Ethereum costs crashed greater than 52% from their December highest ranges, with expertise and chain metrics pointing to extra downsides within the quick time period.

Ethereum (ETH) peaked at $4,105 in December and was buying and selling at $1,970 on March twentieth. This 52% crash is among the worst blue chip cash in the marketplace.

Ether crashed as issues about its future stays. This week, Commonplace Constitution Analysts downgraded estimates by 60% from $10,000 to $4,000, citing rising competitors from Layer-1 and Layer-2 networks that affected income development.

Layer 2 networks on Ethereum, akin to Coinbase's Base, Kinkai and Optimism, attracted extra customers to the ecosystem as a consequence of their decrease charges. for instance, Defi Llama knowledge reveals The Dex Ethereum protocol has processed greater than $9.8 billion within the final seven days.

Arbitrum processed $2.87 billion and Base was $2.8 billion. Prior to now, this quantity was processed within the Ethereum mainnet community.

Ethereum can also be seeing an intensifying competitors with Layer-1 networks akin to Solana (SOL) and BNB chains. BNB Sensible Chain's Dex protocol has processed over $13 billion in DEX volumes over the previous seven days.

Additionally, Ethereum shouldn’t be anticipated to change into a serious beneficiary of rising applied sciences akin to Actual World Asset Tokenization as a consequence of its excessive charges and gradual speeds. As an alternative, builders can select to make use of different scalable and cheap networks, akin to Mantra (OM) or BNB chains.

You may prefer it too: Cardano Pockets Race provides assist for Bitcoin

Ethereum has weak chain metrics

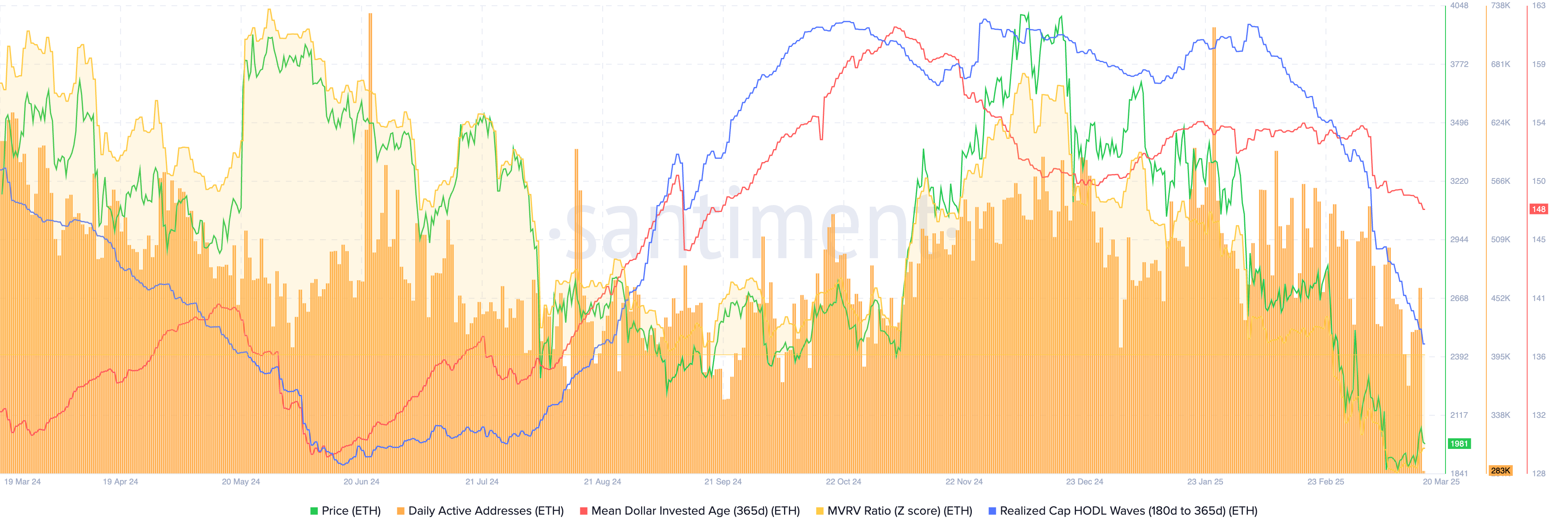

Extra knowledge reveals that the variety of energetic addresses in Ethereum has decreased over the previous few months. Santiment's chart beneath reveals Ethereum had 461,000 energetic addresses on Wednesday, down from 717,000 earlier this yr.

One other notable knowledge level is the realised cap for the Ethereum wave, displayed in blue. Since August final yr, it has hit a low level, an indication that long-term holders have begun promoting.

Common one year of {dollars} invested age or MDIA. This calculated how lengthy every coin stayed on the tackle, and lowered all the cash used for the acquisition to a low September.

Ethereum Day by day Energetic Deal with, MDIA, and Realization Cap | Supply: Santiment

Ethereum worth expertise evaluation

ETH Worth Chart | Supply: crypto.information

Day by day charts present that ETH costs have been on a robust downward development over the previous few months. This drop began after forming a triple prime sample for $4,000, with a neckline of $2,120.

The ether then shaped a cross-pattern of demise because the 50-day and 200-day transferring averages crossed one another. This cross typically results in extra unfavourable facet momentum. Additionally, well-liked oscillators akin to relative energy index and share worth oscillators have been eliminated.

So, the coin might proceed to fall as sellers goal psychological factors for $1,500. That is about 25% beneath the present stage.

You may prefer it too: Moonpay has secured a $200 million credit score line from Galaxy