Ethereum has lastly ended its four-week streak of ETF outflows. The week ending February 18th noticed document inflows, displaying the primary indicators of a return to institutional demand. On the identical time, whale wallets are additionally beginning to accumulate once more. Nevertheless, long-term holders proceed to promote Ethereum each time the worth jumps.

This creates a direct battle that would decide whether or not Ethereum's value restoration continues or stalls.

Whale accumulation begins and steady ETF outflow ends

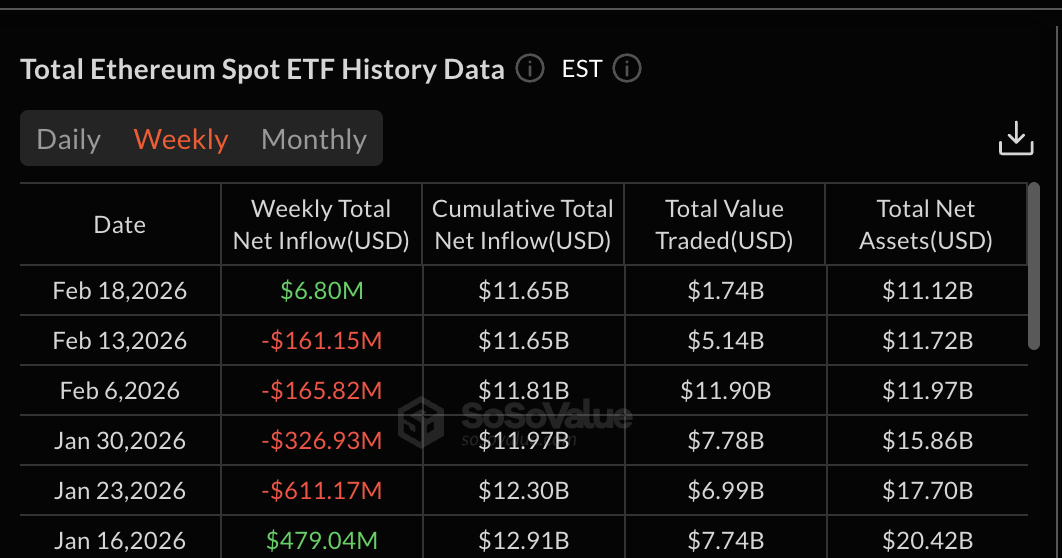

Ethereum has been underneath constant promoting strain from institutional buyers for 4 consecutive weeks. The Spot Ethereum ETF recorded internet outflows for the weeks ending January twenty third, January thirtieth, February sixth, and February thirteenth. This sustained sell-off displays weak institutional confidence and coincided with Ethereum’s broader value decline.

That pattern has now modified. For the week ending February 18, there was a internet influx of $6.8 million. This modification means that promoting strain from institutional buyers has stopped, a minimum of quickly. When ETF flows flip constructive after a protracted interval of outflows, it typically signifies an early stage of stabilization. Nevertheless, influx numbers stay weak and nonetheless can’t match the power of outflows.

Ethereum ETF: SoSo Worth

Need extra token insights like this? Join Editor Harsh Notariya’s Every day Crypto E-newsletter right here.

On the identical time, the buildup of whales has additionally returned. Knowledge reveals that wallets holding massive quantities of Ethereum have elevated their holdings from 113.5 million $ETH 113.63 million folks on February fifteenth $ETH the present. This implies a rise of 130,000 folks $ETH. At present costs, this equates to an accumulation of roughly $253 million price of Ethereum in just some days.

Ethereum Whale: Santiment

Whale accumulation throughout downturns is vital as a result of massive buyers typically take positions early, earlier than a broad restoration begins. However this rising optimism is going through resistance from one other group of buyers.

Ethereum value reveals bullish divergence, however long-term holders proceed to promote

Ethereum's 8-hour chart reveals vital momentum indicators that traditionally precede value rallies.

From February 2nd to February 18th, Ethereum value fashioned one other low. Because of this the worth has fallen under the earlier assist stage. Nevertheless, throughout the identical interval, the Relative Energy Index (RSI) fashioned a good greater low. The RSI measures the power of shopping for and promoting, and this sample known as a bullish divergence.

This sign has already confirmed efficient twice earlier this month. The primary bullish divergence fashioned between February 2nd and February eleventh. Since then, the worth of Ethereum has elevated by 11%. The second divergence appeared between February 2nd and February fifteenth. This resulted in a further 6% restoration.

Recognizing a bullish divergence: TradingView

each of those $ETH The rebound occurred whereas ETF outflows had been nonetheless ongoing, indicating that consumers had been already making an attempt to regain management. Now, ETF inflows are returning and whales are accumulating. This will increase the probability of one other bounce try.

Nevertheless, long-term holders are shifting in the other way. Hodler internet place change measures whether or not long-term holders are accumulating or promoting. A adverse worth signifies that long-term holders are diversifying their holdings.

On February seventeenth, long-term holders offered 34,841 shares. $ETH Rolling over 30 days. By February 18, that quantity had elevated to 38,877. $ETH. This represents a sudden enhance in promoting strain in simply at some point regardless of a bullish divergence sign.

Continued gross sales of holders: Glassnode

This means that long-term holders are benefiting from value power to exit their positions. Comparable actions had been seen at a rally in early February. Each previous rallies failed to take care of upward momentum as promoting by long-term holders restricted the restoration.

This creates an apparent contradiction. Whereas whale accumulation and ETF inflows assist the restoration, promoting by long-term holders limits upside room and indicators clear dangers. This battle is now immediately mirrored in Ethereum's value construction.

Triangular sample reveals important ranges

Ethereum is at the moment buying and selling inside a symmetrical triangle sample on the 8-hour chart. This sample is fashioned when value strikes between converging assist and resistance strains.

A symmetrical triangle represents the stability between consumers and sellers. Within the case of Ethereum, consumers embody institutional buyers coming again via whales and ETF inflows. Sellers additionally embody long-term holders who’re diversifying their positions.

This stability explains why Ethereum continues to be caught in consolidation.

The primary main resistance stage is close to $2,030. At this stage, earlier restoration makes an attempt had been stopped. A profitable transfer above this stage would point out strengthening momentum and in addition verify a breakout of the triangle. The subsequent main resistance stage is $2,100, which can also be a bounce blocker. If we will break via this stage, a stronger restoration could also be confirmed and the next path could also be opened.

Ethereum Value Evaluation: TradingView

Nevertheless, draw back dangers nonetheless stay. The fast restoration stage is $1,960. If this stage isn’t sustained, Ethereum might fall to $1,890. If promoting strain accelerates, the decline might lengthen additional to $1,740.

Put up-Ethereum ETF breaks 4-week outflow streak – Risk $ETH Will costs lastly get well? The put up appeared first on BeInCrypto.