On-chain information means that companies are more and more offloading Lido Dao (LDO), the liquid staking platform for the Ethereum (ETH) blockchain.

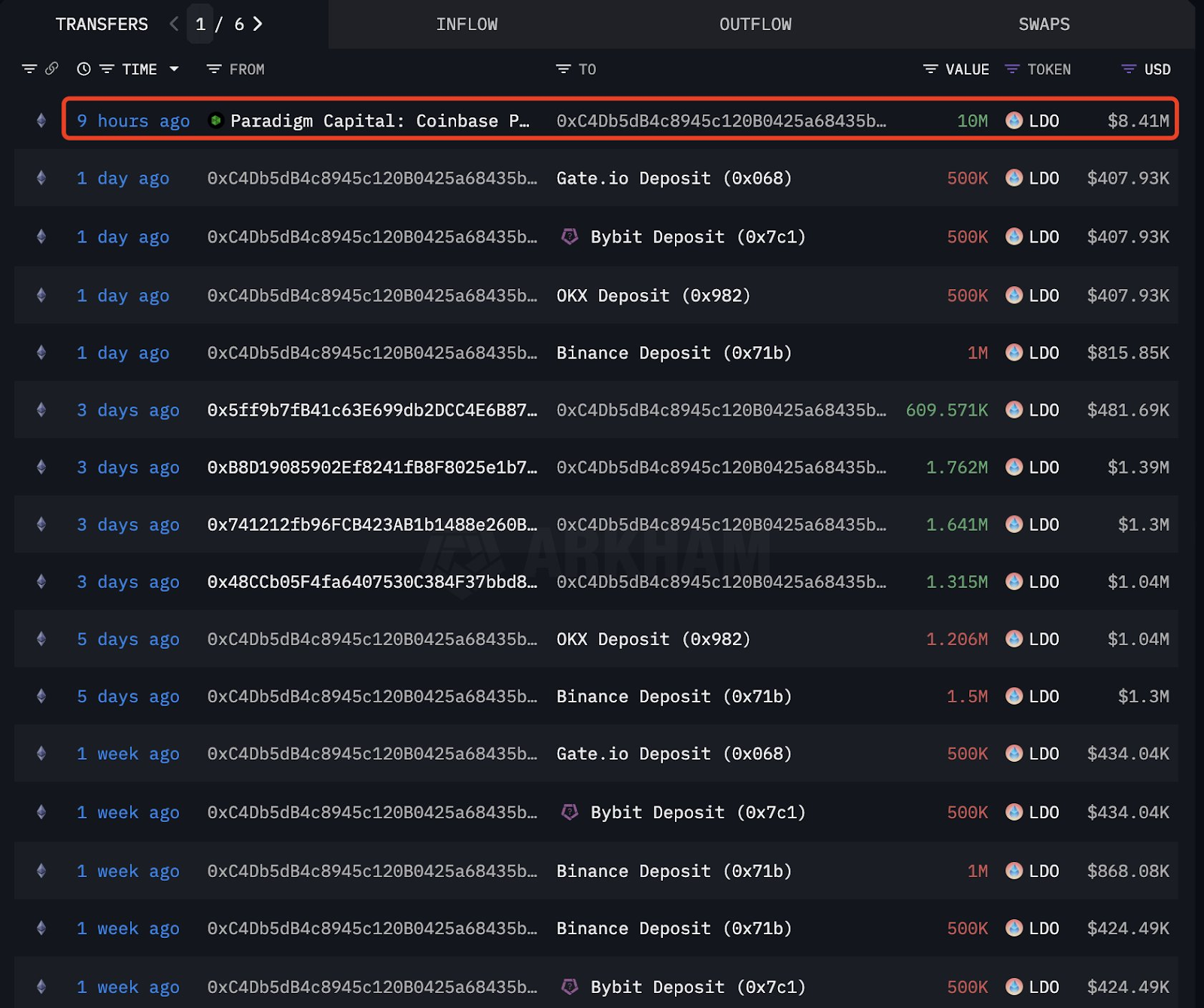

Over the previous month, the establishment's pockets has transferred roughly 48.48 million LDOs in trade, in line with blockchain analytics information obtained from. Arkham Inter June tenth.

In its newest transaction, Paradigm Capital moved 10 million LDOs via a collection of deposits into exchanges resembling Gate.io, Bybit, OKX, Binance and extra.

These transfers ranged from 500,000 to 1.76 million LDOs for the previous week and month. This improve in exchanges suggests potential gross sales strain. The establishment deposits a considerable amount of tokens on the coaching platform earlier than liquidating the place.

In consequence, such a quantity of speedy motion may point out a change in revenue acquisition or institutional technique, significantly contemplating the twin position of LDOs in governance and staking.

LDO worth evaluation

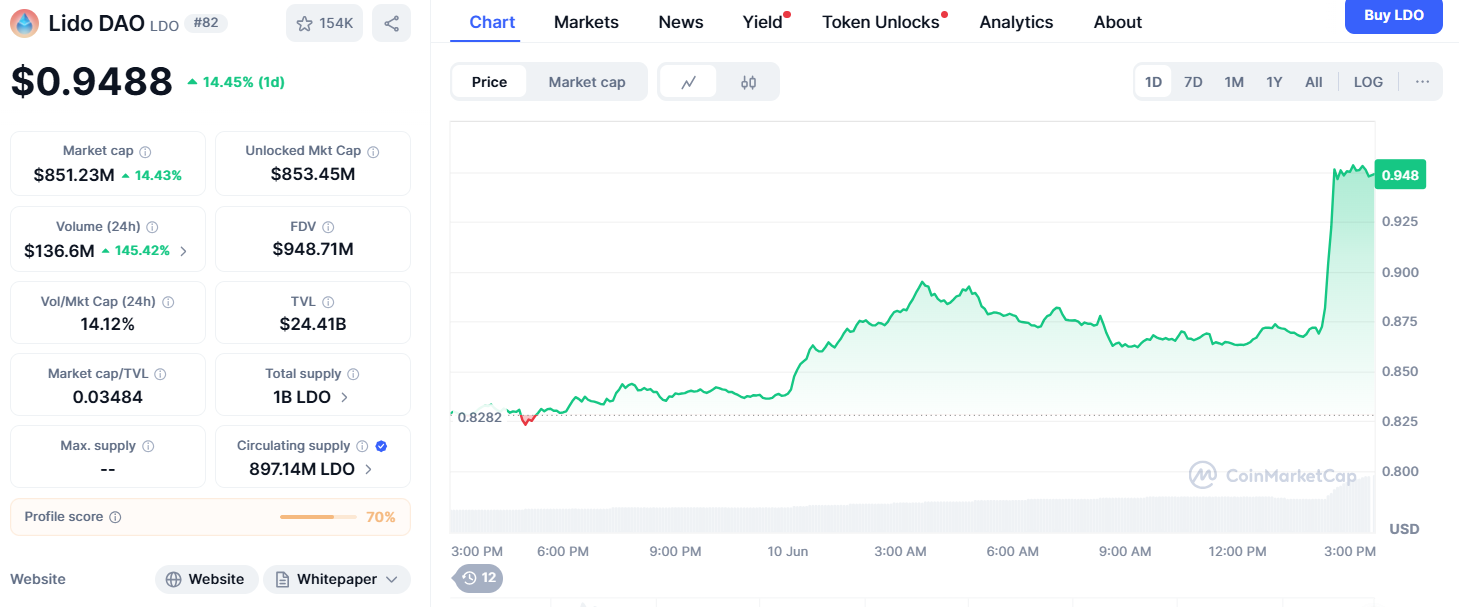

Curiously, this wave of gross sales happens when LDOs rank as the very best performing digital belongings within the final 24 hours. As of press time, tokens have been buying and selling at $0.95, exhibiting a 15% improve prior to now day and an 11% improve prior to now week.

Nonetheless, regardless of this short-term surge, Lido's technical indicators counsel a extra cautious outlook. The 50-day Easy Transferring Common (SMA) is at the moment at $0.927,406, carrying over the 200-day SMA to below $1.16,126, indicating a broader bearish pattern.

In the meantime, the 14-day relative power index (RSI) is at 51.05, reflecting impartial momentum and potential market indecisiveness. A breakout that surpasses the 200-day SMA may cause bullish feelings.

Along with complexity, Lido is experiencing a wave of rising community exercise. For instance, in early Might, Lido Finance launched the Lido Enchancment Proposal (LIP) 28, a key governance overhaul.

The proposal outlines a twin governance mannequin that grants Steth Holders to guess ETH via Lido, which rejects veto on key selections beforehand reserved for LDO token holders.

On this mannequin, a dynamic time lock mechanism delays the choice of the DAO, giving STETH holders time to protest by depositing tokens on designated contracts.

Featured Pictures from ShutterStock