Ethereum is going through robust downward strain after dropping its bullish grip close to the $2,900 mark earlier this month. Mixed with a wider market stoop, elevated liquidation exercise and weaker technological construction, ETH has fallen beneath essential ranges.

Each value motion and on-chain metrics recommend a cautious outlook within the brief time period, and the following few periods might decide whether or not the ETH will stabilize or be headed for a deeper correction.

By Shayan

Each day Charts

The every day chart reveals clear bearish breakdowns from the upward channel, which had been creating since early Might.

The sample was performed with excessive accuracy and inside a couple of days it despatched ETH from almost $2,900 to only over $2,200. Costs had been tapped into a big honest worth hole (FVG) zone between $1,900 and $2,200, with some patrons intervening.

The 100-day transferring common, round $2,200, additionally serves as help. However a 200-day MA rejection across the $2,600 mark reinforces the concept that sellers are in management.

Moreover, the RSI is presently round 35 years outdated and has not but been bought oversold, however is hovering close to key areas. If the talked about FVG just isn’t retained, the following main help zone is $1,500, the extent that beforehand served as the idea for the April rally. Subsequently, patrons ought to test the 200-day transferring common restoration to think about significant bullish continuation.

4-hour chart

Zooming into the four-hour timeframe, ETH has been on a gentle downtrend since dropping its rising channel help earlier this month. After the breakdown, the worth retested the decrease restrict of the channel, unable to regain it, dropping shortly in the direction of the $2,100 space. This degree supplied non permanent aid, however the bounce seems weak and corrected.

There’s a seen bearish construction fashioned at decrease highs and decrease lows. The RSI for this time-frame is roughly 34, reflecting the bearish momentum and lack of energy in bullish makes an attempt. Until Ethereum recovers above $2,300 and may retain that degree as new help, present gross sales strain might result in one other leg in the direction of the $2,000 degree. If selloffs intensify, the following necessary demand zone is near $1,800.

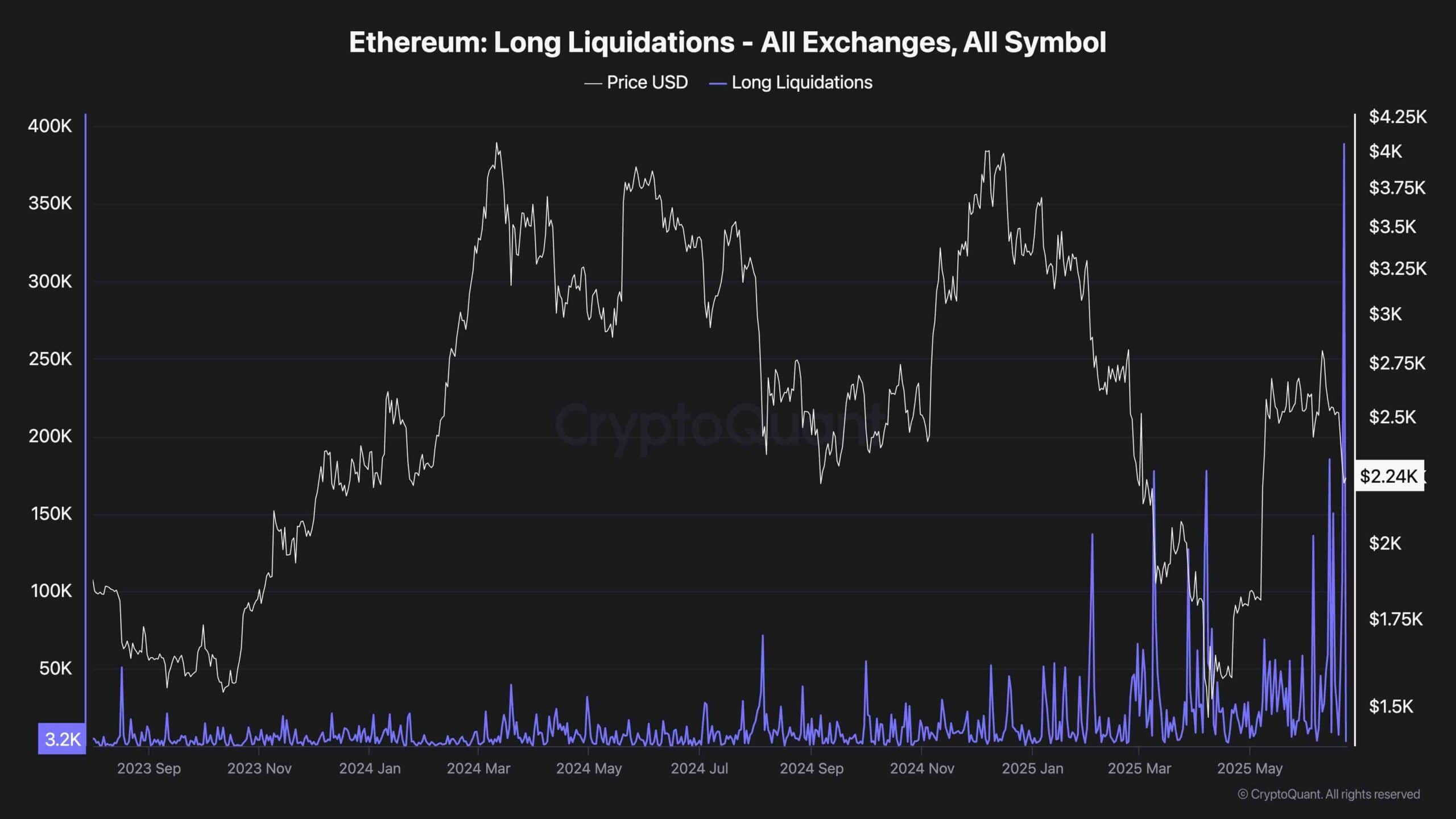

Ethereum's lengthy liquidation

The liquidation chart reveals an enormous spike in lengthy liquidation over the previous few days, bringing Ethereum's aggressive transfer to $2,200. This uptick reveals that many gradual lengthy positions have been worn out throughout this drop, getting into ranges between $2,600 and $2,800 at round $2,600 to $2,800.

These liquidation might quickly exaggerate the motion of shortcomings, particularly in extremely utilized environments, and it seems that that is taking place right here.

The overall clearing reached ranges not seen in months, indicating how busy the bullish commerce has turn out to be.

This might scale back the strain of bought out within the brief time period because it clears probably the most susceptible positions, however it additionally displays the emotional shift from bull to protection. With confidence shaking and lots of merchants underwater, rebound makes an attempt will be met with gross sales strain from contributors making an attempt to shorten exits and low highs.