Ethereum is presently testing a essential resistance area close to the 200-day shifting common for $2.5,000. This brought on a consolidation stage.

Deep short-term corrections are potential resulting from normal provide and extreme circumstances, however market construction and momentum counsel a possible bullish breakout within the medium time period.

Technical Evaluation

Shayan Market

Every day Charts

ETH's latest bullish momentum has pushed costs in the direction of a $2.5,000 zone of resistance, according to the 200-day shifting common (traditionally important ranges of provide and market response). Testing this confluence of resistance, Ethereum misplaced its upward momentum and entered a brief integration section.

This psychological barrier and a essential breakout above 200-day MA will mark a shift in market feelings and doubtlessly mark the start of a broader bullish reversal. Such a transfer may drive costs in the direction of the mid-term 3k$3k threshold.

Nevertheless, the presence of a resting provide at this stage, mixed with an RSI indicator indicating the phrases of acquisition, will increase the probability of short-term correction strikes. Persevering with integration inside the $2.1K-2.5K vary is affordable and means that you can reset the market time earlier than one other breakout try.

4-hour chart

Within the four-hour timeframe, the Ethereum rally stalled visibly on the $2.5,000 mark, revealing indicators of distribution and gross sales strain. This integration fashioned a bullish continuation wedge. It is a dependable sample that implies a brief pause earlier than a possible breakout.

If the decrease wedge restrict is held efficiently, Ethereum may instantly start a bullish breakout, regaining momentum and violating the $2.5,000 resistance zone. Conversely, the breakdown under this sample may present a deeper revision and drive costs in the direction of a key assist stage of two.1k.

In abstract, ETH stays within the built-in state beneath the principle resistance stage. Merchants ought to intently monitor the wedge construction and the $2.1k to $2.5,000 vary for the subsequent vital motion clue.

On-Chain Evaluation

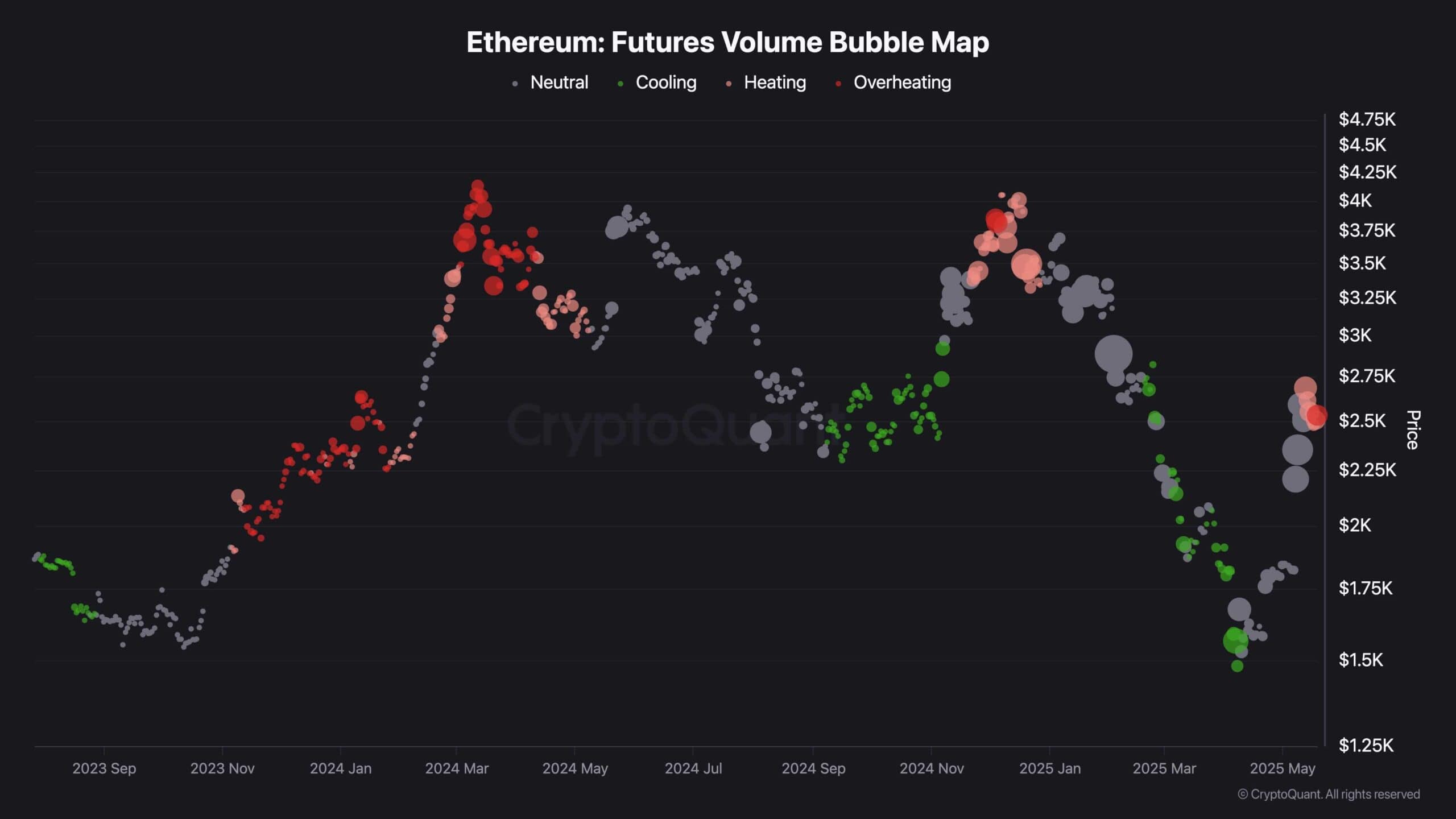

The bubble chart under exhibits the whole transaction quantity for all exchanges. Bubble measurement signifies the speed of quantity change in quantity, the place quantity measurement and colour are categorised as cooling, impartial, overheating, and extremely overheating.

As proven, Ethereum's strategy to a essential resistance stage of $2.5,000 led to an overheating situation characterised by a big surge in buying and selling quantity. This spike is pushed primarily by the profit-making actions and the presence of resting provides on this psychologically vital worth vary. Overheated circumstances point out the potential of short-term corrections because the market cools down and paves the best way for up to date accumulation.

In consequence, Ethereum is predicted to proceed its integration section till new demand emerges to advertise breakouts past this vary of resistance within the medium time period.