Based on the on -chain knowledge, the Ether Leeum community has seen a pointy rise within the weekly whale quantity.

Ether Leeum massive buying and selling quantity was the best since 2021

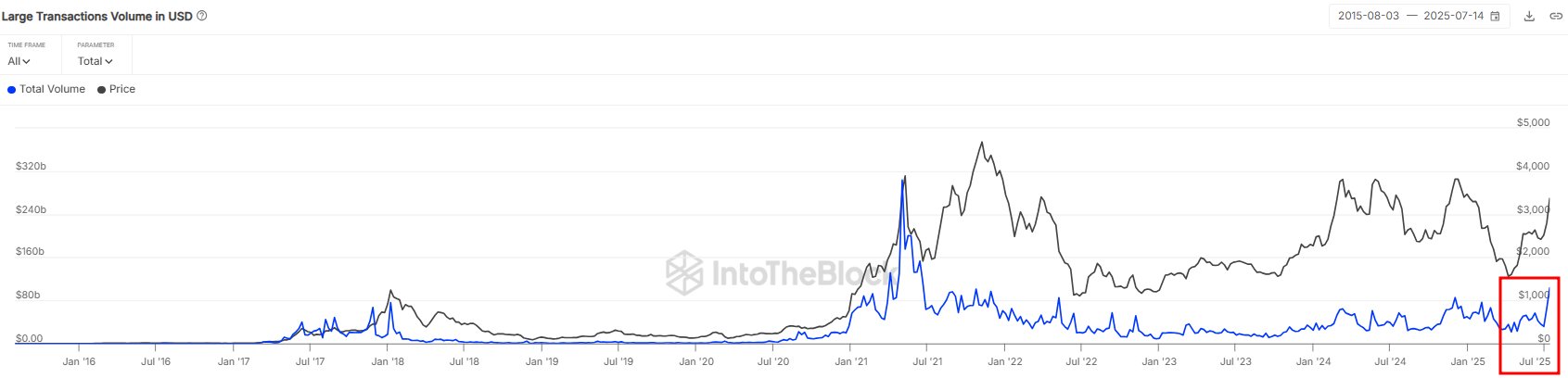

Within the new publish of X, Sentora (earlier INTOTHEBLOCK), an Institutional Defi Options supplier, talked in regards to the newest developments in Ether Lee, a big buying and selling quantity.

Right here, the “massive buying and selling quantity” signifies an indicator of the quantity of complete quantity transferring from the ETH community by a transaction of $ 100,000 or extra.

On the whole, solely whale -sized traders can transfer the quantity of a single switch, so the quantity related to this motion might be assumed as an expression of the actions carried out by a big sum of money traders.

If the worth of the metrics rises, it implies that whales are rising their buying and selling actions. This development could also be a sign that curiosity in belongings is rising. Alternatively, if the indicator goes down, it implies that a giant holder can lose curiosity in cryptocurrency.

Now there’s a chart that exhibits the development of Ether Leeum's massive buying and selling quantity for the historical past of cash.

The worth of the metric seems to have been rising in latest days | Supply: Sentora on X

As proven within the graph above, the Ether Leeum massive buying and selling quantity has not too long ago noticed some fast progress and means that whales have drastically elevated buying and selling actions.

Final week, this metrics' worth is over $ 100 billion, the best daytime stage for the reason that 2021 hearth. The wave of this newest exercise of the whale has raised the present value to $ 3,000 with ETH's brake out.

That is actually a sign that will increase the curiosity of the true actuality, however it’s tough to say whether or not it’s optimistic. Since massive buying and selling quantity doesn’t comprise details about the division between purchases and gross sales actions, the spike doesn’t say something about which conduct is extra dominant, and these holders are making a type of motion.

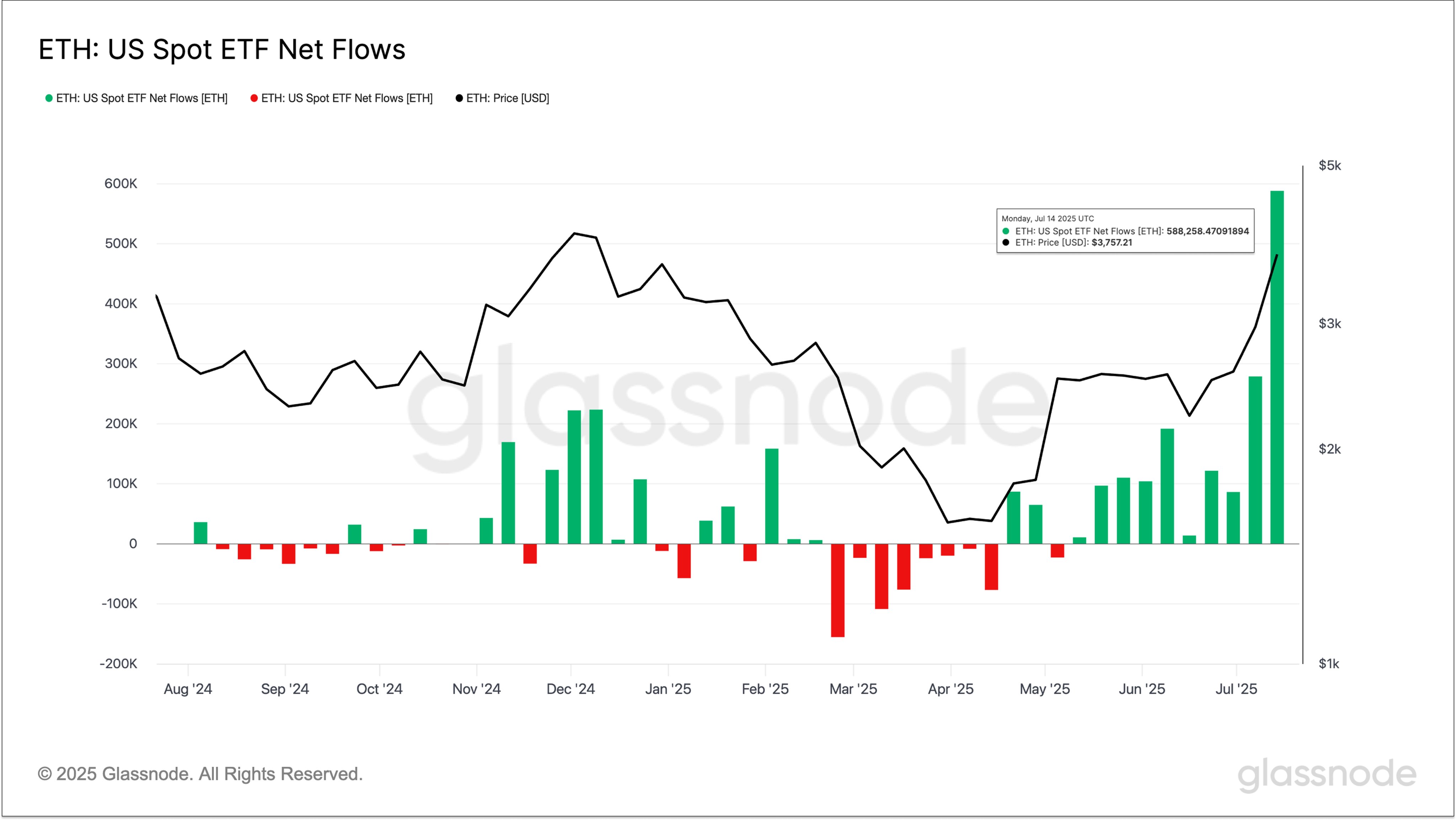

In different information, because the evaluation firm GlassNode identified within the X Submit, US Ether Rige Spot Alternate-Traded Funds (ETF) blocked the report week.

The development within the netflow related to the US ETH spot ETFs | Supply: Glassnode on X

On this chart, Etherrium Spot ETF has seen inexperienced states for some time, however the newest is noticeable on the measurement of the sighted influx.

GlassNode stated, “Final week, Etherum Spot ETF noticed the influx of 588K ETH.

ETH value

On the time of writing, Ether Lee is buying and selling about $ 3,730 final week.

Appears like the value of the coin has been climbing up not too long ago | Supply: ETHUSDT on TradingView

DALL-E, GlassNode.com, INTOTHEBLOCK.COM, TradingView.com

Editorial course of focuses on offering thorough analysis, correct and prejudice content material. We help the strict sourcing commonplace and every web page is diligent within the high know-how consultants and the seasoned editor's crew. This course of ensures the integrity, relevance and worth of the reader's content material.