ETH worth is testing a key help stage after forming a bullish reversal sample. Might a rebound from right here put it again on monitor for a robust rally?

abstract

- ETH worth is testing the $4,100 help stage after falling from Monday's excessive.

- A double backside sample has shaped on the 4-hour chart.

- Technical indicators are displaying early indicators of a reversal.

On Monday, Ethereum (ETH) rose 10% to a weekly excessive of $4,232 earlier than falling again as revenue taking started to roll in, shifting nearer to $4,100, the psychological help it wants to keep up to stop additional losses.

Ethereum’s decline follows the formation of a double backside sample on the 4-hour chart, which frequently results in a reversal to an uptrend. Within the case of Ethereum, each lows of the sample shaped across the $3,713 stage, with the neckline simply round $4,100, at present appearing as a key resistance zone.

ETH worth types a bullish reversal sample on 4-hour chart — October 28 | Supply: crypto.information

A breakout from this sort of construction can result in a sustained pattern reversal over a number of days. In Ethereum’s case, a confirmed transfer above the neckline would open the door for a rally in direction of $4,491, a ten% enhance from present ranges. The goal is calculated by including the depth of the double backside shaped to the breakout level.

You may additionally like: 402bridge hack led to over 200 customers shedding USDC

Nonetheless, be cautious of momentum indicators that ship blended indicators. The MACD line seems to be approaching a bearish crossover with the sign line, whereas the RSI is forming a bearish divergence. Each are indicators that the rally might weaken within the brief time period.

For now, $4,100 is appearing as a direct resistance zone, however draw back help lies round $4,000, a psychological stage that Ethereum wants to keep up if it needs to proceed its upward trajectory.

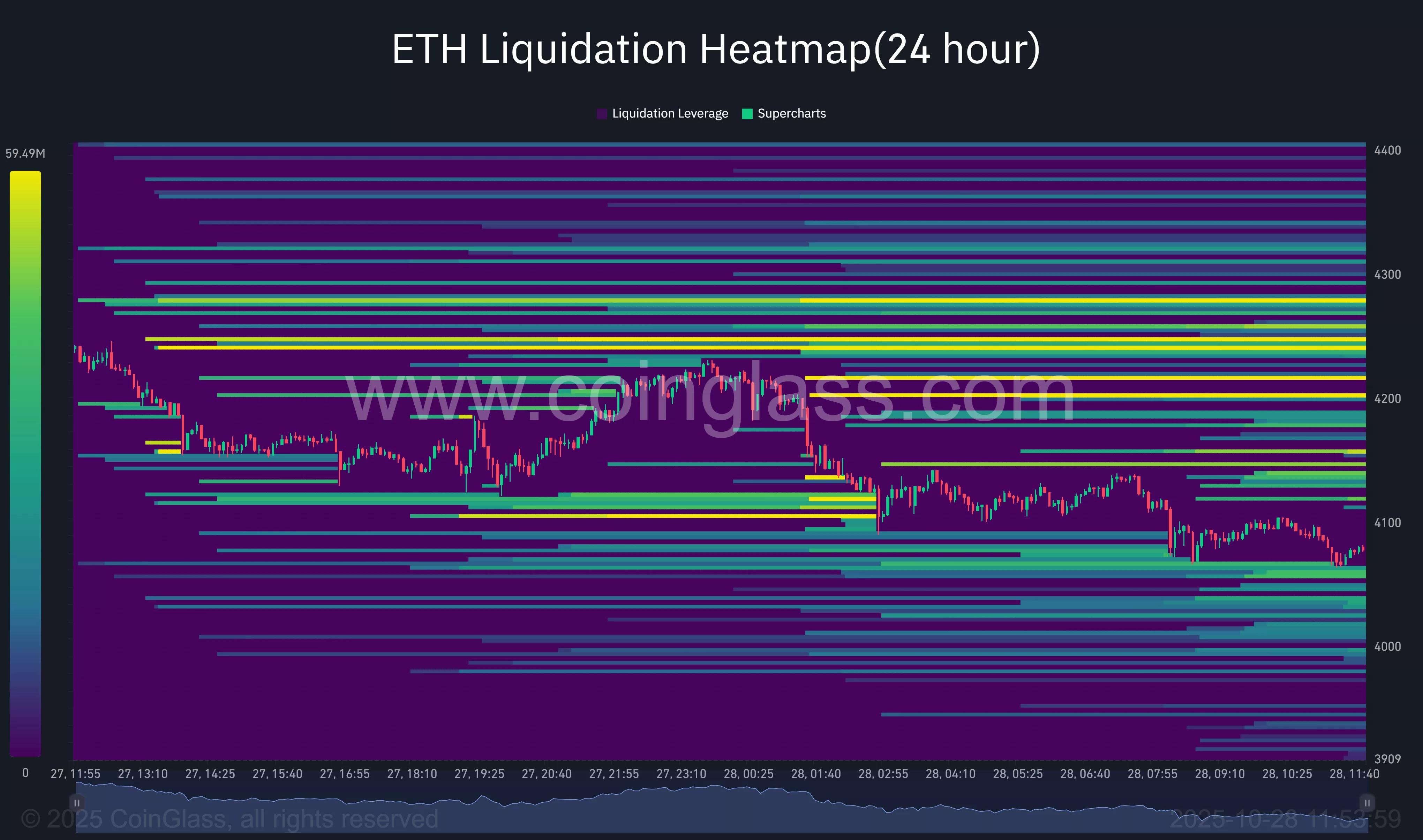

In response to CoinGlass’ 24-hour liquidations heatmap, there’s a notable cluster of short-term liquidations between $4,100 and $4,200, coinciding with the neckline of the double backside sample and the higher sure of the beforehand recognized descending wedge.

Supply: Coin Glass

A clear breakout of this band may create a brief squeeze, forcing the liquidation of overleveraged positions and accelerating worth appreciation. With a lot liquidity piling up on this zone, the bulls may discover the momentum wanted to push ETH into the $4,400-$4,500 goal vary.

On the draw back, the heatmap reveals important liquidation curiosity between $4,000 and $3,900, suggesting this area may act as a robust demand zone within the close to time period.

If Ethereum enters the area, patrons are prone to intervene aggressively to guard key helps. Nonetheless, if ETH dips beneath $3,900, the chart will start to skinny, indicating decreased liquidity and restricted buy-side curiosity, doubtlessly exposing the token to elevated volatility and elevated losses, probably dragging ETH into the $3,700-$3,650 space.

learn extra: Ethereum ETF reaches second consecutive week of outflows with $555 million in outflows

Disclosure: This text doesn’t symbolize funding recommendation. The content material and supplies revealed on this web page are for academic functions solely.