A major quantity of Ethereum (ETH) has shifted to centralized exchanges by main gamers on the previous day, indicating delays within the community's Pectra improve face till investor sentiment has weakened.

Upgrades, the main improvement after registration, have been pushed from March to Might seventh.

Greater than $117 million ETH strikes into exchanges, inflicting fearful sale

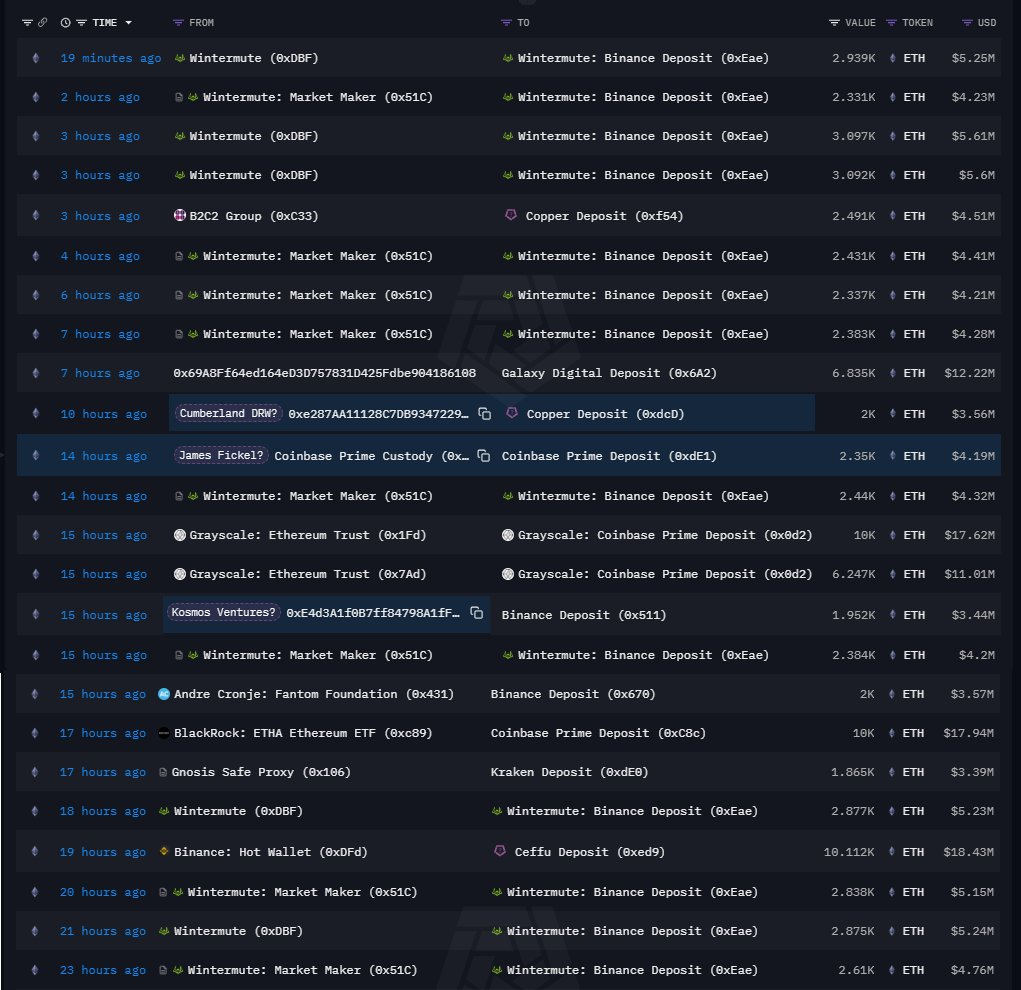

Massive establishments and particular person holders moved tens of 1000’s of ETH to the change inside 24 hours. Knowledge reported by X information nerds embody transfers from.

In accordance with X's information nerd, the next transfers have been recorded:

- Grayscale: 16,247 ETH (~$28.63 million)

- BlackRock: 10,000 ETH (~$17.94 million)

- WinterMute: 34,634 ETH (~$62.94 million)

- Different cronje (fantom): 2,000 eth (~$3.44 million)

- James Fickle: 2,350 ETH (~$4.19 million)

These transfers totaling over 65,000 ETH (over $117 million) are sometimes seen as preparations on the market, with out offsetting inflow or bullish information, significantly within the air.

ETH Value Evaluation for April

Ethereum is presently down 1.3% at $1,801.12 during the last 24 hours, CoinmarketCap information reveals. ETH was violating key assist round $1,800, reaching its day by day low of $1,751.33 a day and making an attempt to regain the $1,800 degree.

The $1,928 $20-day Exponential Shifting Common (EMA) presently serves as a crucial resistance. With ETH falling 32% beneath this EMA and 24-hour buying and selling quantity down 32%, the short-term momentum seems bearish.

Technical indicators present bearish momentum

A Day by day Chart's relative energy index (RSI) learn at almost 37.61 suggests present bear management worth motion, whereas the gradient signifies potential short-term integration.

ETH Value Motion is presently when you find yourself close to the underside fringe of the Bollinger Band and assist with ETH Value Motion approaches the underside Bollinger Band. If roughly $1,734 in assist is retained, the center band ($1,928) may be retested.

A breakout ($2,112) above the higher band requires persistent bullish management. Conversely, failing to regain a 20-day EMA ($1,928) may hold costs silenced, potential strikes can transcend $2,000.

Disclaimer: The knowledge contained on this article is for data and academic functions solely. This text doesn’t represent any form of monetary recommendation or recommendation. Coin Version is just not chargeable for any losses that come up because of your use of the content material, services or products talked about. We encourage readers to take warning earlier than taking any actions associated to the corporate.