As November approaches, so too does the controversy over the way forward for the world's second-largest cryptocurrency. Consultants stay divided on Ethereum's trajectory, leaving the market with an important dilemma: Is shorting ETH a smart transfer or a dangerous wager?

Current analysis and exchange-traded fund efficiency counsel warning. Nonetheless, on-chain and derivatives information paint a unique image.

Why some analysts advocate brief promoting Ethereum

10x Analysis positions Ethereum as a greater hedge than Bitcoin for brief sellers within the present state of affairs. Their evaluation, shared amid ETH’s latest decline under $4,000, highlights main weaknesses that might amplify draw back danger.

This bearish thesis focuses on Ethereum’s eroding “digital finance” narrative that when attracted institutional capital. This mannequin, exemplified by BitMine's technique of accumulating ETH at price and offloading it to retail at a premium worth, fueled a self-reinforcing cycle all through the summer time. Nonetheless, 10x Analysis claimed that the loop was damaged.

“Market tales don't die with the headlines. When new capital stops believing, market tales die in silence. The Ethereum machine store story satisfied many, however the bidding behind it wasn't what it appeared. Whilst retail turns a blind eye, institutional possibility positioning is quietly selecting sides,” the put up reads.

Moreover, spot ETFs have additionally skilled important outflows. In accordance with information from SoSoValue, the ETH ETF recorded outflows of $311.8 million and $243.9 million within the third and fourth weeks of October, respectively.

“The ETH ETF misplaced $184.2 million yesterday. BlackRock offered $118 million in Ethereum,” added analyst Ted Pillows.

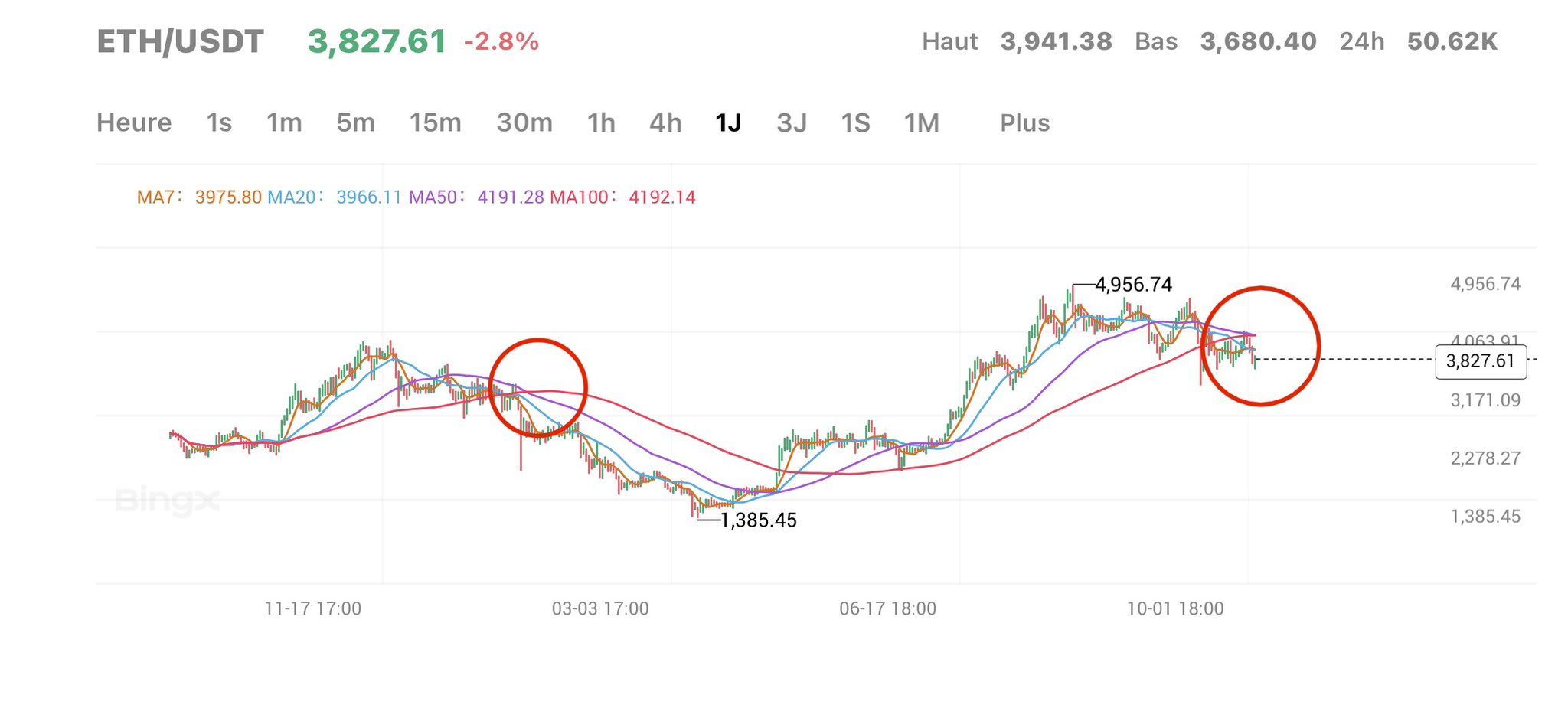

From a technical perspective, analysts identified that ETH is forming a bearish crossover. It is a technical evaluation sign indicating a possible downtrend. He famous that the final time this sample appeared, the value of Ethereum fell from about $3,800 to $1,400.

Bearish sentiment matches bullish information: Will Ethereum bounce again in November?

Nonetheless, not all indicators are according to a bearish outlook. Some are suggesting that Ethereum may rebound in November.

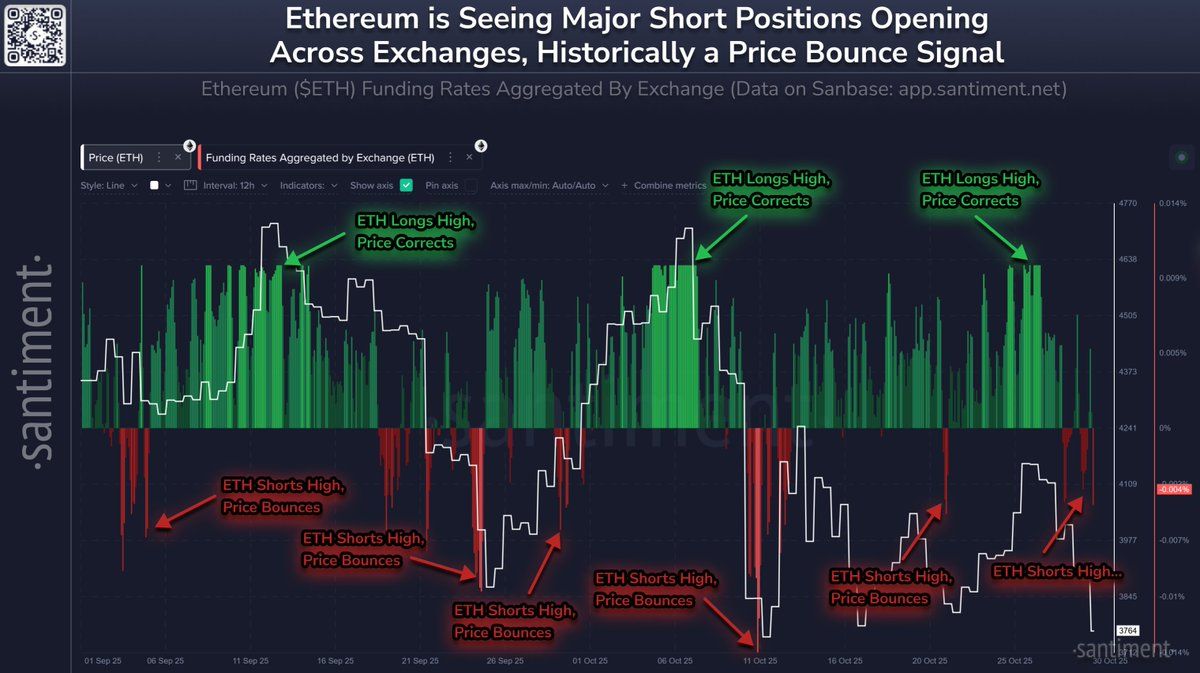

Santiment famous that when Ethereum fell to $3,700, merchants started taking brief positions once more, a transfer that paradoxically preceded the value rally. The put up highlighted that over the previous two months, trade funding charges have been a key indicator of the place ETH will go subsequent.

When funding charges flip optimistic, indicating that lengthy positions are prevailing, extreme optimism typically builds and costs appropriate. Conversely, if shorts are dominant and funding charges change into adverse, the potential for a rebound will increase.

“If the main longs are dominant (grasping), the value will appropriate. If the main shorts are dominant, a rebound is probably going.” Santiment highlights.

ETH funding fee and worth correlation. Supply: X/Santiment

One other analyst famous that Ethereum's “ecosystem each day exercise index” has reached an all-time excessive, indicating sturdy involvement within the community.

This surge in on-chain exercise supplies a strong elementary basis for Ethereum and means that market energy is being pushed by actual consumer progress quite than hypothesis.

“This excessive stage of participation has the potential to strongly assist additional worth will increase sooner or later,” CryptoOnchain stated.

#Ethereum / $ETH goes to behave like gold and outperform all of them

Don't enable MM to dump you

Have a look at this graph and inform me one thing isn't occurring. pic.twitter.com/BVnZgA7p5K

— Mikybull 🐂Crypto (@MikybullCrypto) October 31, 2025

Subsequently, the outlook for Ethereum heading into November stays delicately balanced. Then again, institutional dynamics, ETF outflows, and bearish technical patterns counsel warning. Then again, enhanced on-chain exercise and derivatives information point out the potential for elevated consumer engagement and restoration.

Whether or not ETH extends its decline or rebounds might finally rely upon which power proves to be stronger within the coming weeks.

The put up Ethereum dips under $4,000—is that this the start or a shakeout? appeared first on BeInCrypto.