Ether might shock many bears subsequent month. September will deepen the corrections that may very well be fully “invalid” by the point October arrives.

“It might appear bewildering at first, but when it unfolds, it may very well be the most important bear entice I've ever seen,” full-time crypto dealer and analyst Johnny Woo stated Monday.

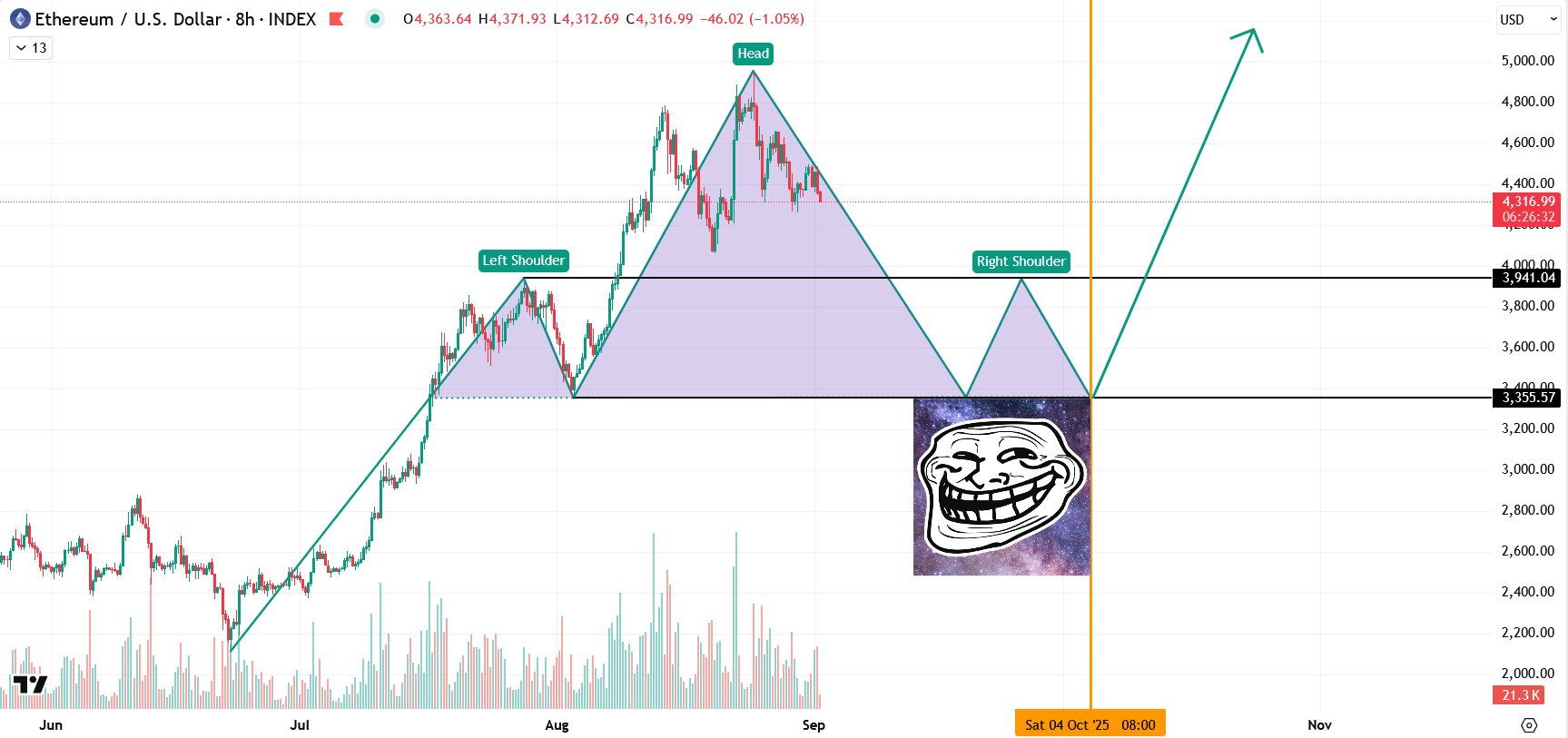

He disabled it on “As much as Ver” after including that the chart might draw head and shoulder patterns in September “to scare everybody.” This traps merchants throughout paper and forces them to purchase increased.

“I've seen this many occasions so it's positively doable,” he added.

On this state of affairs, Ether (ETH) will return to help ranges in September for round $3,350 in September, get well in October and construct up in November.

The identical factor recovered in November to print the very best ever excessive after ETH fell 30% from $3,950 to $2,750 in September 2021.

Potential ETH head and shoulder sample. sauce: Johnny Woo

One other analyst says that the look of a fall to help

fellow dealer Daan Crypto Trades reiterated that sentiment, saying that at X, “everyone seems to be being chopped up” as ETH is consolidating an space of $4,300 to $4,500 within the heart of the vary.

He stated the low vary retest and the 4-hour 200 transferring common trendline (roughly $4,160) could be “an fascinating place.”

Associated: Historical past means that the Ether August rally might result in a downtrend in September

Give attention to the fundamentals

Apollo Capital's chief funding officer, Henrik Anderson, was a little bit extra skeptical of technical indicators and traditionally bearish September and chart patterns.

“For my part, it's usually higher to deal with fundamental evaluation fairly than counting on issues that may typically be false historic patterns,” he advised Cointelegraph.

“Whereas previous developments typically present perception, they shouldn’t be the primary basis for predicting market actions, particularly in a dynamic, evolving house like cryptocurrency.”

“The macro occasions like US employment information (this Friday) and future Federal Reserve price selections are more likely to lead to short-term volatility, however the story is structural,” OKX Singapore CEO Gracie Lynn advised Cointelegraph.

She added that stubcoin's progress and laws have gotten extra clear.

Ether continues to be fastened

ETH continues to retreat and loses one other 1% within the final 24 hours.

The property fell to an intraday low of $4,238 earlier than recovering to commerce at $4,374 on the time of writing. It’s at the moment down 11.7% from an all-time excessive. That is a lot shallower than the pullbacks of the previous September.

ETH costs have fallen at decrease highs and decrease lows. sauce: TradingView

journal: XRP 'Cycle Goal' $20, Strategic Bitcoin Lawsuit Dismissed: Hodler's Digest, August 24-30