Ethereum costs face danger amid current worth declines affecting the market. As giant markets skilled a recession, ETH costs noticed excessive lows, identical to different cryptos. Most cryptocurrencies improve their lows annually, following BTC costs.

Ethereum worth is $1,542.74, a major drop underneath the typical buy worth of $2,200 for Ethereum holders.

Many Ethereum traders face web losses as their belongings fall beneath the acquisition worth, indicating important capital losses throughout the Ethereum community.

Giant Ethereum holders with over 100,000 tokens provide a mean value base of $1,290.

This specific worth quantity is robust because it defines vital assist boundaries. That is the place Ethereum might attain in case the value slides.

The market confirmed indicators of restoration throughout the June 18th, 2022 Luna disaster, inflicting different earlier market declines wherein Ethereum costs fell to $870.

Earlier market restoration affords hope for stabilization and restoration as soon as Ethereum costs attain these historic ranges.

In keeping with Coinmarketcap, Ethereum's worth fell 10.84% inside a day to settle at $1,542.74.

Buying and selling quantity rose 552.31%, and market capitalization was $1861.3 billion as a result of important gross sales strain.

Market worth seems to be very unstable, however means that short-term worth drops might happen.

Technical Evaluation of Ethereum Value Charts

In keeping with the graphical knowledge supplied, the Ethereum market confirmed appreciable worth instability throughout the noticed interval.

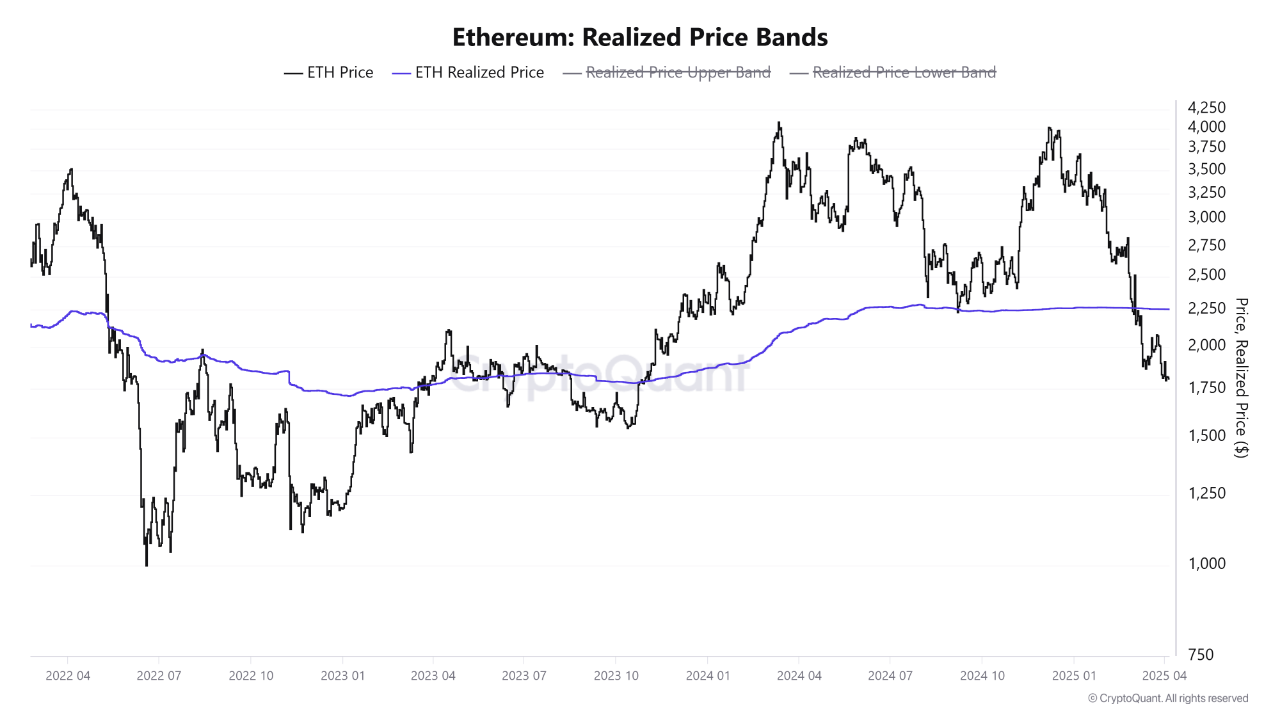

Ethereum Knowledge Chart | Supply: Cryptoquant

In keeping with the chart, the typical worth at which all Ethereum tokens are traded throughout market buying and selling is a crucial indicator often called realised worth.

The Black Line depicts Ethereum market costs from the present trade whereas remaining underneath realized worth values.

The realized worth line is the primary criterion for a lot of holders figuring out the utmost loss degree.

Commerce actions beneath realised costs point out the present market state of affairs of adverse dynamics. This results in losses for many Ethereum holders.

The present worth place on the lowest finish of Ethereum suggests a further downward worth motion, except it begins to alter costs.

The present worth motion on this evaluation displays the present market stabilization for Ethereum.

Nevertheless, in addition they counsel substantial modifications going ahead primarily based on tendencies throughout the market.

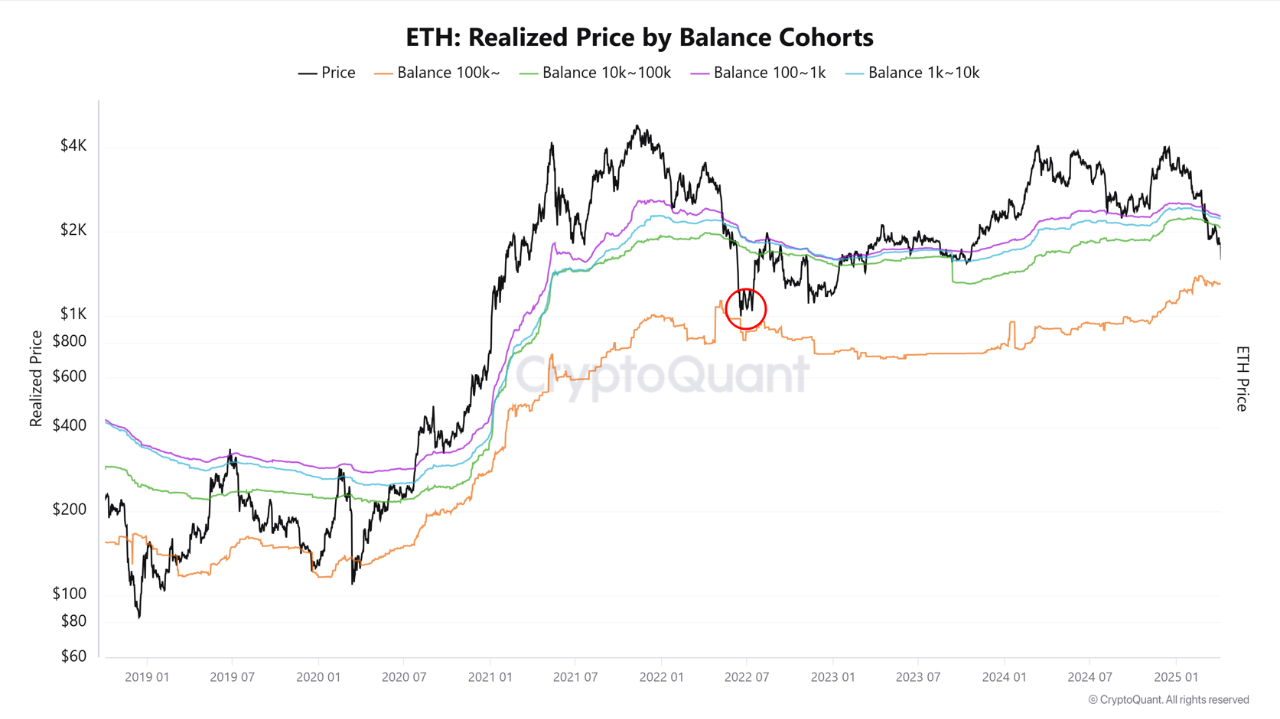

ETH: Realized worth cohort evaluation by steadiness

Different charts present Ethereum holders in several teams primarily based on the steadiness measurement. That is the value achieved by the steadiness cohort.

The acknowledged costs reached the next degree amongst holders, as indicated by the inexperienced and purple traces, in comparison with different traces.

Ethereum Knowledge Chart | Supply: Cryptoquant

Teams with 1,000-100,000 Ethereum holdings are paying for an asset worth improve primarily based on the quantity of possession.

Holders at these ranges are presently going through losses of their asset positions because the market worth of Ethereum has fallen to an outlined extent.

Small Ethereum holders present proof that they maintain belongings at a costlier worth.

This means that there’s a tendency to promote in response to further market declines.

Subsequently, this might additional degrade the market.

However not everyone seems to be afraid of dipping. The sudden, high-liquid 50x whale look could imply that some, if not all, traders are concentrating on bounce.

Thus, whales have been open for a very long time with a large leverage of $47 million from whales. Which means that ETH will inevitably get well or keep on the worth degree they’re presently buying and selling.

The entry of main market gamers tends to precede main worth actions, and such giant transactions typically precede main worth reversals.

If whales elevate costs for Ethereum, this may change sentiment within the broader market and encourage different traders to observe the whales' habits.