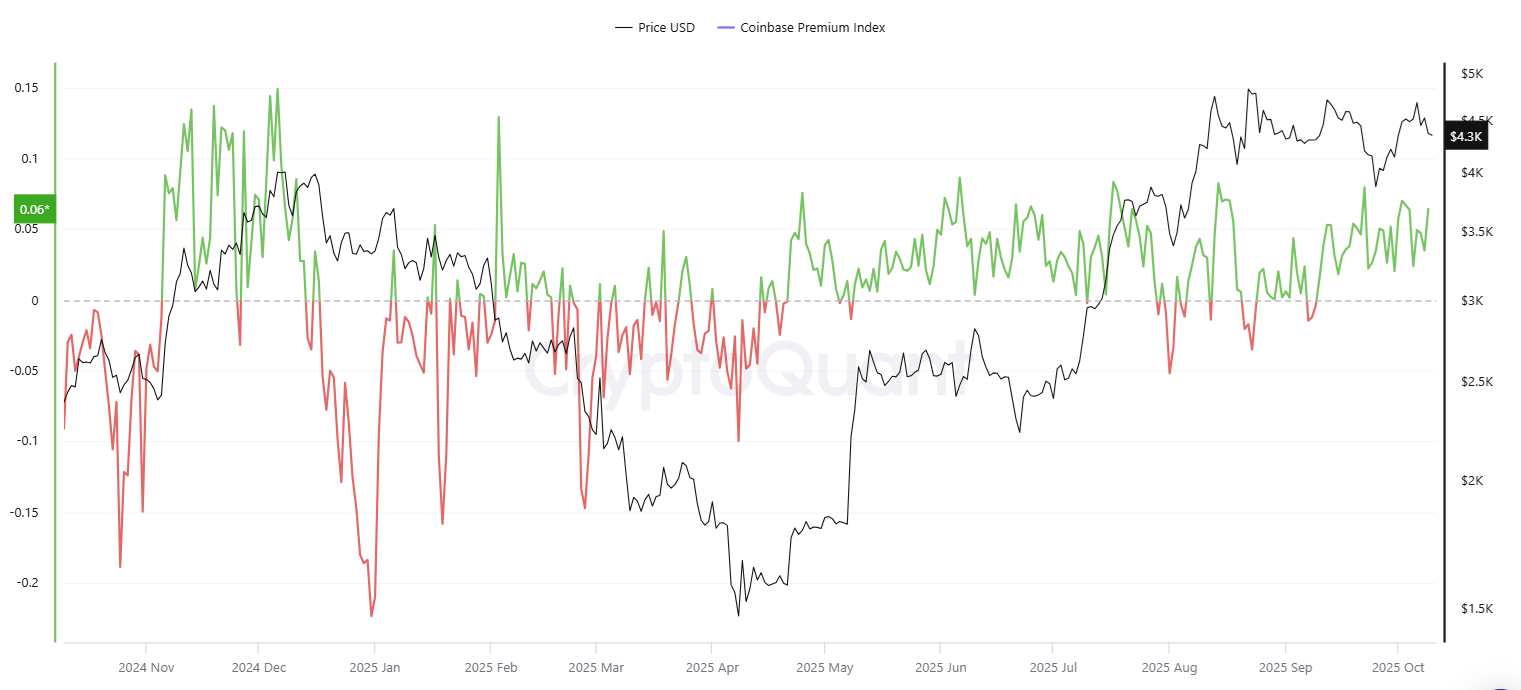

The present ETH value vary is supported by hype, as mirrored in Coinbase's premium. On the identical time, whales choose to build up in decrease ranges.

Ethereum (ETH) continues to indicate excessive ranges of hype as retailers nonetheless present robust curiosity in buying. Current knowledge reveals that ETH continues to be buying and selling at a Coinbase premium, suggesting that US-based merchants are ready to cowl the price of the rally.

ETH continues to be buying and selling at a Coinbase premium, indicating hype from US merchants, however not essentially strategic accumulation. |Supply: Cryptocurrency

ETH is buying and selling at $4,357.20 and the Coinbase premium has remained constructive for the previous few weeks. Coinbase costs are a proxy for US investor sentiment and measure retailer habits, not sensible cash. Since Coinbase is measuring direct purchases because of the hype, ETH has a number of sources of influx together with ETFs and ETPs.

The Ethereum Coinbase Premium Index has been persistently constructive since early September and has remained constructive regardless of value fluctuations and the latest drop beneath $4,500.

In late 2025, ETH extra typically traded at a premium. ETH is displaying power within the quick time period, however the whales are situated in several value ranges.

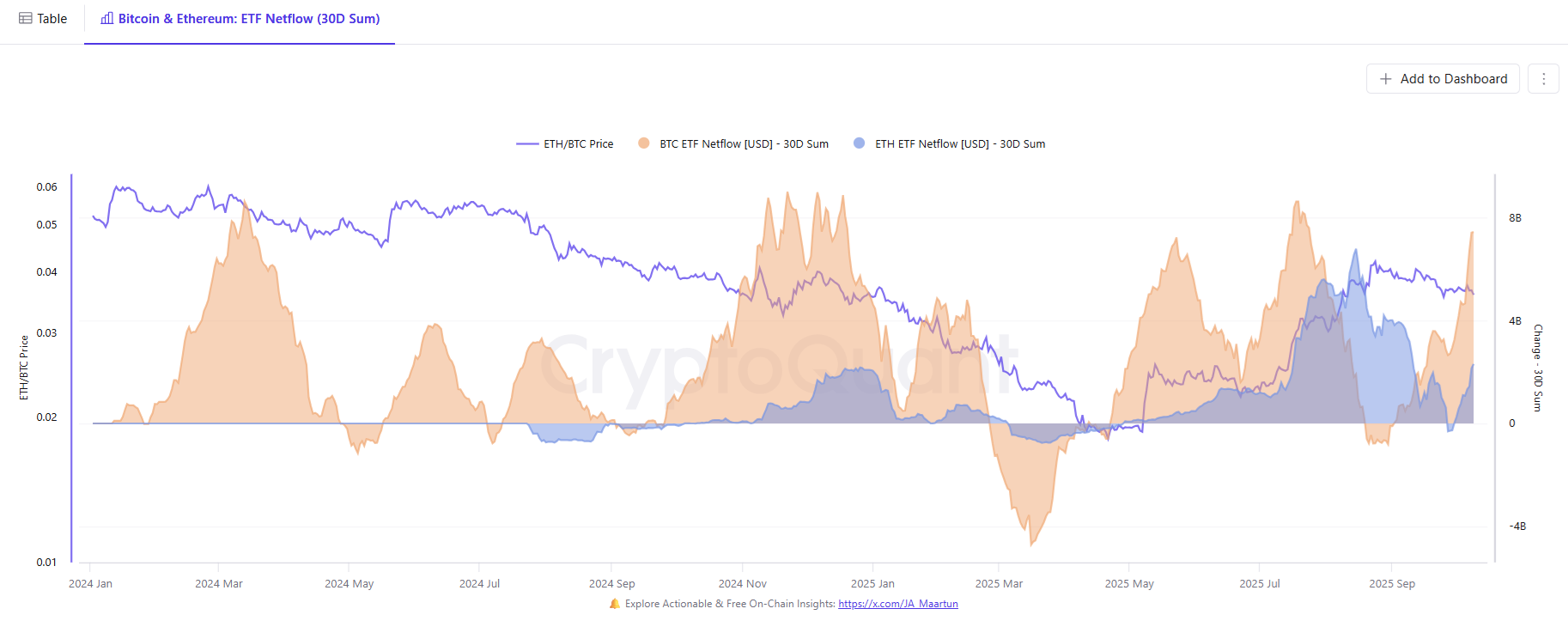

ETH has slower restoration in ETF demand

In contrast to shopping for straight from Coinbase, ETFs influx Restoration might be slower. Like Cryptopolitan, ETF patrons can nonetheless pour in recent capital. reportedhowever ETH patrons are extra cautious.

With BTC as soon as once more taking the highest spot, the demand for ETH by ETFs is lowering. |Supply: Cryptocurrency

ETF internet flows are a lot stronger for BTC, whereas ETH continues to be making an attempt to regain one in every of its latest peaks. In 2025, ETH skilled its first steady two-week interval with a lot stronger inflows in comparison with BTC, however the development has reversed.

ETH can also be flowing into the buildup pockets, which nonetheless has over 27 million tokens remaining. The market is expecting a return to much more sturdy demand that would come from staking ETFs.

Will ETH appropriate additional?

Current developments in ETH counsel {that a} correction could possibly be coming quickly. Strategic whales are nonetheless expecting accumulation within the a lot decrease $2,200-$1,800 zone. Nonetheless, the market is enthusiastic sufficient to keep away from a drawdown.

The ETH whale was already in that value vary earlier than the latest rally. Most authorities bonds and a few ETP reserves have been constructed at lower cost factors.

ETH open curiosity is barely decrease at $27 billion, however merchants are reluctant to desert the token. ETH continues to be a part of the altcoin season, so merchants are nonetheless ready for a short-term breakout. Value actions have additionally been subdued as consideration has shifted to the story of BNB, SOL, and different altcoins. ETH has misplaced some mindshare to those cash after gaining traction in September.

Within the quick time period, ETH continues to be pushed by derivatives buying and selling, rebuilding long- and short-term liquidity between $4,200 and $4,400. Primarily based on the quick liquidity generated, the squeeze could possibly be as excessive as $4,500. Nonetheless, ETH has not proven sufficient momentum and continues to be looking for liquidity for a good larger breakout. ETH market dominance is 12.4%, a step again from latest ranges of 13%.