Ethereum worth has struggled to regain momentum, hovering across the $3,000 degree in current buying and selling. This extended consolidation has weighed on costs and weakened short-term confidence amongst ETH holders.

Nonetheless, adjustments in on-chain alerts and historic worth habits recommend that circumstances could also be forming for a possible rebound.

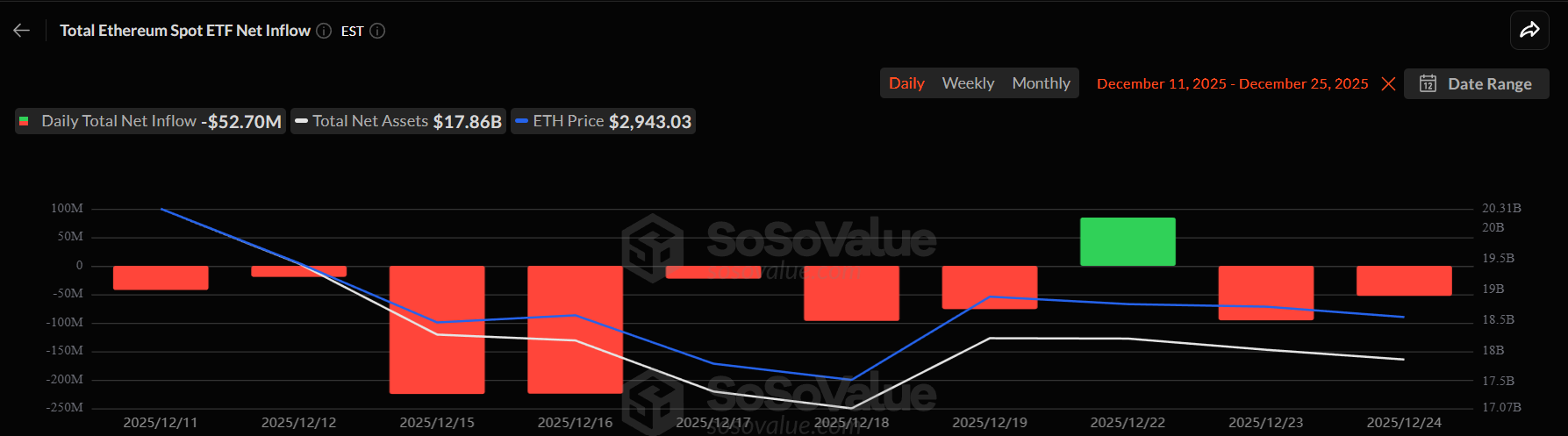

Ethereum ETF continues to lose cash

Ethereum ETFs have been dealing with sustained stress over the previous two weeks. Throughout this era, just one buying and selling day recorded internet inflows, primarily attributable to grayscale exercise. Exterior of that session, buyers persistently withdrew funds from ETH ETFs, displaying warning throughout conventional monetary channels.

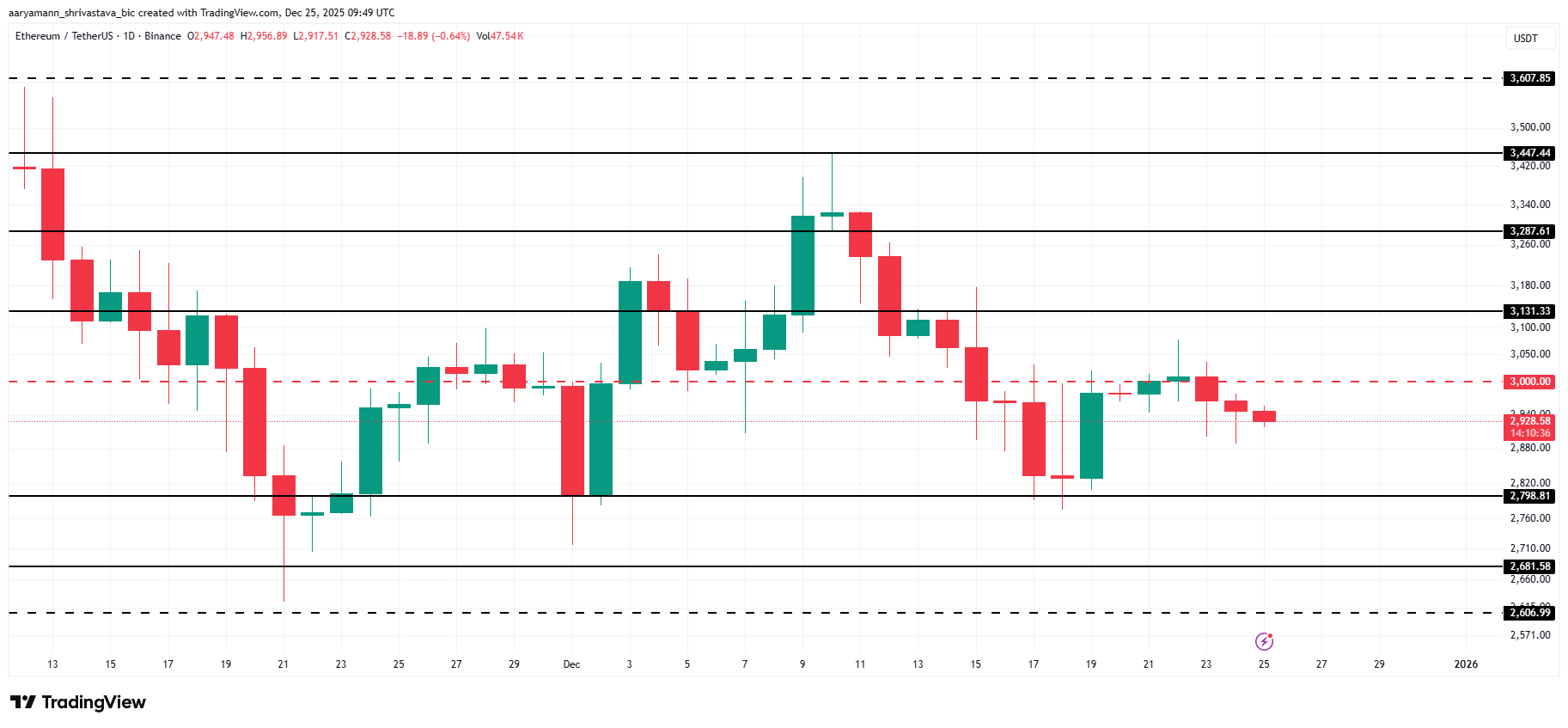

This rebound seems to be cyclical somewhat than structural. Consumers may re-enter if Ethereum retests the $2,798 assist degree. Profitable restoration and reclamation of that zone may reset market expectations and restore the upward trajectory of costs.

Ethereum ETF Netflow. Supply: SoSoValue

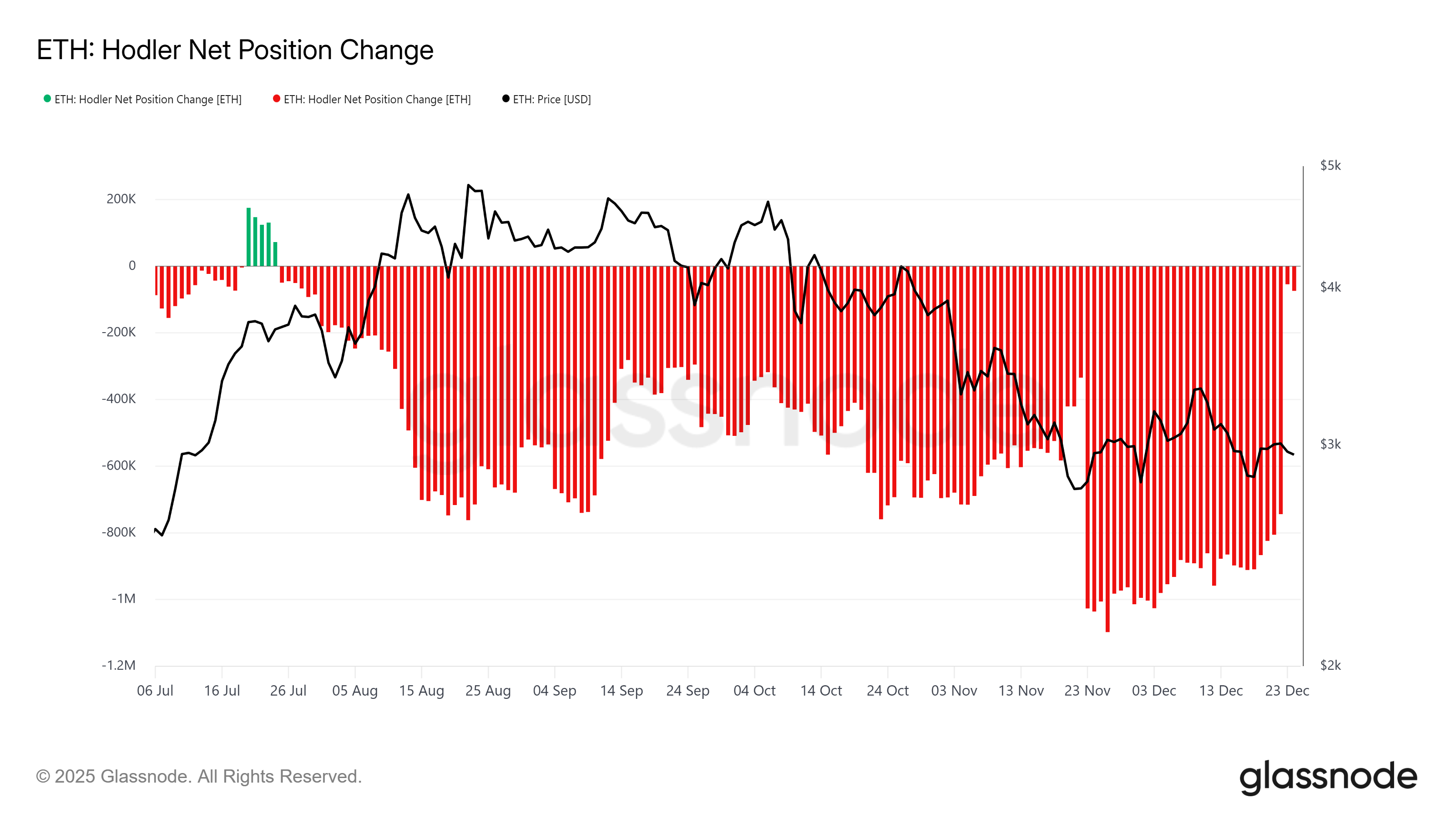

Essential holders are displaying energy

On-chain information exhibits that behind-the-scenes macro momentum is enhancing. Ethereum’s HODler Web Place Change, which tracks the habits of long-term holders, has soared. The index is at the moment close to the very best degree of outflows up to now 5 months.

This variation means that older holders are easing promoting stress and regaining confidence in Ethereum's restoration potential. If this indicator rises above the zero line, we are going to verify internet inflows from long-term holders. Such actions traditionally assist worth stability and development reversals.

ETH worth could rebound

On the time of writing, Ethereum is buying and selling round $2,978, nonetheless under the psychological barrier of $3,000. This consolidation raised issues about whether or not ETH may end 2025 at that degree. Persistent hesitance has elevated volatility and sentiment stays fragile.

Nonetheless, the dynamics of ETFs and the habits of long-term holders recommend that change is feasible. A managed decline in the direction of $2,798 may present the premise for a rebound. If Ethereum regains $3,000 as assist, the value motion may widen to above $3,131.

ETH worth evaluation. Supply: TradingView

Draw back dangers stay if bullish momentum doesn’t develop. A break under $2,798 will weaken the technical construction. In that case, Ethereum worth may fall in the direction of $2,681, invalidating the bullish outlook and rising near-term bearish stress.