Ethereum has entered the consolidation part after robust gatherings up to now few months. Costs vary between the principle assist and resistance zones, with a number of failed makes an attempt to transcend the $2,700-$2,800 area.

Regardless of the dearth of speedy developments, chain fundamentals similar to Change Reserves counsel necessary structural modifications. That is the setting for potential volatility because the market is prepared for the subsequent path.

Technical Evaluation

Shayan Market

Every day Charts

Within the each day timeframe, ETH stays throughout the rising channel, discovering constant assist across the $2,400 space and struggling to exceed $2,800.

This channel cap is mixed with the 200-day shifting common and key order block fashioned in February, and serves as a heavy resistance aspect. Every check at this degree has led to rejection, however thus far the construction has not been damaged, indicating that the Bulls are nonetheless in management for now.

Nonetheless, the momentum is weakening. The RSI floats across the midline of the 51, reflecting indecisiveness and lack of drive of robust path. If ETH can regain its prime vary and flip to assist an space between $2,700 and $2,800, you can begin a brand new leg greater than $3,000. On the again, a breakdown under $2,400 modifications bias and exposes a $2,150 assist zone.

4-hour chart

Though it zooms in on the 4H chart, ETH remains to be crushing throughout the identical ascending channel. After a current drop to $2,430 from $2,875, the worth was pulled again to the 0.5-0.618 Fibonacci zone, however was rejected on the draw back and is now built-in. The world has repeatedly acted as a provide zone between $2,600 and $2,700, refusing bullish makes an attempt a number of instances. For brief-term merchants, this stays a crucial degree of flips.

ETH might proceed to function in a range-bound state till this resistance collapses. The RSI has recovered barely from being oversold, however is now sitting at practically 52. This implies that momentum is rising barely, however there aren’t any clear indications of bullish domination but. If the Bulls don't break above this key FIB zone anytime quickly, one other drop might be made in direction of the decrease restrict of the channel, near $2,400.

Emotional evaluation

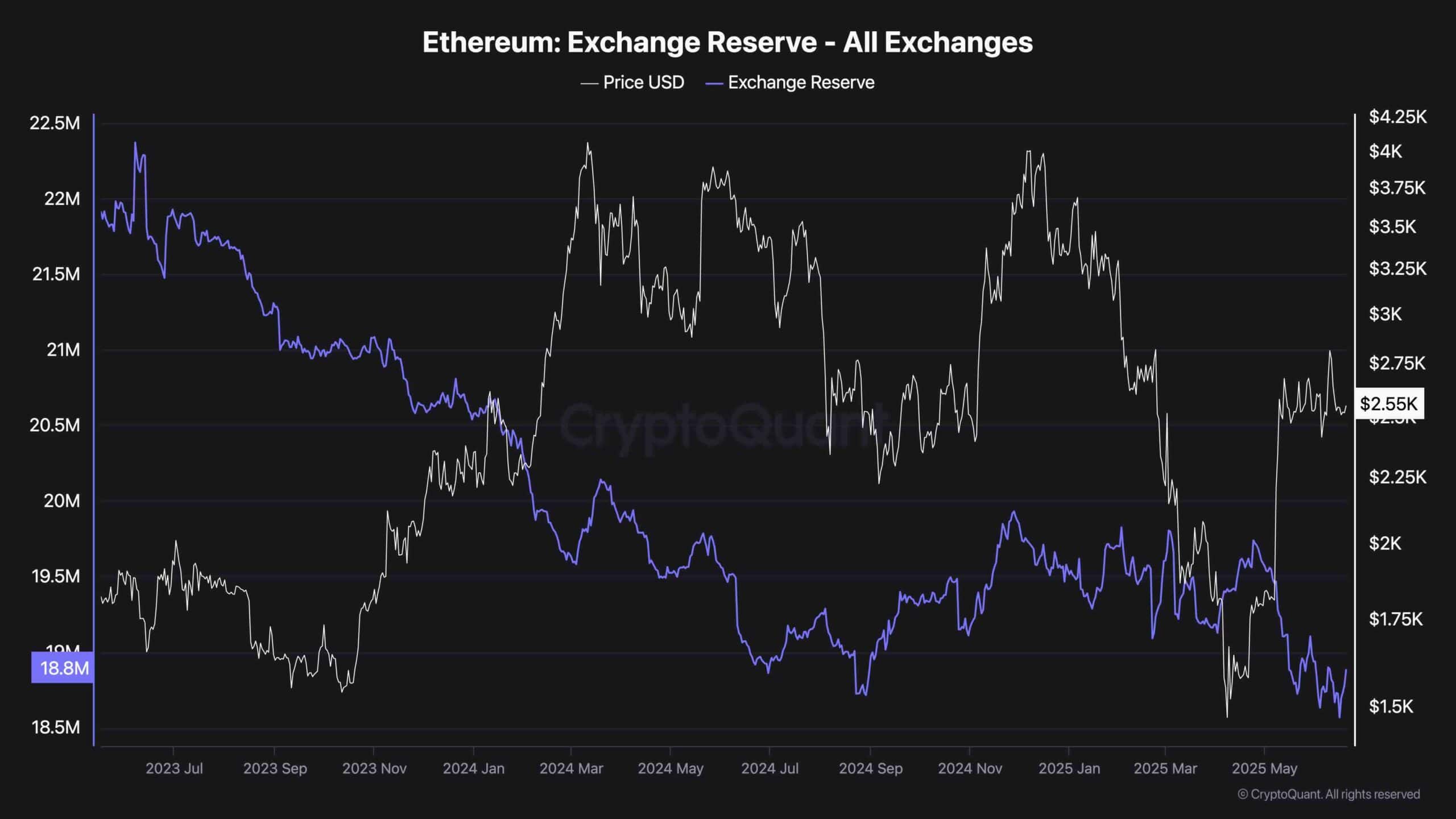

One in every of Ethereum's most necessary long-term indicators stays a constant downtrend in alternate reserves. At present, they sit at 18.8 million ETH, one of many lowest ranges in current historical past. Change Reserve knowledge exhibits the quantity of ETH that an ETH is held on a centralized buying and selling platform. This implies a decline sign that the coin is being withdrawn into independence, staking, or chilly pockets.

Traditionally, the continual drops of the alternate counsel that the provision squeezes the story constructing beneath the floor. Much less alternate tokens can result in decrease obtainable gross sales pressures and explosive the other way up when demand rises.

Regardless of ETH's technically struggling to flee, this quiet accumulation stage exhibits belief amongst long-term holders. If this pattern continues, it may function a robust tailwind if technical resistance ranges are finally compromised.