Ether's weekend drop in early February revived acquainted questions. Is the Ethereum community lagging behind newer opponents or struggling to justify its valuation?

as $ETH It plummeted 17%, consistent with most cryptocurrencies, however skeptics questioned if this was a warning sign that the protocol's dominance could also be eroding.

Nonetheless, inside the Ethereum ecosystem, there is no such thing as a comparable sense of alarm concerning the inventory worth decline. Builders and long-term gamers primarily framed this transfer as a market-driven correction quite than a judgment on Ethereum’s well being.

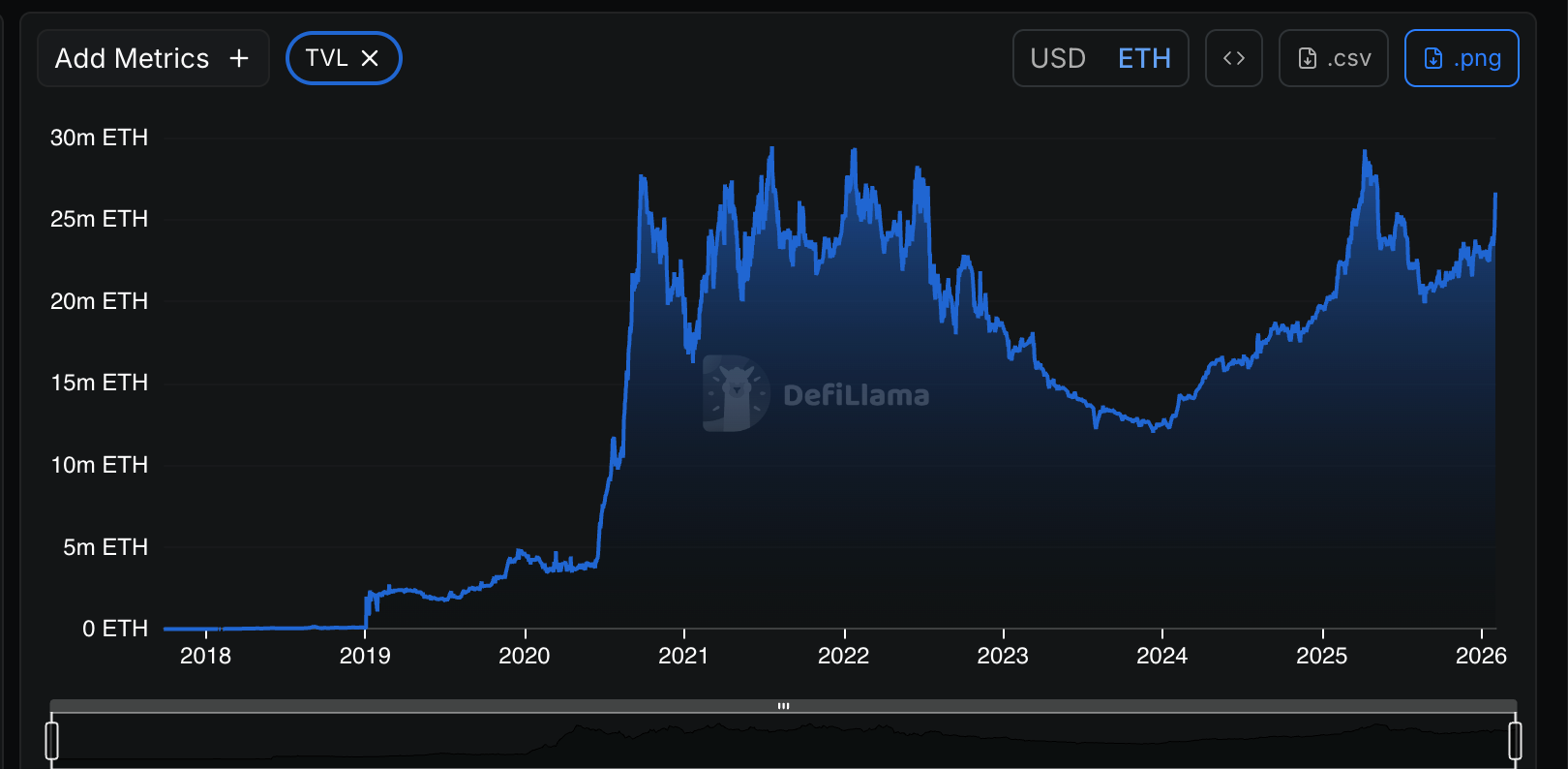

By a number of measures, community exercise stays close to peak ranges. “Ethereum TVL is definitely $ETH” mentioned Messari analyst Sam Raskin, suggesting that capital just isn’t leaving the ecosystem in a significant method regardless of the decline within the greenback worth of the token.

($ETH TVL-built $ETH/Defilama)

Different indicators additionally level in the identical course. entry queue for $ETH Staking (the ready time confronted by validators to make sure the community is safe) spans roughly 70 days, indicating that demand to place cash into Ethereum stays robust, particularly amongst massive establishments, regardless of short-term volatility.

That resilience can also be evident throughout decentralized finance, the place exercise stays at the same time as costs decline. Merchants and customers nonetheless have interaction with on-chain functions in the hunt for yield. This reveals that utilization has not evaporated together with sentiment.

“We’re nonetheless rising and gaining extra customers and income, however the token worth is lagging,” Mike Shiragadze, CEO of ether.fi, one of many largest restaking networks, advised CoinDesk through Telegram. “We’re solely targeted on the long run.”

Some market individuals argue that the value actions themselves are being overinterpreted. Marcin Kazmierczak, CEO of blockchain knowledge agency Redstone, mentioned Ether's decline appears extra like market “noise” than a sign of weakening fundamentals, particularly as retail buying and selling exercise declines. Extra importantly, he mentioned, there’s a degree of institutional confidence round on-chain finance that has by no means been seen earlier than.

“The shortage of retail pleasure is definitely refreshing. The subsequent cycle will likely be pushed by precise adoption quite than memes, permitting builders to concentrate on long-term worth creation,” Kazmierczak added.

The disconnect between worth traits and progress on the bottom is a well known sample in Ethereum’s historical past. Intervals of market disruption usually coincide with the community's most necessary improvement milestones, as builders proceed to ship no matter short-term sentiment.

“As we've seen with the merge, the market is fairly unhealthy at factoring within the elementary technical realities of the chain,” mentioned Marius van der Weyden, a core developer on the Ethereum Basis, noting that huge technical modifications are sometimes mirrored in costs solely lengthy after they've been accomplished.

Some analysts imagine that the discrepancy between worth knowledge and on-chain knowledge displays broader market traits quite than Ethereum's particular weaknesses. Raskin mentioned the community “appears as wholesome as ever” and claimed: $ETH’s latest decline has extra to do with Bitcoin traits and broader market sentiment than with deteriorating Ethereum fundamentals.

Learn extra: The quiet power of DeFi: As market declines check merchants, the worth locked into the platform stays