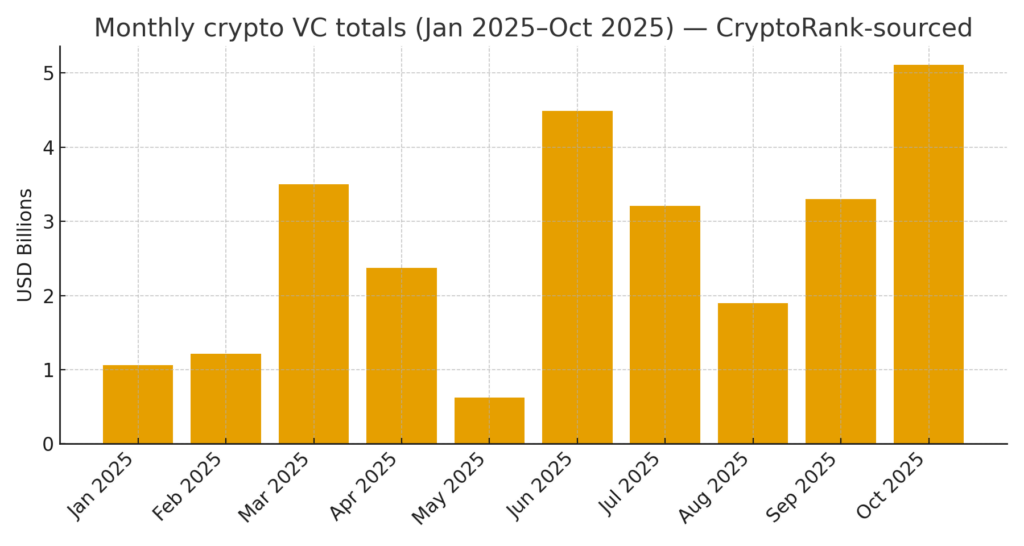

Bitcoin costs ended October down about 4%, however enterprise funding for the month reached $5.1 billion, making it the second-strongest month since 2022.

In keeping with CryptoRank knowledge, October defied its personal seasonal fable, with three mega trades accounting for the majority of it.

Bitcoin has fallen 3.7% over the previous month, which earned merchants the nickname “Uptober” for its historic profitable streak, breaking a sample that has lasted since 2019.

Nevertheless, enterprise capitalists invested $5.1 billion in crypto startups throughout the identical 31-day interval, marking the second-strongest month-to-month complete since 2022 and one of the best VC efficiency of 2025 outdoors of March.

The disconnect between spot market weak point and enterprise market energy creates a puzzle: Both builders see one thing that merchants miss, or just a few large checks are skewing the sign.

Focus speaks volumes. Three offers accounted for roughly $2.8 billion of October's $5.1 billion complete: Intercontinental Trade's (ICE) strategic funding of as much as $2 billion in Polymarket and Tempo's $500 million Collection A. Rounds led by Stripe and Paradigm and Kalshi’s $300 million Collection D spherical.

CryptoRank’s month-to-month knowledge exhibits that there have been 180 funding rounds printed in October, with the highest three offers accounting for 54% of the entire capital deployed in lower than 2% offers.

The median spherical dimension might be within the single digits of thousands and thousands. When you take polymarket, tempo, and calci out of the equation, the story would change from “finest month in years” to “a gradual however unglamorous continuation of a modest tempo in 2024.”

The story of the “enterprise rebound” largely is dependent upon whether or not individuals view the strategic acquisition spree and two infrastructure bets by the New York Inventory Trade's mum or dad firm as an indication of broad builder confidence or as outliers that occurred to finish in the identical reporting window.

Why Spot Merchants Bought Whereas VCs Draw Checks

Bitcoin's fall in October was pushed by profit-taking following September's rally, macroeconomic headwinds from rising U.S. Treasury yields, and continued ETF outflows that started mid-month and accelerated into the ultimate week.

Bitcoin ETFs recorded almost $3.4 billion in internet inflows, however Pharcyde Buyers' day by day movement knowledge exhibits that there have been vital redemptions from main spot Bitcoin merchandise, notably within the final 10 buying and selling days.

Enterprise capital operates on a special clock. The businesses that invested in October had been dedicated to paper-driven positions for months.

The timing of precise money transfers and bulletins displays authorized processes and strategic alignment moderately than spot market sentiment.

Polymarket's $2 billion from ICE doesn’t mirror bets on Bitcoin's November worth, however displays ICE's view that prediction markets characterize a multi-billion greenback addressable market through which first-mover benefit and regulatory positioning are extra vital than token worth actions.

Tempo’s $500 million spherical will fund stablecoins and funds infrastructure aimed toward enterprise adoption. The success metrics of a revenue-generating product should not immediately correlated as to whether Bitcoin trades at $100,000, $60,000, or $40,000.

Mr. Kalsi's $300 million increase is in related territory. The CFTC-regulated prediction market platform competes with polymarkets and conventional derivatives exchanges, and its valuation has soared to $5 billion primarily based on quantity progress and regulatory moats moderately than crypto market timing.

October's three greatest offers have one thing in widespread. Which means cryptocurrencies are focused at infrastructure, compliance, and institutional use instances the place they function plumbing moderately than hypothesis.

Enterprise capitalists are betting on constructing a decade of monetary infrastructure moderately than subsequent quarter's worth actions, and this focus helps clarify why enterprise exercise soars whereas retail merchants retreat.

Danger of big buying and selling focus

Focus breeds vulnerability. Two of October's flagship offers may characterize peak valuations moderately than verified milestones if Polymarket faces regulatory headwinds or growth of Tempo's enterprise pipeline is slower than anticipated.

If these few large bets stumble as a result of similar focus that inflated October's headline numbers, the sector stands a very good likelihood of a downward correction.

You additionally should be cautious about timing. ICE introduced its funding in Polymarket days earlier than the U.S. mayoral election, positioning the platform to benefit from file prediction market volumes.

This timing displays strategic opportunism as ICE capitalizes on elevated consciousness and person progress, however calls into query sustained engagement if election-driven volumes return to regular.

Mr. Kalsi's $300 million was acquired amid related election-related momentum. Each trades may show to be prescient if prediction markets stay energetic post-election, and if buying and selling volumes spike after the twin political occasion is resolved, they may characterize exaggerated costs at their peak.

If October's sample of weak retail, rotating establishments and concentrated infrastructure spending holds true, the winners will inevitably be public sector platforms moderately than tasks that seize the speculative frenzy.