For some institutional buyers, $ETH Regardless of rising issues about rising unrealized losses, something under $2,000 represents alternative relatively than danger.

$ETH entered the sixth consecutive month of decline. That is the longest shedding streak for the reason that 2018 decline.

Tom Lee and K3 Capital Enhance $ETH Possession ratio hits document excessive

In accordance with Lookonchain, Tom Lee, founding father of Fundstrat and head of Bitmine, executed a considerable amount of funds. $ETH Bought within the third week of February.

On February 18th alone, Bitmine earned a further $35,000 $ETH Equal to roughly $69.37 million. Buy included 20,000 $ETHprice $39.8 million, from BitGo, 15,000 $ETHprice $29.57 million from FalconX.

K3 Capital additionally made large strikes. In accordance with OnchainLens knowledge, a pockets linked to an funding fund bought $20,000. $ETH Binance price $40.08 million.

These massive trades mirror robust, long-term beliefs. $ETHEven when the asset is buying and selling for lower than $2,000.

CryptoRank knowledge exhibits that long-term buyers are growing their Ethereum accumulations through the present financial downturn.

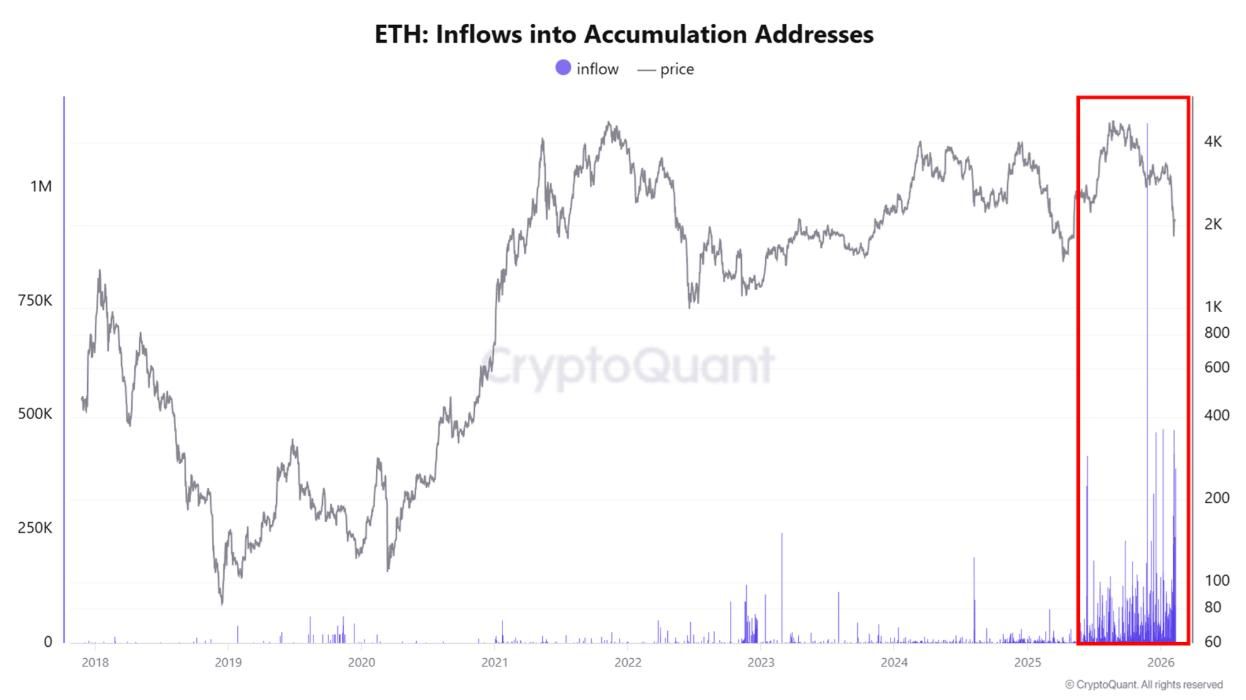

$ETH accumulation deal with. Supply: CryptoQuant. “>

$ETH accumulation deal with. Supply: CryptoQuant. “>

move into $ETH Accumulation deal with. Supply: CryptoQuant.

In the meantime, in keeping with knowledge from CryptoQuant; $ETH Amassed addresses over the previous six months have reached their most energetic interval in historical past. As historical past exhibits, in 2018, $ETH It skilled seven consecutive months of decline earlier than recovering.

“The whales and the largest banks are shopping for it and constructing it. $ETH. These are the most important inflows into Whale Financial savings wallets we have now ever seen. In the meantime, the retail business is abandoning it and calling for its failure. They’re exhausted after 5 years of seeing costs fall inside this large vary. ” – commented crypto investor Seth.

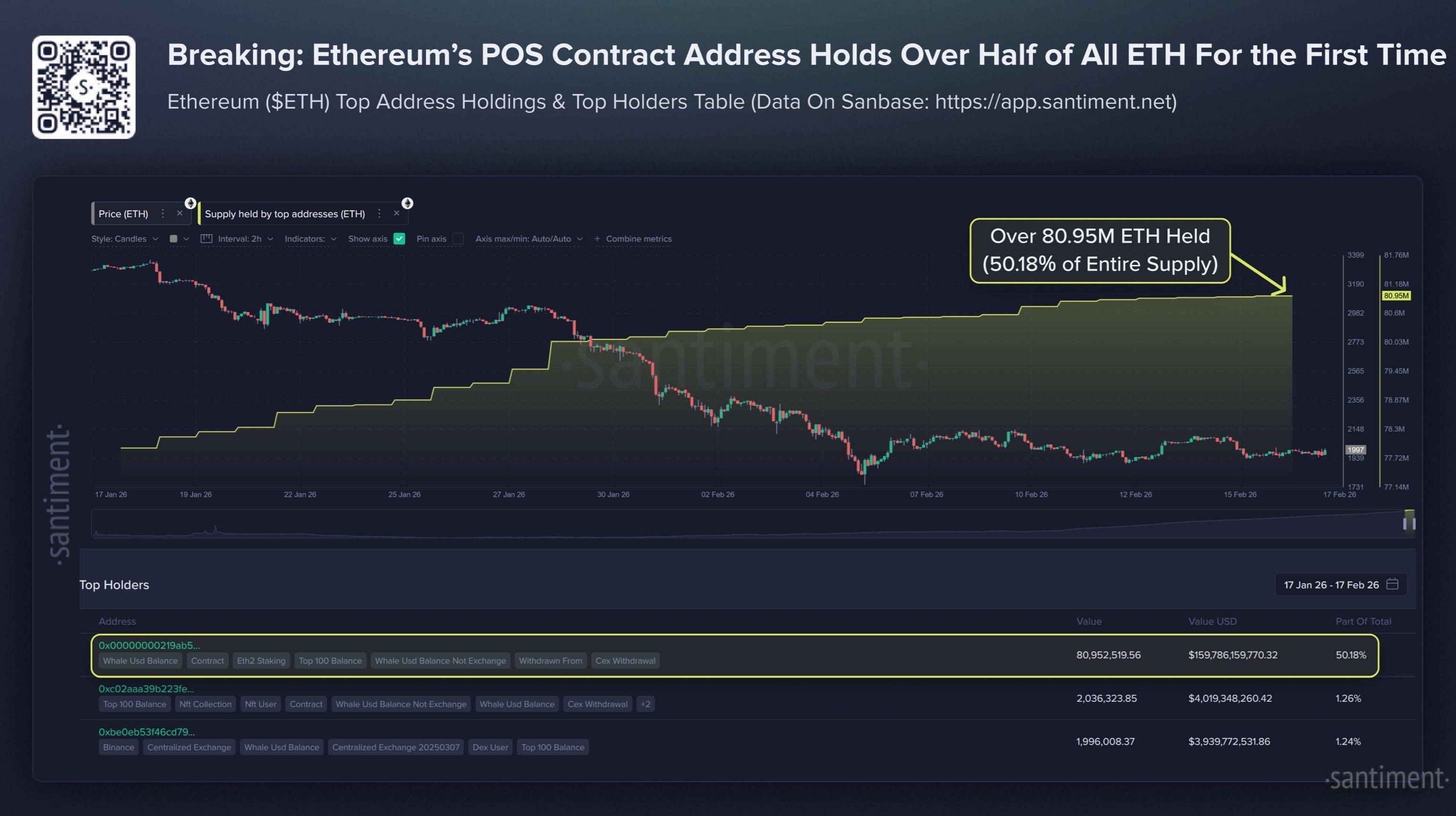

One other necessary milestone has appeared. For the primary time in Ethereum’s 11-year historical past, greater than half of the entire $ETH Provide is at stake.

On-chain knowledge platform Santiment reviews that $ETH At the moment, provide is inside proof-of-stake (PoS) contracts.

$ETH is held by an Ethereum PoS contract deal with. Supply: Santiment”>

$ETH is held by an Ethereum PoS contract deal with. Supply: Santiment”>

whole $ETH It’s held by an Ethereum PoS contract deal with. Supply: Santiment

This contract acts as a one-way repository. investor deposit $ETH Take part in staking to guard the community. Staked cash are briefly taken out of circulation and can’t be traded.

Staking exercise continues to extend, particularly throughout bear cycles. furthermore $ETH When locked, fluid provide is diminished.

“When greater than 50% of the provision is locked into staking, the liquidity provide decreases. There are fewer cash obtainable for buying and selling. This reduces promoting stress and makes the market extra delicate to new demand,” stated verifier Everstake.

Everstake revealed that fifty.18% corresponds to the entire $ETH The remaining 30% is energetic stake, held by Ethereum PoS contract addresses.

Nevertheless, current evaluation by BeInCrypto doesn’t exclude the next potentialities: $ETH Amid probably the most unfavorable market sentiment in years, the inventory may fall additional to $1,385 within the quick time period.

Even when that state of affairs performs out, on-chain knowledge suggests that giant buyers and establishments stay positioned for a long-term restoration.

This text “Ethereum falls for six consecutive months, however establishments proceed to build up under $2,000” was first printed on BeInCrypto.