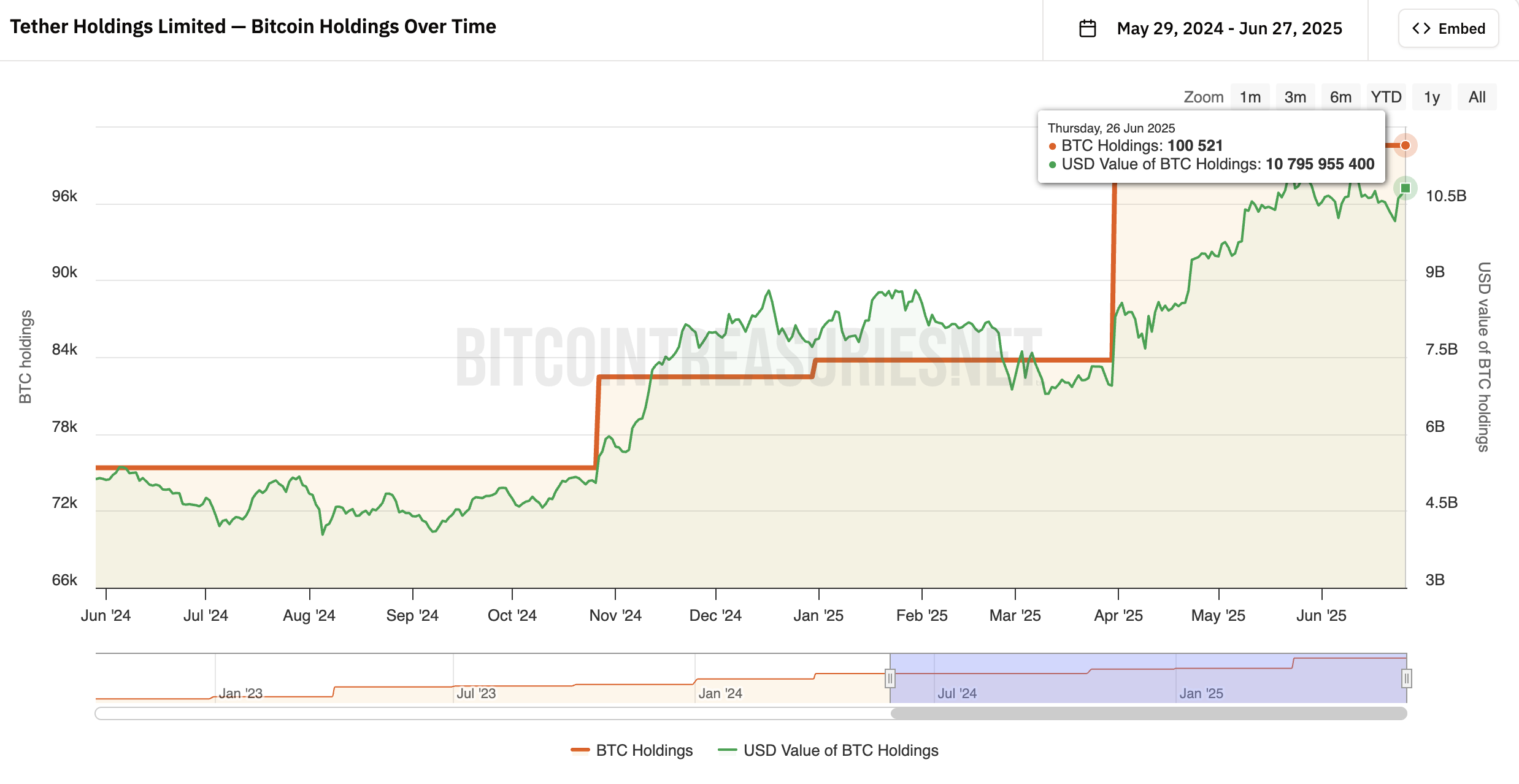

Tether's BTC Holdings. Supply: Bitcoin Treasuries

In response to information from Bitcoin's Treasury, Tether is at present over 100,000 Bitcoin (BTC). That is valued at round $10.8 billion. This creates fierce competitors and accelerates the pattern of centralization as massive corporations outperform particular person miners.

In consequence, as reported by Beincrypto, Bitcoin Miners are promoting their shares to keep up their upward momentum amid rising market instability.

Hat8 beforehand partnered with American Bitcoin on March 31, 2025, with a view to leverage Donald Trump's public help for cryptocurrency.

This collaboration brings new capital and know-how, including doubtlessly 5-10 EH/s to the worldwide hashrate. That is essential as, as beforehand reported by Beincrypto, mining prices have exceeded 34% attributable to rising electrical energy costs.

Advantages and challenges

Technically, due to superior applied sciences just like the Hut 8's optimized cooling system, the involvement of Hut 8 and Tether can decelerate the discount in difficulties when the hashrate recovers shortly.

On the identical time, the code-friendly insurance policies Trump might push if re-elected, together with tax incentives, might help this development. Tether has additionally invested $1 billion in El Salvador's inexperienced mining infrastructure, tailoring international sustainability traits.

Nevertheless, the challenges stay essential as U.S. industrial electrical energy demand rises, placing stress on miners and benefiting massive operators like Hat8 and Tethers because of the economic system of scale.

With Bitcoin stabilising at $105,000 and the US inventory market is declining, mining is going through main alternatives, however success is determined by value administration and regulatory compliance.