Right now's Ethereum Value: $2,420

- The Ethereum spot and derivatives markets have skilled sluggish actions, indicating that buyers have had much less shopping for exercise up to now few days.

- Ethereum has seen a rise in community utilization regardless of the worth remaining in vary.

- ETH confronted a denial on the $2,500 stage after posting an inverted hammer.

Ethereum (ETH) fell 1% throughout early buying and selling hours on Friday. It is because market actions stay cautious after low realised earnings and losses, together with steady rights. However, Ethereum's community utilization rebounded, with transactions rising from 123 million to 1.75 million on Wednesday, spurring a rise in lively addresses.

Ethereum costs stay in scope as community exercise grows

Ethereum's derivatives and buying and selling actions throughout the spot market have been pretty impartial over the previous few days, revealing that cautious sentiment stays primarily prioritized available in the market.

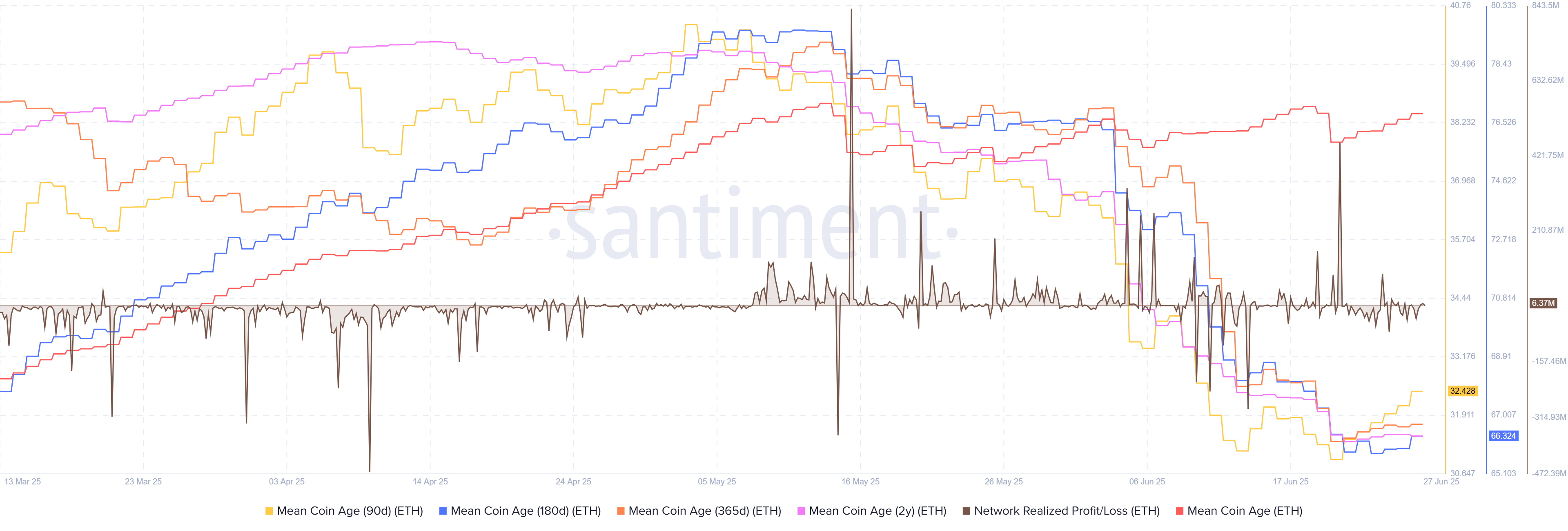

The community realized revenue/loss and common coin age metrics. It reveals buyers have decreased buying and selling exercise, each day losses and earnings fall under the $100 million mark, with distribution/accumulation remaining flat for the previous few days.

ETH community achieved revenue/loss and common coin age. Supply: Santiment

In keeping with information from Cryptoquant, whales with 10,000-100,000 ETH balances have additionally been steady because the starting of the week, rising by simply 7,000 ETH. This comes with a barely upward-leaning alternative spare, indicating a slight improve in weekly gross sales strain.

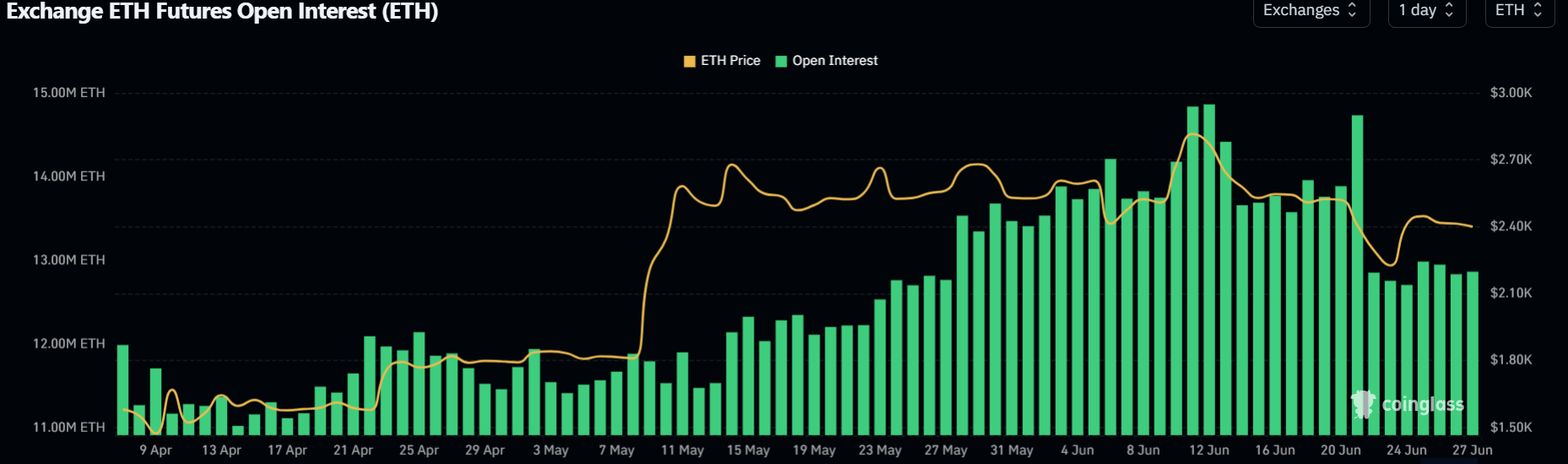

The derivatives market has painted an analogous image, with open curiosity (OI) not surpassing the 13 million ETH mark since falling on Saturday. Open revenue refers back to the whole worth of any excellent or unresolved contracts within the derivatives market.

ETH open curiosity. Supply: Coinglass

These metrics painting cautious market sentiment with slight bias in direction of the draw back, however Ethereum's community use and institutional sentiment leaning considerably in direction of bullish developments.

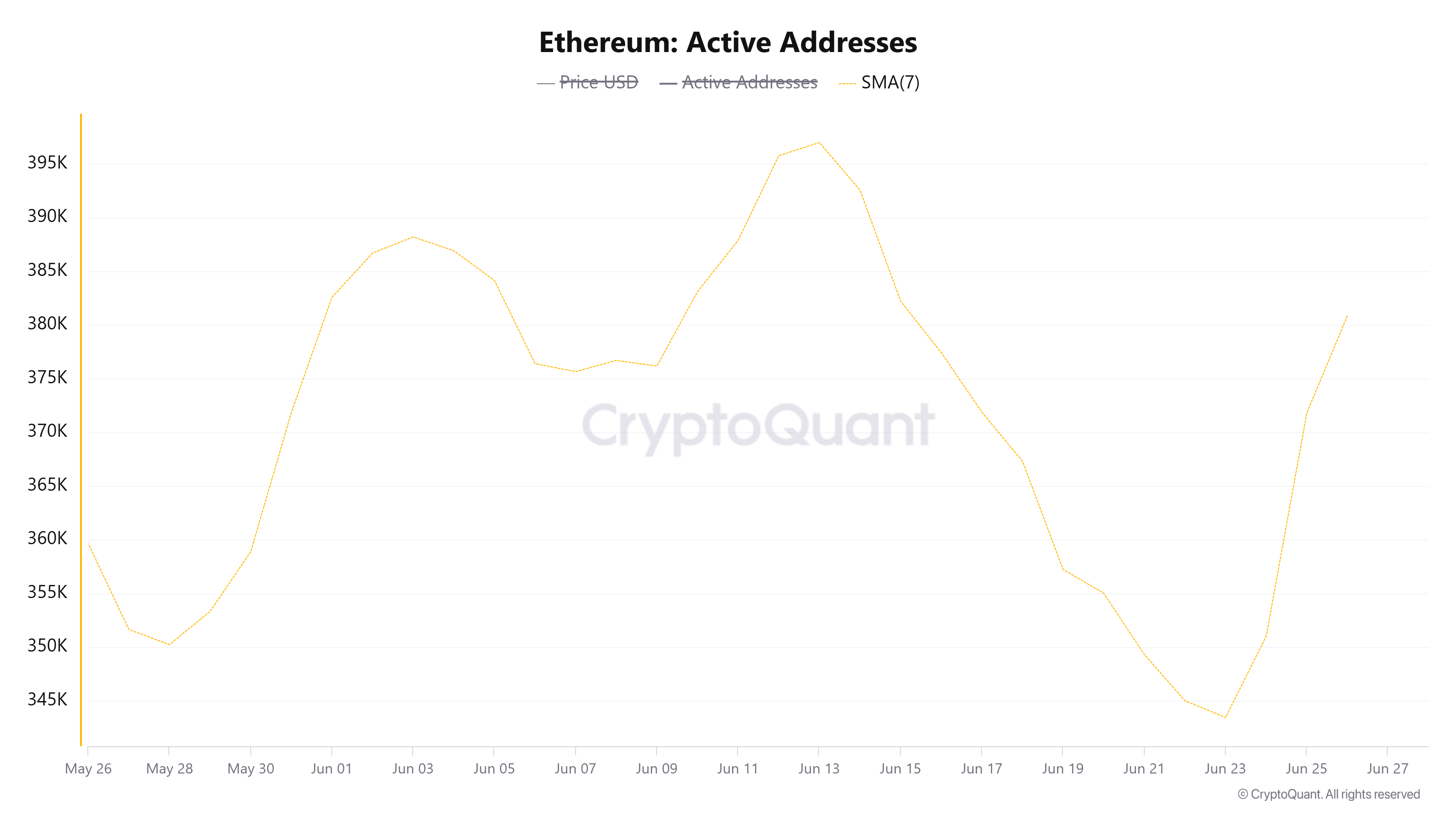

Ethereum's lively tackle is rising once more, breaking the downtrend that started on June thirteenth regardless of the largely leveling costs.

ETH lively tackle. Supply: Cryptoquant

These addresses are additionally lively when making transactions as Ethereum transactions elevated from 123 million to 1.75 million between Sunday and Wednesday, indicating a rising curiosity in Ethereum ecosystems.

Such development in community exercise reveals energy and infrequently varieties the idea for long-term restoration when macroeconomic elements are constant. Nevertheless, this seems to be unclear for now as market members seem to comply with the ready strategy as a result of uncertainty surrounding President Trump's 90-day tariff suspension, which is approaching the July 9 deadline. This leaves the bearish shadows hanging on a lot of the ETH and Crypto market.

https://x.com/kobeissiletter/standing/1938291119483224102

Ethereum Value Prediction: Key Degree $2,500 after posting ETH Check Inverted Hammer

Ethereum has skilled a $755 million futures liquidation within the final 24 hours, reaching $37.08 million and $38.03 million in lengthy and quick positions that had been liquidated, respectively.

After briefly accumulating the $2,500 stage for the primary time up to now week, ETH noticed rejections on the a hundredth Easy Shifting Common (SMA) and posted an inverse hammer within the course of. A bullish reversal is verified as ETH holds practically $2,400 in assist and breaks the $2,510 resistance.

ETH/USDT 12-Hour Chart

Nevertheless, should you scale back under the assist line of practically $2,400, you possibly can ship ETH to check the higher line of downward channels. When ETH drops under the decrease boundary of the triangle, which is symmetric with the channel's higher certain, the bearish flag sample is validated, permitting the worth to fall under the important thing stage of $2,110.

The relative energy index (RSI) checks impartial ranges, and the stochastic oscillator exceeds its midline. Crossovers above the impartial stage of RSI might strengthen bullish momentum.

Associated Information

- Ethereum worth forecast: Bitcoin miner pivots to ETH Ministry of Finance technique

- Ethereum worth forecast: Powell's hawkish tone as a ceasefire between Israel and Iran ignores Powell's hawkish tone to burn bullish feelings

- Cryptocurrency can be utilized as a mortgage asset in 2025: For this reason