Ethereum is trying a structural restoration after weeks of downward strain, with worth motion stabilizing round $3,194. Market circumstances stay tense, however merchants proceed to watch the coin's subsequent response close to key resistance ranges.

Analysts observe that along with the short-term pullback, Ethereum is presently at a essential intersection of worth construction and community exercise. This mix shapes expectations for December, as futures positioning, spot flows, and new technical alerts from the Ethereum Basis all influence sentiment on the identical time.

Value construction tightens close to essential obstacles

Ethereum has regained its short-term transferring common on the 4H chart, supporting an ongoing restoration try. The following main hurdle lies on the 0.382 Fibonacci retracement close to $3,244.

This degree coincides with the 200-day EMA and kinds a definitive resistance cluster. Subsequently, a clear 4-hour shut above this space may allow a transfer in direction of $3,438 after which $3,632. Importantly, merchants have additionally outlined extension ranges at $3,908 and $4,260 if momentum accelerates.

ETH worth dynamics (Supply: Buying and selling View)

The draw back stays equally necessary. Ethereum maintains help close to $3,051, adopted by a serious response zone round $3,000. If sellers push the coin beneath this space, the chart reveals deeper help at $2,998, $2,902, and a broader swing low at $2,616. Moreover, the broader construction nonetheless requires a confirmed breakout above $3,244 to vary the pattern.

Open curiosity will increase as participation expands

Supply: Coinglass

Ethereum futures open curiosity continued to extend and reached roughly $38.3 billion. This pattern signifies a rise in participation, particularly throughout instances of worth fluctuations. Furthermore, the rise has continued steadily from November to early December.

Associated: Chainlink Value Prediction: LINK faces a essential tipping level…

Merchants proceed to construct positions as ETH trades across the mid-$3,100s. If costs proceed to get well, the rise in open curiosity may amplify short-term momentum and entice extra speculative flows.

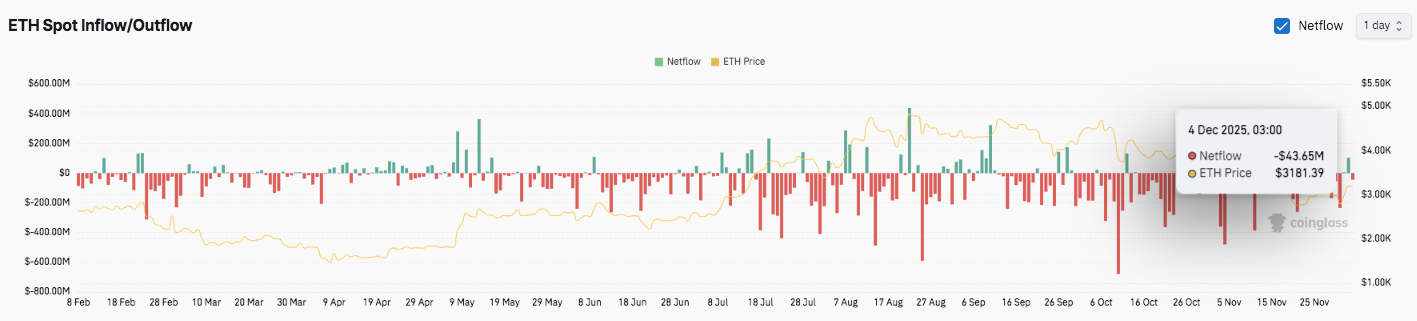

Supply: Coinglass

Nevertheless, the scenario is completely different for spot flows. The trade reviews sustained outflows by means of 2025, together with some sell-side surges. By December 4, web outflows had reached practically $43.6 million. Traders subsequently stay cautious and proceed to scale back their trade balances in periods of excessive volatility.

Mainnet configuration warning will increase technical urgency

Ethereum builders have issued an necessary discover relating to the Prysm consensus consumer following the activation of Fusaka. CL nodes working Prysm require pressing reconfiguration to stop disruption.

🚨 PSA: There may be an ongoing situation with the Prysm consensus consumer on mainnet. If you’re working Prysm, you will have to reconfigure your CL nodes as per the linked tweet.

If you’re working one other consumer, you aren’t affected and no motion is required. https://t.co/AngPNlzoTT

— Ethereum Basis (@ethereumfndn) December 4, 2025

The Basis has recognized a easy workaround that requires operators to disable the final epoch goal. No adjustments are required for validator purchasers. Moreover, nodes working different purchasers are usually not affected by this situation.

Technical outlook for Ethereum worth

Ethereum trades inside a tightening construction, so the important thing ranges are nonetheless clearly outlined.

Rapid hurdles for the upside worth lie at $3,244, $3,438, and $3,632. If momentum strengthens, a breakout above these zones may prolong to $3,908 and $4,260.

Associated: Bitcoin Value Prediction: Sellers Block Restoration as Value Compresses Close to Main Assist

Downward ranges embody pattern help at $3,051, adopted by $3,002 and $2,902. Deeper help lies round $2,616.

Ethereum is presently buying and selling beneath the key resistance on the 200-day EMA close to $3,244. This degree stays a key level for a flip to bullish momentum within the medium time period.

Technical circumstances counsel that ETH is compressed between rising short-term help and overhead-heavy clusters, usually forming a coil forward of sharp volatility. If we will decisively break by means of this construction, we might be able to resolve on the subsequent route.

Will Ethereum rise additional?

Ethereum’s subsequent steps will rely upon whether or not consumers can defend the $3,051 to $3,000 zone lengthy sufficient to problem the $3,244 resistance band. Each the compression sample across the finish of the yr and the historic volatility sample level to elevated motion forward. Robust inflows and continued growth in open curiosity may help a push in direction of an extension of $3,632 and $3,908.

Failure to carry $3,000 dangers breaking the short-term accumulation base and exposing the chart to $2,902 and $2,616. For now, ETH continues to be within the necessary zone. Merchants stay cautiously optimistic, however confidence circulation and breakout affirmation will decide the subsequent pattern leg.

Associated: BOB (Bitcoin Base) Value Prediction 2025, 2026, 2027-2030

Disclaimer: The knowledge contained on this article is for informational and academic functions solely. This text doesn’t represent monetary recommendation or recommendation of any form. Coin Version is just not liable for any losses incurred because of using the content material, merchandise, or providers talked about. We encourage our readers to do their due diligence earlier than taking any motion associated to our firm.