After weeks of uneven value motion, Ethereum is specializing in brewing volatility throughout the crypto market. ETH has been at a major degree not too long ago, however the rising variations between value actions and open curiosity in futures have frowned upon.

As macro uncertainty eases and Altcoin's story slowly returns to the highlight, ETH is ready for potential directional actions, however it stays to be seen whether or not it is a bonus or a downside.

Technical Evaluation

Shayan Market

Each day Charts

Ethereum continues to consolidate slightly below the $2,800 resistance zone after recovering its 200-day transferring common yesterday. Costs are hovered inside a slender vary, with the primary resistance area sandwiched between the demand zones of round $2,800 and $2,500.

It additionally creates tight ascending channel patterns of lower than $2,800. That is often the inversion sample if it breaks on the draw back. Nevertheless, a bullish breakout from this sample might negate the inversion and add gas to the potential rally.

The RSI chart additionally stays secure on the sixtieth degree, indicating that there’s nonetheless room for upward motion earlier than belongings enter the territory the place they had been acquired. Nevertheless, with out a compelling break of over $2,800, the transfer might be categorized as a variety moderately than a continuation of the pattern.

If $2,500 collapses and the channels are break up into destructive points, deeper pullbacks to the $2,100-$2,200 disparity zone are more and more doable, particularly as resting fluidity is recovered.

4-hour chart

Zooming in on the 4H timeframe reveals the worth motion of ETH inside the ascending channel. This sample shaped after an almost vertical impulse motion from the $1,800 space, forsaking a outstanding imbalance that was nonetheless unfulfilled. There’s additionally a good worth hole shaped across the $2,600 degree, however it now serves as short-term assist.

This space is vital to the client's protection in the event that they need to protect the present market construction. To date, belongings have attacked the channel's larger trendlines a number of instances, however every retest has been lowering bullish momentum.

Moreover, though RSI prints low highs, the costs are secure, suggesting that potential bearish divergence is being shaped. If confirmed, this might return to the decrease restrict of the channel and even potential failures, sending ETH to a $2,350 liquidity pool and even deeper into an imbalance zone of about $2,000. For bullish breakouts, ETH should clear $2,800 in power and continuity. Ideally, the assembly ought to be fueled by the quantity and the stream of liquidation.

Emotional evaluation

Shayan Market

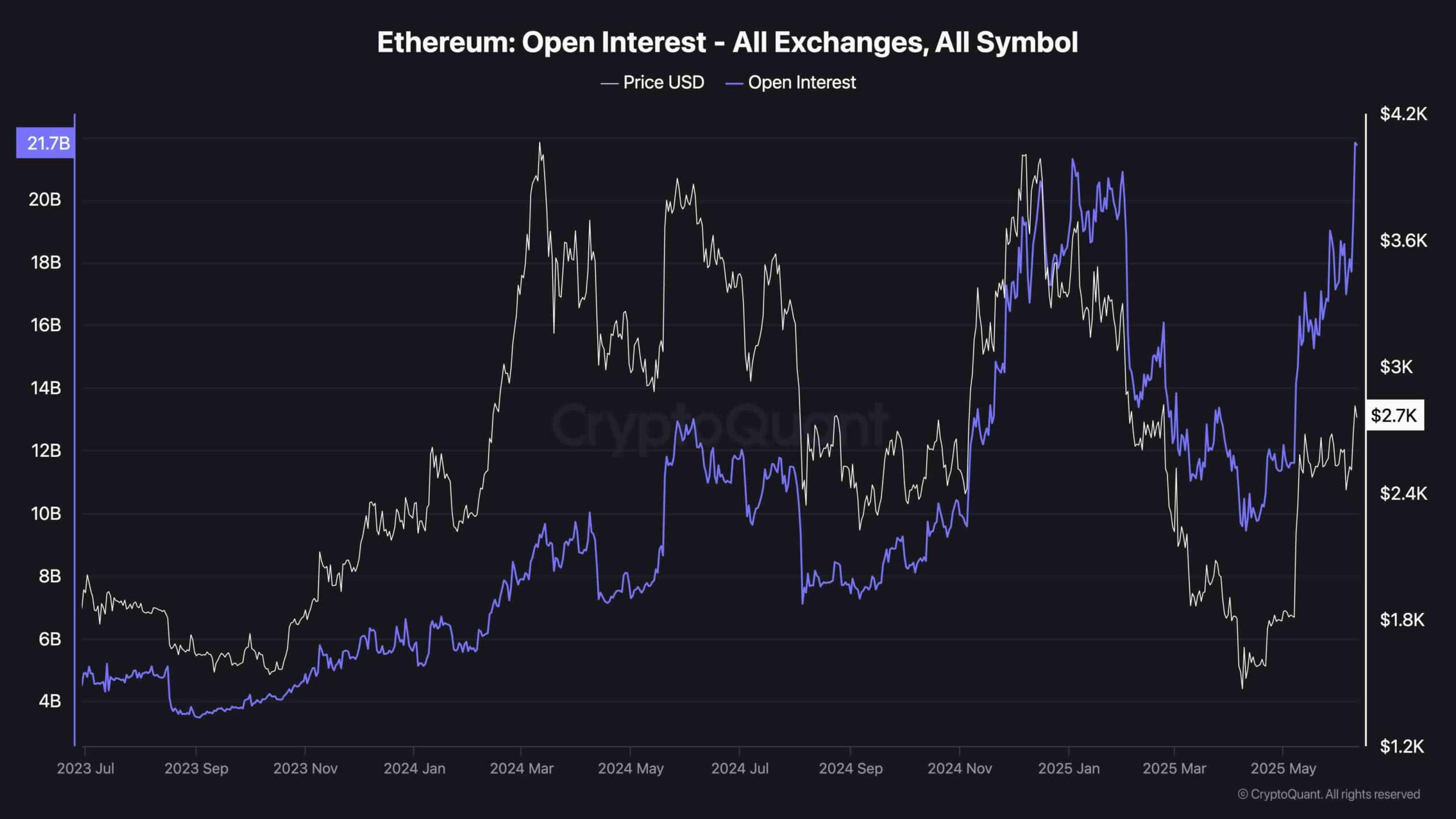

Probably the most notable modifications lately is Ethereum's open curiosity (OI). As proven within the chart, the metric reached a brand new excessive of over $21.7 billion on all exchanges, regardless of the ETH costs nonetheless falling under the latest excessive.

This creates a transparent divergence. The OI is actively climbing, however costs stay comparatively calm. This kind of divergence usually precedes sharp volatility within the type of a liquidation flash or breakout aperture. Merely put, the market is essentially situated, however costs don’t confirm accumulation.

This state of affairs can result in two outcomes: If ETH exceeds necessary resistance, heavy open curiosity can promote fast quick apertures and steady rallies. On the again, if costs fail to regain $2,800 instantly and lose $2,500 in assist, a protracted cascade of liquidation might start, doubtlessly wiping out the bullish leverage of latest years.

Merchants have to be ready for the growth transfer shortly, as compression between OI and stuck charge will increase and stuck charges will not be sustainable. It is a volatility lure ready for spring. Timing it proper is necessary for short-term positioning.