The most important Altcoin Ethereum has been heading downwards since an unsuccessful try and retrieve an all-time excessive on August thirteenth.

ETH costs are anticipated to proceed to say no with 10% falling over the previous 5 days as gross sales pressures strengthen as income enhance.

Ethereum Bears acquire management

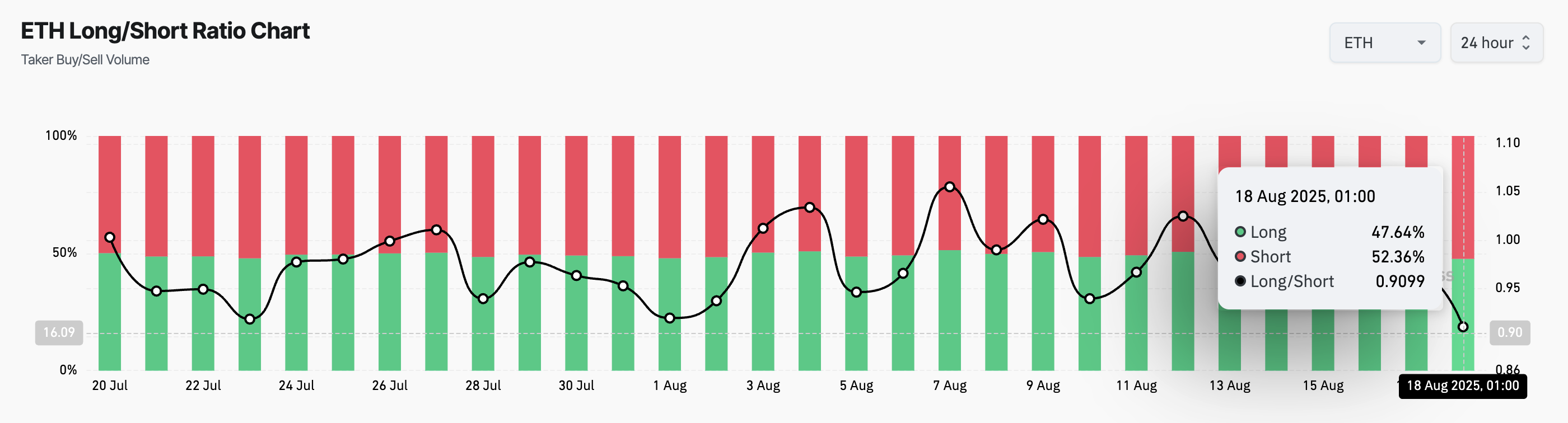

The lengthy/quick ratio of ETH fell to 30-day lows, reflecting elevated dealer consideration and lowered bullish sentiment. On the time of writing, this ratio is 0.90.

For token TA and market updates: Need extra token insights like this? Join Editor Harsh Notariya's every day crypto e-newsletter.

ETH lengthy/quick ratio. Supply: Coinglass

This ratio compares the variety of lengthy and quick positions out there. If the lengthy/quick ratio of property exceeds 1, it may be longer than the quick place, indicating that the dealer is primarily betting on value will increase.

Conversely, as seen in ETH, one decrease ratio suggests that almost all merchants are positioning as a result of value drops. This highlights a rise in bearish sentiment amongst ETH futures holders as expectations for sustained unfavourable actions develop.

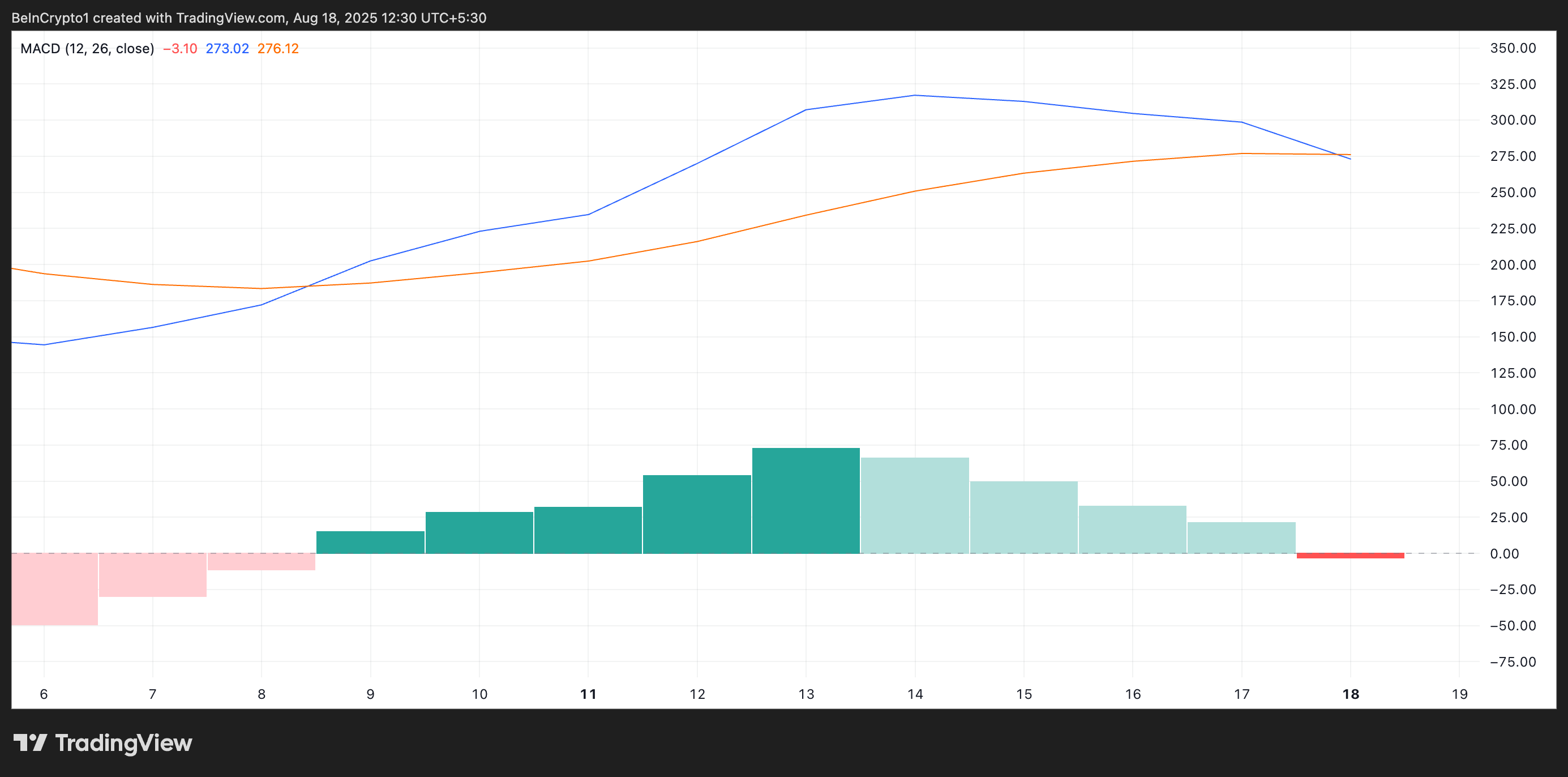

Moreover, unfavourable crossover of ETH transferring common convergence divergence (MACD) throughout at this time's session refers to updating the vendor's management. Throughout urgent, the MACD line (blue) of the coin is situated beneath the sign line (orange).

ETH MACD. Supply: TradingView

MACD indicators establish developments and momentum in value motion. This helps merchants discover potential buy or sale indicators by a crossover between the MACD line and the sign line.

When a MACD line crosses beneath the sign line, it’s thought-about a bear sign. This means that the downward momentum is growing and the vendor could also be in management.

ETH's latest unfavourable MACD crossover means that its costs may proceed to face gross sales strain. This exacerbates the chance of a drop of almost $4,000 decrease help ranges.

ETH Costs face necessary assessments

At press time, ETH trades for $4,224. If gross sales proceed, there’s a threat that main Altcoin will plummet to $4,063. If this value ground isn’t retained, the worth of the ETH may drop to $3,491.

ETH value evaluation. Supply: TradingView

In the meantime, as new demand enters the market, it may increase Altcoin's value to as much as $4,793. A profitable break past this stage may convey the rally again to ETH's all-time excessive of $4,869.

Publish Ethereum Bulls Retreat as your $5,000 dream fades. I noticed the primary $4,063 featured on Beincrypto.