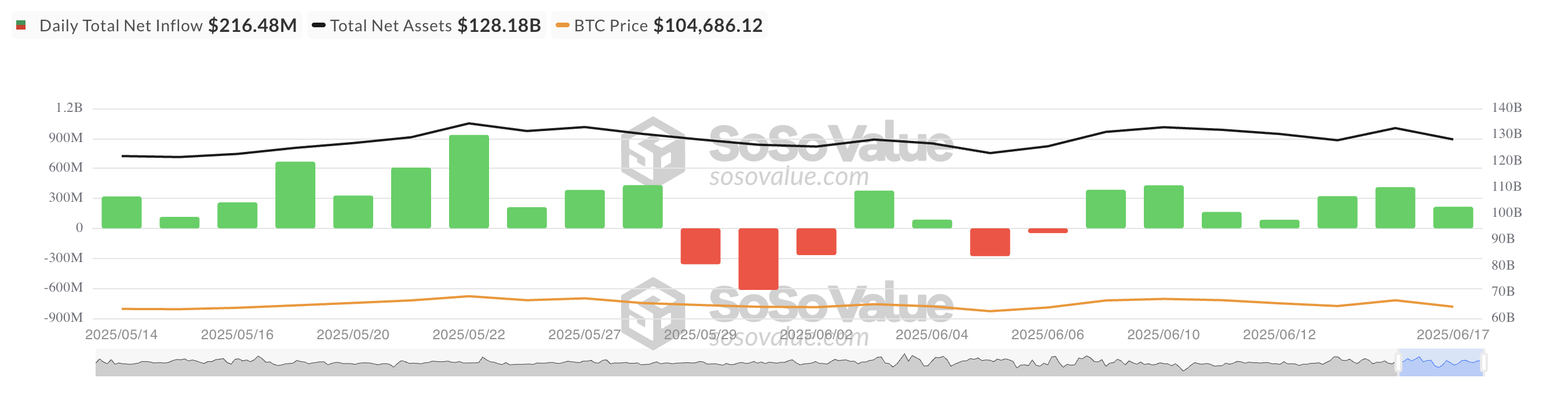

On Tuesday, the Bitcoin Alternate Gross sales Fund (ETF) recorded an influx of over $200 million. This marked a internet optimistic influx into these funds, however represents a pointy drop from the $421 million we noticed yesterday.

Cooling advantages will come up as BTC slipped to a low low of $103,371 on Tuesday, signaling buyers' cautious consideration. As decline continues, the inflow of ETFs could also be even weaker as institutional sentiments proceed to hit.

BTC ETF reveals a each day inflow hunch

On Tuesday, the US-registered Spot Bitcoin ETF recorded a internet influx of $22,648 million, indicating that buyers' earnings remained intact. Nonetheless, this reveals a 47% steep decline from $412 million posted yesterday, indicating a slower momentum.

Whole Bitcoin Spot ETFs inflows. Supply: SosoValue

The inflow flooding coincided with a decline in BTC costs through the day buying and selling session. As demand fell, it fell to an intraday low of $103,371. The recession is closely sluggish with market sentiment, and recent capital seems to be stagnating because it enters BTC-related ETFs.

Yesterday, BlackRock's IBIT led the pack with the best each day influx, bringing its whole historic internet influx to $50.67 billion, totaling $639.19 million.

In the meantime, Constancy's FBTC witnessed the biggest internet outflow of those ETFs, with $2846 million withdrawing the fund.

BTC faces new strain

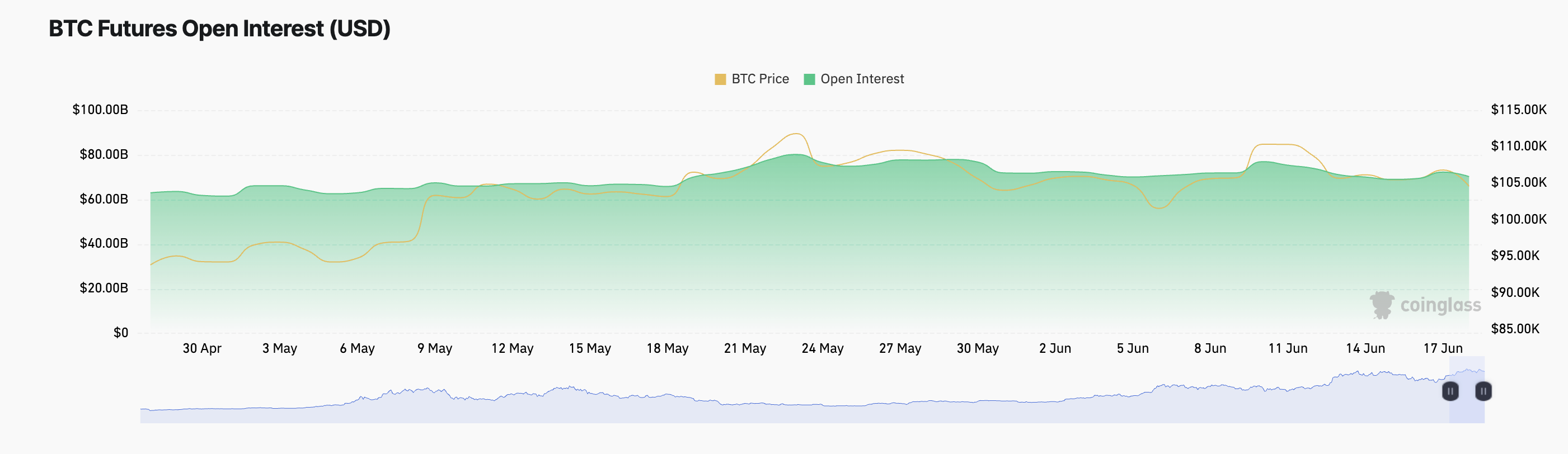

Immediately, BTC is chopping one other 2% because the broader crypto market faces new gross sales strain. The value decline is accompanied by Coin's open futures curiosity (OI) DIP, suggesting a slower leveraged buying and selling exercise.

This was $70.24 billion at press, down 3% over the previous day. This pullback signifies that merchants will cut back publicity and, in some circumstances, shut positions. This can be a pattern that displays the eye of a rising market.

BTC futures are open to curiosity. Supply: Coinglass

Open revenue refers back to the whole variety of unresolved futures contracts that haven’t but been resolved. If a worth falls throughout such a decline, it signifies that the dealer is closing his place fairly than opening a brand new place. This can be a signal that it weakened convictions amongst BTC futures merchants and decreased speculative urge for food.

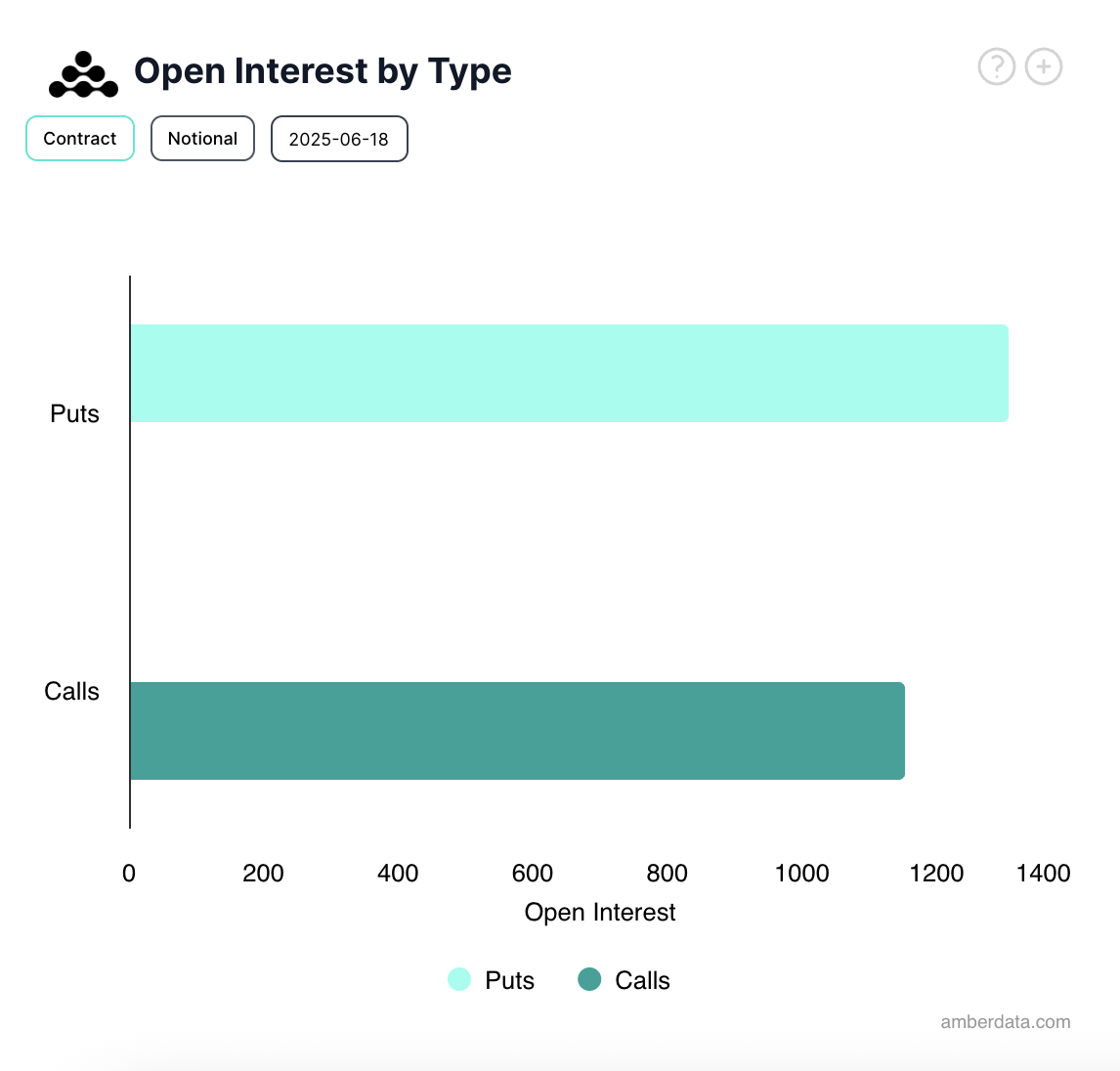

Moreover, bearish sentiment continues to dominate the choices market, as evident from the rising demand for contracts which have referred to as for a name, in accordance with Delibit. This imbalance means that increasingly merchants are positioning themselves to revenue from the additional adverse facets of BTC costs.

Fascinated by opening Bitcoin choices. Supply: Deribit

The mix of cooling ETF inflows, a decline in open curiosity, and a bearish slope in choices markets has not light institutional earnings, however the decline in capital flows and buying and selling conduct counsel that many buyers are making ready for additional draw back, or at the least ready for a extra clear sign earlier than re-entering the market.