By Omkar Godbole (except in any other case indicated)

Bitcoin

On Monday, the nine-spot Ether ETFS recorded $465 million (the biggest web runoff on file), following a $152 million drawdown on Friday. The Bitcoin ETF noticed a considerable leak that bleed $333 million after $812 million on Friday. This means that facility capital is much less optimistic than spot markets.

In the meantime, long-term bullishness has evaporated from the BTC choices as issues about new US inflation and labor market slowdowns and weighted buyers' threat urge for food.

Conversely, some analysts nonetheless maintain largely constructive market outlook, predicting Fed rate of interest cuts.

“Regardless of short-term volatility, structural knowledge nonetheless means that the US is present process a slowdown in development quite than an entire recession,” HTX analysis analyst Chloe Zheng instructed Coindesk. “House debt stays low in comparison with earnings, decreasing credit score stress and persevering with development in enterprise lending. This mixture of labour knowledge softening and mitigation expectations traditionally precedes monetary easing.

Knowledge from CME's FedWatch device exhibits that merchants have been priced at three fee reductions by the January 2026 assembly. In different phrases, the Fed is anticipated to cut back borrowing prices at three of the next 4 conferences:

The brand new Crypto Market Highs hinges on Fed fee reductions, based on Wincent's Paul Howard, senior director of Crypto Market-Making Agency.

“The vast majority of the following macro information will seemingly come as early as September with fee modifications,” mentioned Howar. “If that occurs, you possibly can anticipate costs to be catapulted by present ATH as low cost cash is searching for yields. My sense is BTC and the key ALTs have a robust outperformance within the fourth quarter.”

Talking of the broader market, based on Analytics Agency Sentora, the usual coin quantity for the July chain reached a excessive of over $1.5 trillion in July. The UNISWAP V4, which debuted on the finish of January, has surpassed $100 million in buying and selling quantity, based on knowledge tracked by 21Shares.

In conventional markets, US inventory futures traded positively in flats, exhibiting a sluggish opening following a 1.3% improve on Monday. The greenback index traded barely increased at almost 99.00, however gold dropped to $3,360 per ounce because the freight market cratered, sending warnings to the financial system. Preserve alerts!

What to see

- Crypto

- August fifth at 1:30pm: The Stellar Growth Basis (SDF) can be holding an AMA session on Reddit. CEO Denelle Dixon, Chief Advertising Officer Jason Karsh and Chief Development Officer José Fernández Da Ponte reply your questions.

- August seventh, 10am: The circle can be holding a webinar. “The period of genius acts begins.” This session will cowl the primary US federal funds secure framework and its impression on crypto innovation and rules.

- August 15: File the date of the following FTX distribution to the holders of the Class 5 buyer {qualifications}, common unsecured and comfort claims for Class 6.

- August 18: Coinbase Derivatives launches Nano Sol and Nano XRP US Perpetual Type Futures.

- Macros

- August fifth 10am: Provide Administration Institute (ISM) will launch US Companies Sector knowledge for July.

- The PMI service is. east. 51.5 vs. 50.8

- August fifth 2pm: Uruguay Nationwide Institute of Statistics will launch July inflation knowledge.

- Earlier than the annual inflation fee. 4.59%

- August Sixth, 12:01am: 50% US tariffs start most Brazilian imports.

- August Sixth 2pm: Federal Reserve Governor Lisa D. Cook dinner will give a speech entitled “The USA and the World Financial system.” Stay stream hyperlink.

- August 7, 12:01am: The brand new US mutual tariffs outlined in President Trump's July 31 government order can be efficient for a variety of buying and selling companions who haven’t secured transactions by August 1. These tariffs vary from 15% to 41% relying on the nation.

- August seventh: 8am: Mexico Nationwide Institute of Statistics releases shopper value inflation knowledge for July.

- Core inflation fee earlier than mother. 0.39%

- Across the core inflation fee. 4.24%

- Earlier than mothers inflation. 0.28%

- Across the inflation fee. 4.32%

- August seventh: 3pm: Mexico's central financial institution, Banco de Mexico, publicizes its financial coverage choice.

- In a single day interbank goal fee EST. 7.75% vs. 8%

- August 8: Federal Reserve Governor Adriana D. Coogler's resignation can be efficient and create an early vacancies for the Governor's Committee that can enable President Trump to appoint his successor.

- August fifth 10am: Provide Administration Institute (ISM) will launch US Companies Sector knowledge for July.

- Income (Estimation based mostly on reality set knowledge)

- August 5: Galaxy Digital (GLXY), in entrance of the market, $0.19

- August 7: Block (XYZ), Put up Market, $0.67

- August 7: CleanSpark (CLSK), Postmarket, $0.19

- August 7: Coincheck Group (CNCK), Put up Market

- August 7: Crypto Mining (CIFR), former market

- August 7: HUT 8 (HUT), pre-market – $0.08

- August 8: Terawulf (Wulf), former market, – $0.06

- August 11: Exod, Postmarket

- August twelfth: Bitfarm (BITF), former market

- August twelfth: Foldable (FLD), Put up Market

- August 14th (TBC): Core Scientific (Corz), Put up Market

- August fifteenth: Bitfufu (Fufu), former market

- August 18: Bitdeer Applied sciences Group (BTDR), former market

- August 27: Nvidia (NVDA), Put up Market, $1.00

Token Occasion

- Governance votes and cellphone calls

- Mixed DAO votes to pick out the following Safety Service Supplier (SSP). Representatives have chosen Chainsecurity & Certora and Cyfrin. Voting will finish on August fifth.

- Balancer Dao is voting to create Balancer Enterprise, a profit-owned subsidiary of Balancer Opco Ltd. The brand new company will formalize protocol price administration and chain operations on behalf of the present DAO multisig mannequin. Voting will finish on August fifth.

- Arbitrum Dao is voting to resume its partnership with Entropy Advisors for an additional two years beginning in September. The proposal contains $6 million in funding and $15 million ARB for incentives the place Entropy focuses on monetary administration, incentive design, knowledge infrastructure and ecosystem development. Voting will finish on August seventh.

- Benddao is voting for a plan to stabilize Bend by burning 50% of the Treasury tokens, restarting lender compensation, and utilizing 20% of protocol income to start out month-to-month buybacks. Voting will finish on August Tenth

- August fifth, 1:30pm: CEO, CMO, and Head of Methods and Partnerships for taking part in Ask Me Something (AMA) classes at Stellar Growth Basis.

- August seventh 12pm: Cello hosts the governance name.

- Unlock

- August 9: Unlocking 1.3% of the circulation provide value $12.4 million (IMX).

- August 12: APTOS unlocks 1.73% of distribution provide value $48.07 million.

- August 15: An avalanche unlocking 0.39% of distribution provide value $37.45 million.

- August 15: StarkNet (STRK) unlocks 3.53% of its distribution provide value $14.95 million.

- August 15: SEI unlocks 0.96% of the circulation provide value $16.42 million.

- August 16: arbitrum unlocks 1.8% of its distribution provide value $36.35 million.

- August 18: FastToken unlocks 4.64% of its distribution provide value $91.6 million.

- Token launch

- August 5: Keeta (KTA) listed in Kraken.

- August 5: USDC, Tron, Tron, Ondo, Chainlink, Cardano, and Polkadot listed on Arkham Alternate.

assembly

Coindesk Coverage & Regulation Convention (Previously generally known as Cryptographic State) At a one-day boutique occasion held in Washington on September Tenth, generals, compliance officers and regulatory executives will be capable of meet with civil servants liable for crypto legislation and regulatory oversight. Area is restricted. Please use Code CDB10 for 10% off registration till August thirty first.

- Day 3: Blockchain Convention Science of 2025 (Berkeley, California)

- August 6-7: Blockchain Rio 2025 (Rio de Janeiro, Brazil)

- August Sixth-Tenth: Rarebo (Las Vegas)

- August 7-8: Bitcoin++ (Latvia, Riga)

- August Ninth-Tenth: Baltotic Honey Badger 2025 (Riga, Latvia)

- August Ninth-Tenth: Conviction 2025 (Ho Chi Minh Metropolis, Vietnam)

- August Eleventh: Paraguay Blockchain Summit 2025 (Asuncion)

- August Eleventh-Thirteenth: MATB 2025 (Intanbul)

- August Eleventh-Seventeenth: Ethereum NYC (New York)

- August Thirteenth-14th: Cryptowinter '25 (Queenstown, New Zealand)

- August fifteenth: Bitcoin Educator's Non-Customs (Vancouver)

- August Seventeenth-Twenty first: Crypto 2025 (Santa Barbara, California)

- August 18th-21: Wyoming Blockchain Symposium 2025 (Jackson Gap, Wyoming)

- August Twenty first-22: Coinfest Asia 2025 (Indonesia, Bali)

- August Twenty fifth-Twenty fifth: Webx 2025 (Tokyo)

Token discuss

By Shaurya Malwa

- Hyperliquid closed its highest month of all time, reaching a buying and selling quantity of $320 billion in July. This was elevated by 47% attributable to exercise in ethers and different Altcoins.

- Dex additionally surpassed its whole open revenue for the primary time by over $15 billion.

- Excessive lipids generated greater than $4 million in day by day charges over the interval, reflecting record-breaking dealer engagement.

- With a $597 million TVL, the Alternate presently leads almost 12% of Binance's derivatives market share, strengthening its whale exercise and extremely leveraged buying and selling.

- The platform's hype token slid to $38.54 after almost touching $50.

- The hype's open curiosity fell a month low to $1.46 billion, with 70% of merchants longer and the potential for a adjusted liquidation flash.

- Value discoveries moved to exterior exchanges, attenuating the reflective momentum that drove the early earnings of the hype.

Positioning of derivatives

- Open curiosity on BTC futures fell by greater than 1%, in distinction to elevated participation in futures associated to different main tokens, together with ether and XRP.

- Funding charges hover at 5%-10% per yr on most main cash, indicating a bullish place out there.

- In Delibit, long-term BTC calls trades on par with places, exhibiting a bullish to impartial change in feelings. The block circulate on the paradigm includes a Bitcoin calendar unfold on August eighth, quick stradule.

Market actions

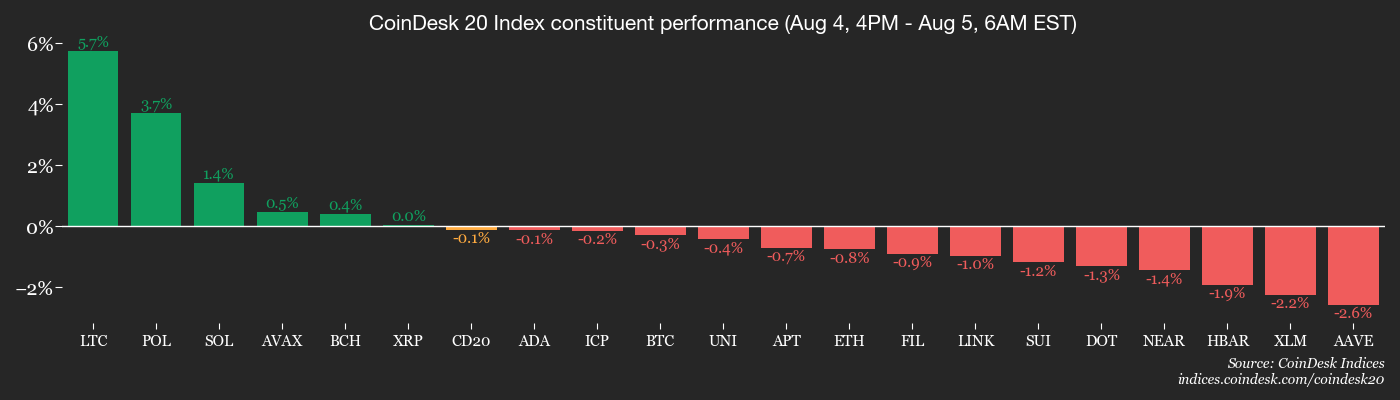

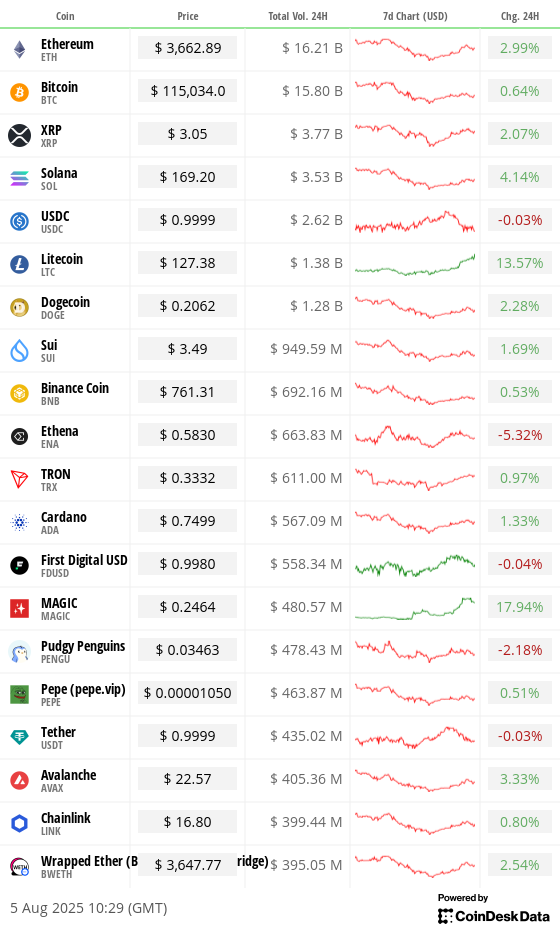

- BTC has remained unchanged at $114,615.76 (24 hours: 0.18%) from 4pm on Monday

- ETH is down 0.87% at $3,661.62 (24 hours: 2.9%)

- Coindesk 20 is up 3.14% at 3,839 (24 hours: +1.95%)

- Ether CESR Composite staking fee fell 6 bps at 2.857%

- BTC's funding fee is 0.0189% (20.69% per yr) for Kucoin.

- DXY is up 0.18% at 98.97

- Gold futures fell 0.39% at $3,413.10

- Silver futures elevated by 0.13% to $37.38

- The Nikkei 225 rose 0.64% to 40,549.54

- Cling Seng rose 0.68% at 24,902.53

- FTSE is up 0.32% at 9,157.57

- The Euro Stoxx 50 is up 0.24% at 5,254.78

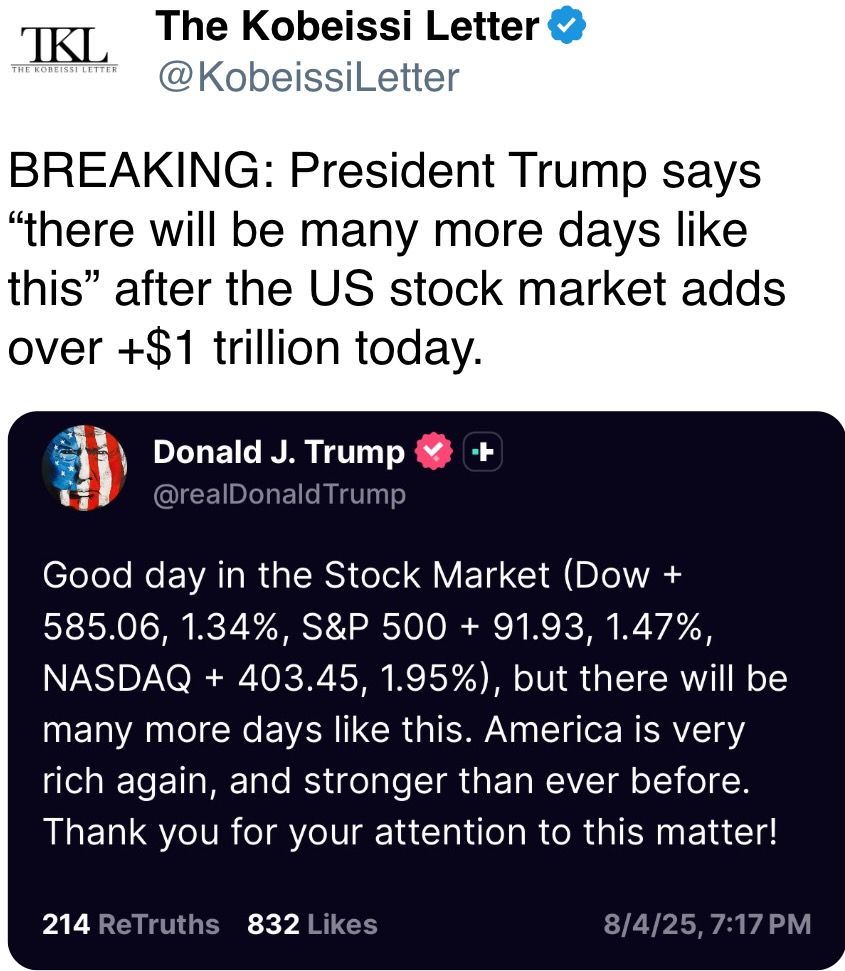

- DJIA rose 1.34% on Monday to 44,173.64

- S&P 500 closed 1.47% at 6,329.94

- NASDAQ Composite rose 1.95% to 21,053.58

- S&P/TSX Composite closed 0.88% at 27,020.43

- S&P 40 Latin America closed 0.72% at 2,572.27

- The ten-year monetary ratio within the US is up 1.6 bps at 4.214%

- E-Mini S&P 500 futures are up 0.17% at 6,366.50

- E-Mini Nasdaq-100 futures are up 0.23% at 23,349.00

- The e-mini dow Jones Industrial Common Index is up 0.11% at 44,351.00

Bitcoin statistics

- BTC dominance: 61.6% (0.27%)

- Ether to Bitcoin ratio: 0.03192 (-1.24%)

- Hash fee (7-day shifting common): 926 EH/s

- Hashpris (spot): $56.83

- Whole price: 3.33 BTC/$382,733

- CME Futures Open Curiosity: 136,145 BTC

- Gold Value BTC: 34 oz

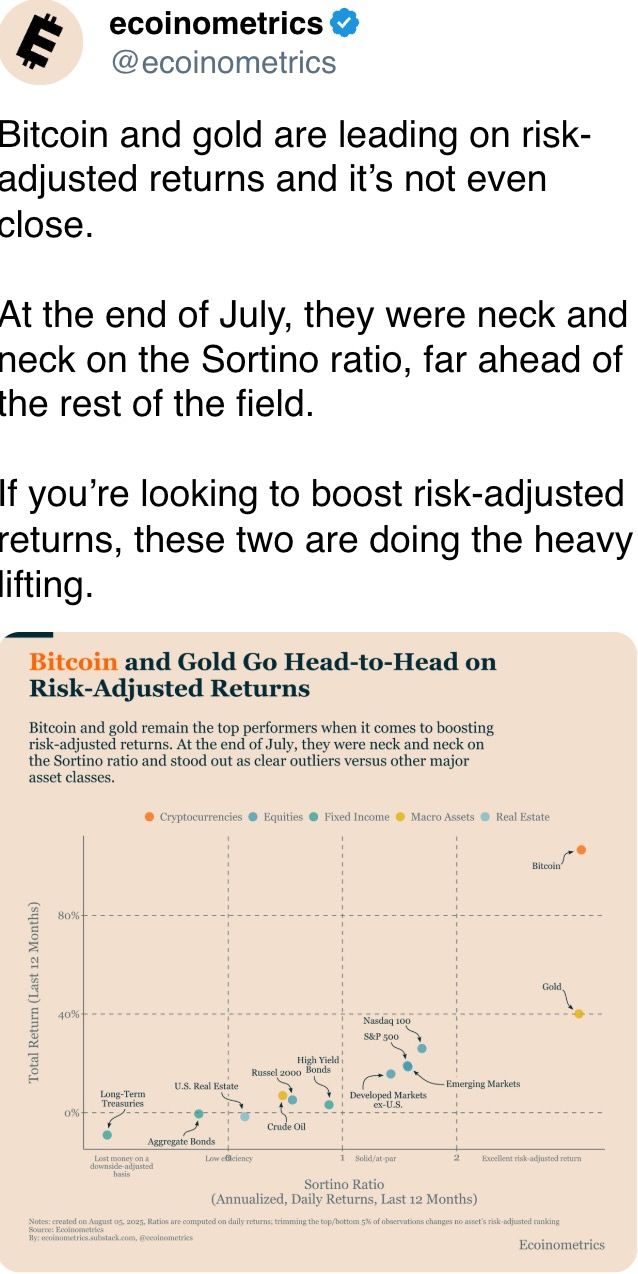

- BTC vs. Gold Market Cap: 9.61%

Technical Evaluation

- The XRP/ETH ratio carries head and shoulder patterns in day by day charts.

- A break beneath the horizontal assist line confirms signaling reversal of ether outperformance towards XRP.

Crypto shares

- Technique (MSTR): Closed on Monday at $389.24 (+6.17%), at -0.42% at a market worth of $387.59

- Coinbase World (Coin): Closed at $318.17 (+1.11%), and unchanged pre-market.

- Circle (CRCL): $164.82 (-1.95%), closed at -1.65% at $162.18.

- Galaxy Digital (GLXY): Closed at $28.89 (+7.48%), with +5.23% at $30.40.

- Mara Holdings (Mara): $16.04 (+3.48%), closed at -0.19% at $16.01

- Riot Platforms (Riot): Closed at $11.42 (+3.54%) and has not been modified.

- Core Scientific (CORZ): $13.65 (+7.91%), closed at +0.81% at $13.76.

- CleanSpark (CLSK): $10.62 (+1.72%), +0.19% at $10.64 at +0.19%.

- Coinshares Valkyrie Bitcoin Miners ETF (WGMI): Closed at $24.83 (+6.02%)

- Semler Scientific (SMLR): Closed at $35.37 (+2.64%) and has not been modified.

- Exodus Motion (Exod): Closed at $29.57 (+4.19%) and has not been modified.

- Sharplink Gaming (SBET): $19.14 (+11.67%), +2.61% at $19.64 at +2.61%.

ETF Move

Spot BTC ETF

- Each day Internet Move: -$323.5 million

- Cumulative web circulate: $5.383 billion

- Whole BTC holdings: 129 million

Spot ETH ETF

- Each day Internet Move: -$465.1 million

- Cumulative web circulate: $9.04 billion

- Whole ETH holdings: 569 million

Supply: Farside Buyers

One night time circulate

The chart of the day

Ether ETF: Each day Internet Move. (sosovalue)

- The US-registered ether ETF registered a file $465 million spill on Monday.

- The dearth of participation through ETF raises query marks relating to the sustainability of ether value restoration after Sunday.

When you're asleep

- The bottom community suffers from its first downtime since 2023 and can cease operation for 29 minutes (Coindesk): Technical flaws have been recognized and resolved inside minutes of investigation. The outage is noteworthy given the rising significance of bases within the Ethereum Layer-2 ecosystem.

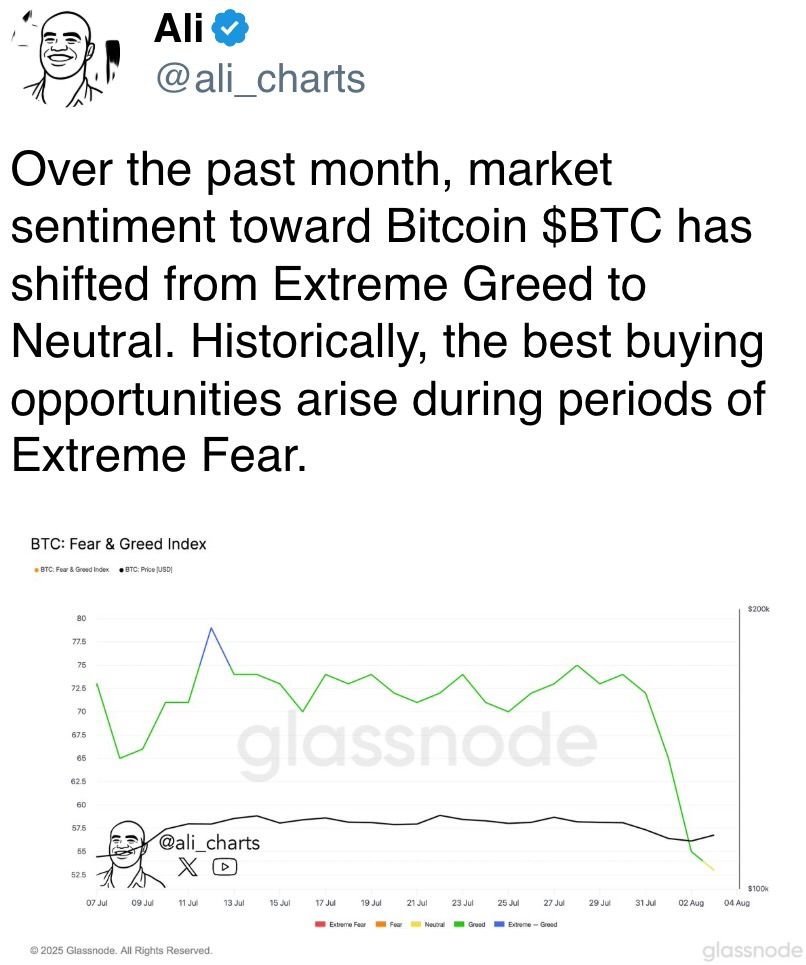

- Bitcoin's long-term bullishness evaporates from choices markets as inflation issues rise (Coindesk): Bitcoin choices market metrics present that long-term sentiment has shifted from bullish to impartial as analysts warn that US inflation knowledge may complicate potential fee cuts by the Federal Reserve.

- Trump's BLS firing check Wall Avenue reliance on authorities knowledge (Wall Avenue Journal): Some buyers have questioned the reliability of US inflation and employment knowledge after Trump fired Erica Mantelfer, elevating long-term issues in regards to the transparency and reliability of financial reporting.

- A yr in the past at this time, Bitcoin received $49K within the winding up of the Yen Carry commerce. It’s presently a rise of 130% (Coindesk). Over the previous yr, Bitcoin has bounced together with shares and gold regardless of rising bond yields, however long-term holders have doubled their provide share and convicted them by stronger market volatility by robust convictions.

- The Brazilian Supreme Courtroom locations Bolsonaro beneath home arrest (The New York Occasions): The choose mentioned Bolsonaro used his allies' social media accounts to achieve his supporters, indicating “a evenly empty towards the judicial choice,” and ordered police to seize a cellphone and restrict visits to their properties.

- In almost two weeks, Gold Hover will elevate rate-cut bets (Reuters) in US employment knowledge. OANDA analysts mentioned Gold's latest power displays expectations for a discount in rates of interest, however even stronger catalysts might be restricted with no stronger catalyst to beat the close to $3,450 technical resistance.

With ether