Ethereum has just lately grown Bitcoin, resulting in a pointy improve in ETH/BTC buying and selling pairs. This surge sparked hope for the upcoming Altcoin season.

Nevertheless, a more in-depth have a look at historic information means that these expectations could also be untimely.

A breakout that provides you hope

The ETH/BTC pair recorded its first breakout since December 2024. For the primary time in 5 months, the pair recorded the next low. This breakout is vital, with a 34% improve in only one week.

This rise has not been seen in virtually three years. The final equal surge occurred in July 2022 when the ETH/BTC pair rose 56% in a month and a half. Regardless of this encouragement value motion, it stays to be seen whether or not this momentum will have the ability to keep and set the hearth in a variety of Altcoin rallies.

ETH/BTC breaks out. Supply: TradingView

Ethereum's fast development in 2022 offers perception into the present state of affairs. On the time, Ethereum costs rose 121% over a month, rising from round $1,800 to almost $4,000. This spectacular rally might additionally set off a wider altcoin season.

Ethereum costs for 2022. Supply: TradingView

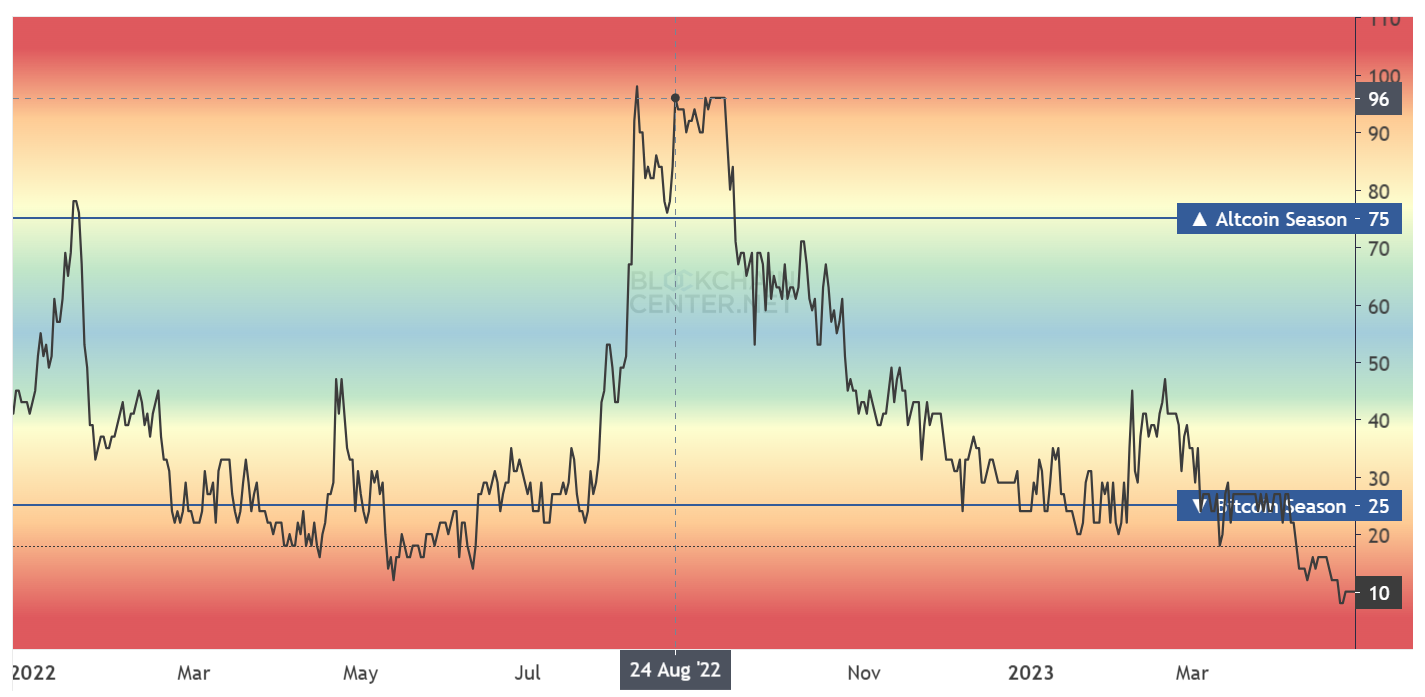

Historic information exhibits that following the Bull Run in July 2022, the market confirmed the Altcoin season in August 2022. The disaster has been met. 75% of the highest 50 cryptocurrencies outperformed Bitcoin within the final 90 days, with the Altcoin index rising to 96.

Moreover, there are solely 18% of the highest 50 cash presently outperforming Bitcoin. These metrics spotlight that regardless of latest ETH/BTC breakouts, the chance of a full-fledged Altcoin season stays low within the brief time period, however that's not fully out of the query. If altcoin runs within the coming weeks tagging Bitcoin development, the market might witness the altcoin season earlier than the tip of the second quarter.

Highlighted AltCoin Season Index for August 2022. Supply: BlockChaincenter

Can ETH costs mimic the previous?

Ethereum's value rallies might not coincide with the dramatic development seen in July 2022. ETH has grown by 32% over the previous few days, however it reaches $4,004, and requires an extra 67% improve to duplicate the earlier surge, requiring a constant bullish market state of affairs.

Nonetheless, Ethereum's extra sensible goal is to maintain it in violation of its assist stage of $2,814. Profitable assist for this resistance might probably enable for over $3,000.

Ethereum value evaluation. Supply: TradingView

Nevertheless, this bullish outlook will depend on sustaining key assist ranges. If Ethereum fails to violate $2,654 and as an alternative falls beneath $2,344 or $2,141, it might erase latest earnings and invalidate a optimistic value paper.