Ethereum wants to interrupt above key SMA ranges to keep up bullish momentum, and futures flows are displaying combined volatility.

Ethereum (ETH) rose 1.2% prior to now 24 hours, pushing its value to $3,235.25. Notably, throughout this era, the value fluctuated between $3,160.13 and $3,267.70.

Over the previous week, Ethereum has proven a rise of three.5%, whereas its 14-day efficiency reveals a modest enhance of 5.7%. Nonetheless, the 30-day efficiency nonetheless fell by 7.0%.

Regardless of short-term features, the market is displaying indicators of exhaustion and bulls are struggling to keep up management. Ethereum could also be vulnerable to returning to its earlier vary except stronger momentum intervenes.

With a market capitalization of $390.38 billion and 24-hour buying and selling quantity of $24.5 billion, indicating stable exercise, Ethereum is at a essential juncture. The following few days will decide whether or not Ethereum breaks out of the present vary or reverses.

Ethereum’s main help and resistance ranges

In response to the technical chart, Ethereum value is hovering simply above its 9-day easy shifting common (SMA) of $3,166.96. Ethereum is making an attempt To take care of the latest bullish momentum. The second-largest cryptocurrency is testing the higher finish of its vary, and its capacity to carry above the SMA stage may sign additional upside.

ETHUSD 1 day chart

The relative energy index (RSI) is at present at 53.88, suggesting that Ethereum is neither overbought nor oversold, with room for potential value motion in both path.

With the RSI hovering simply above the impartial mark of fifty, Ethereum seems to be in a consolidation section awaiting additional momentum. If the RSI continues to rise, it may point out that Ethereum is gearing up for a breakout and will goal the subsequent resistance zone.

The MACD (Transferring Common Convergence Divergence) indicator additionally confirmed a constructive worth of 53.36, with the MACD line above the sign line, suggesting bullish momentum. The histogram can also be constructive, indicating a rising want to buy.

This, mixed with a impartial studying on the RSI and value positioning above the SMA, signifies that Ethereum may transfer larger if it might probably break via an instantaneous resistance stage like $3,600. Nonetheless, if the value falls under the 9-day SMA, it may point out a pullback to decrease help ranges.

Ethereum futures buying and selling leak

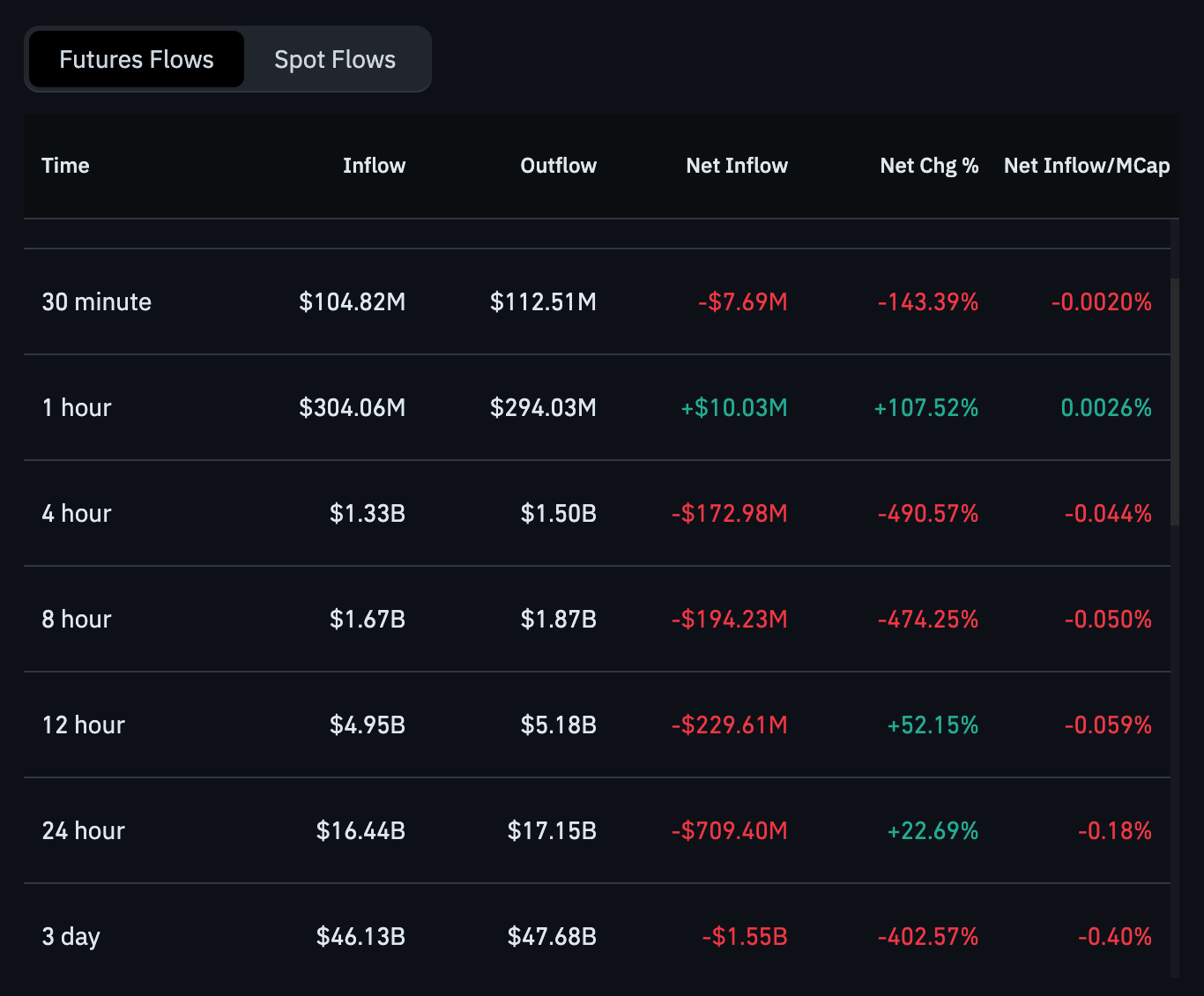

vice versa, futures movement information Within the case of Ethereum, we see combined developments throughout completely different time frames, indicating elevated market volatility. Over the previous half-hour, Ethereum skilled small web outflows of $7.69 million, with inflows of $104.82 million and outflows of $112.51 million, leading to a unfavourable change of 143.39%.

Nonetheless, the one-hour information confirmed a extra constructive outlook with web inflows of $10.03 million, up 107.52%, indicating renewed shopping for curiosity.

ethereum futures

longer time frames, the 4-hour, 8-hour, and 12-hour information point out a extra bearish sentiment. Within the 4-hour interval, Ethereum recorded a web outflow of $172.98 million (-490.57%), and the 8-hour interval noticed an identical decline with web outflows of $194.23 million (-474.25%).

There was a slight enchancment within the 12-hour interval, with web inflows of $5.18 million. The 24-hour information revealed a web outflow of $709.4 million, whereas the three-day information confirmed an excellent larger outflow of $1.55 billion.