- Buyers in BlackRock and Constancy Ethereum ETFs are at present down greater than 21% as ETH is way under entry costs.

- Since Might sixteenth, ETF has recorded an influx of $435.6 million for 9 consecutive days regardless of losses.

- Ethereum has not but been built-in past $3,000, however institutional demand is far larger.

Ethereum ($ETH) is struggling at beneath $2,650, however most ETF holders are nonetheless deeper into crimson. GlassNode recorded a median price base for BlackRock and Constancy Ether ETFs of $3,300 and $3,500, respectively. ETH is at present buying and selling at $2,621 and has acquired a complete unrealized loss as a consequence of over 20% as a consequence of worth changes.

The common eat ETF investor is affected by heavy losses.

In accordance with GlassNode, the common price bases for ETF traders are 3.3K and $3.5,000 for BlackRock and Constancy, respectively.

Have they got an opportunity for this cycle? pic.twitter.com/svqvamsfrc

– Coin Bureau (@coinbureau) Might 30, 2025

Nevertheless, my emotions have modified over the previous two weeks. Geopolitical tensions and US tariffs have inspired long-term gross sales from ether, however cryptocurrencies rose 44% from their annual low of $1,472 in April.

The 9 consecutive ether ETFs that started on Might sixteenth additionally attracted consideration for $435.6 million. The inflow adopted a US federal court docket determination to dam most of Trump's import duties on excessive macro strain on the crypto market.

However nonetheless, GlassNode analysts identified that ETFs hardly ever have an effect on spot costs. On the time of launch, the product accounted for just one.5% of the commerce quantity, and in November 2024 it was lowered to 2.5% earlier than fading.

Nevertheless, institutional traders don't leap in a rush. This slimy response is recommended, particularly to trace earlier breakaways in August 2024 and the primary quarter of 2025. Since its launch, the cumulative intrusion of the Ethereum ETF has reached $2.94 billion, giving the establishment's urge for food a real style.

Market construction exhibits potential

In accordance with Crypto Caesar, Ethereum escaped from a long-term downtrend in early Might after seeing modifications in market construction (MSS). After the breakout, ETH cleared many resistance zones and reached new assist for $2,485.52. At the moment, analysts are on the lookout for continuity patterns set with larger bass surrounding key ranges.

Technical indicators additional assist bullish bias. Sustainable demand pushes RSI close to development in practically 66 acquired territories. With a possible bounce from the $2,487 assist, we will see market check ranges round $2,880, adopted by $3,200.

Supply: Buying and selling View

Ethereum's additional success in regaining the $3,000 mark will encourage up to date ETF purchases that would assist institutional traders wipe out paper losses. If present assist isn’t retained, you would collapse under $2,300.

On-chain metrics spotlight robust provide

In accordance with Cryptoquant Alternate Reserve information, the alternate's Ethereum stability continues to be deleted. As of Might thirtieth, the variety of ETHs held on the centralized platform is nineteen.5 million, after surpassing 30 million earlier this 12 months. This long-term drawdown exhibits that there’s much less sell-side strain as most traders develop with confidence of their independence.

Supply: Cryptoquant

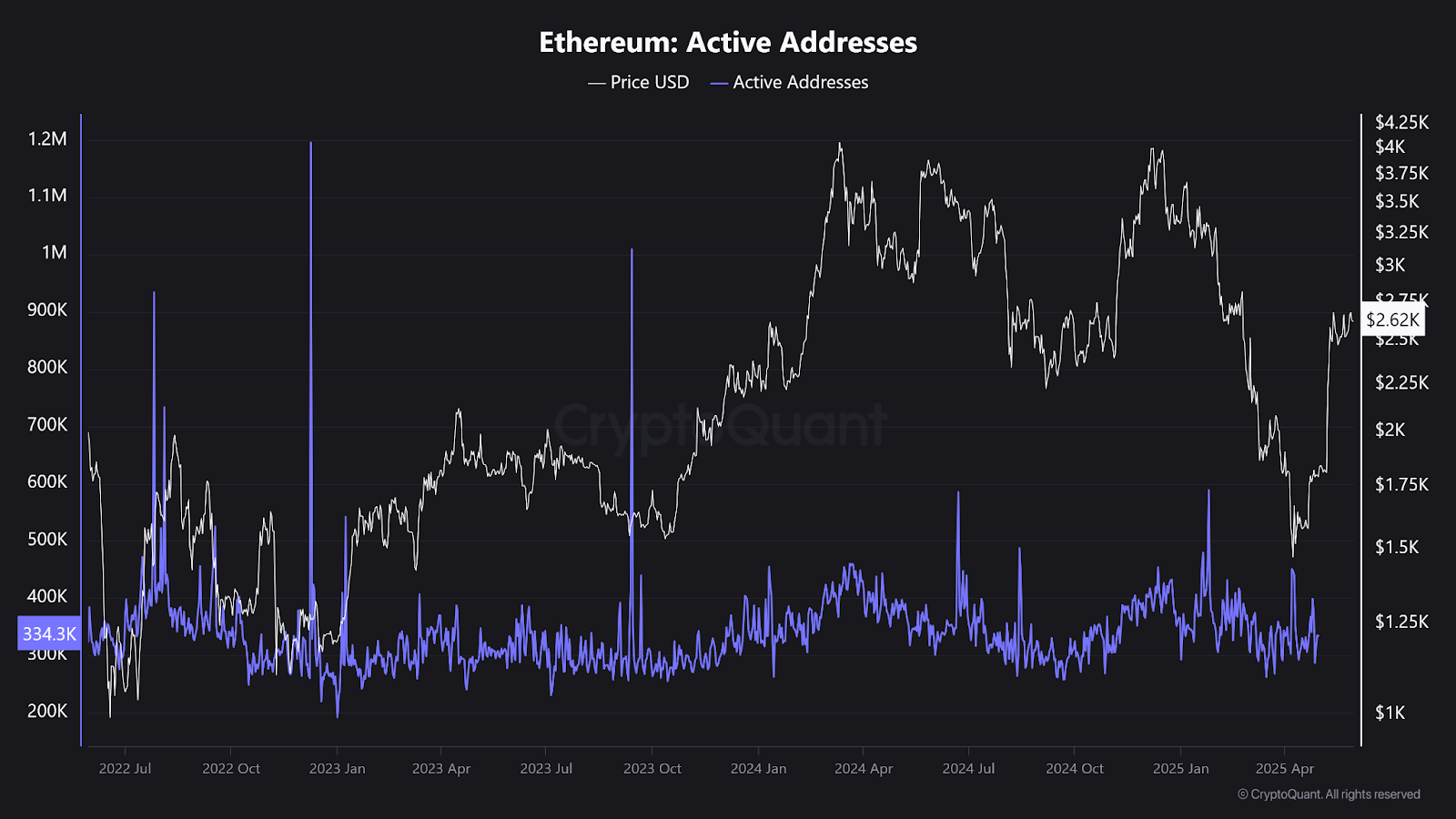

In the meantime, the energetic tackle rely has dropped to 334,000. This can be a degree that has not been seen since early 2023. This DIP might point out a lull in retail exercise, nevertheless it follows the present market construction the place ETFs dominate when establishments purchase in massive portions and have few addresses.

Supply: Cryptoquant

Open curiosity on Ethereum Derivatives rose to $35 billion, up 8.8% final week. Coinglass mentioned the constructive funding charge signifies that the majority merchants have taken lengthy positions. In accordance with choices information, retailers are hoping to push costs this month to $3,000, whereas institutional gamers hope to take it to $3,500 by June.