The foremost Altcoin Ethereum has remained in vary since Tuesday, providing inactive efficiency over the previous 4 days.

Nevertheless, institutional traders appear to be barely stunned by this worth stagnation. On-chain information exhibits that publicity to AltCoin continues to extend.

Ethereum etf weekly influx surge 400%

After President Trump introduced the Israel-Iran ceasefire on Monday, the market rebounded after seeing some easing from final week's sale. That day, ETH recorded an 8% daytime rallies.

Nevertheless, its costs have since moved largely sideways and haven’t been in a position to clearly get away in both route. Curiously, amid this lukewarm efficiency, institutional traders stay resilient.

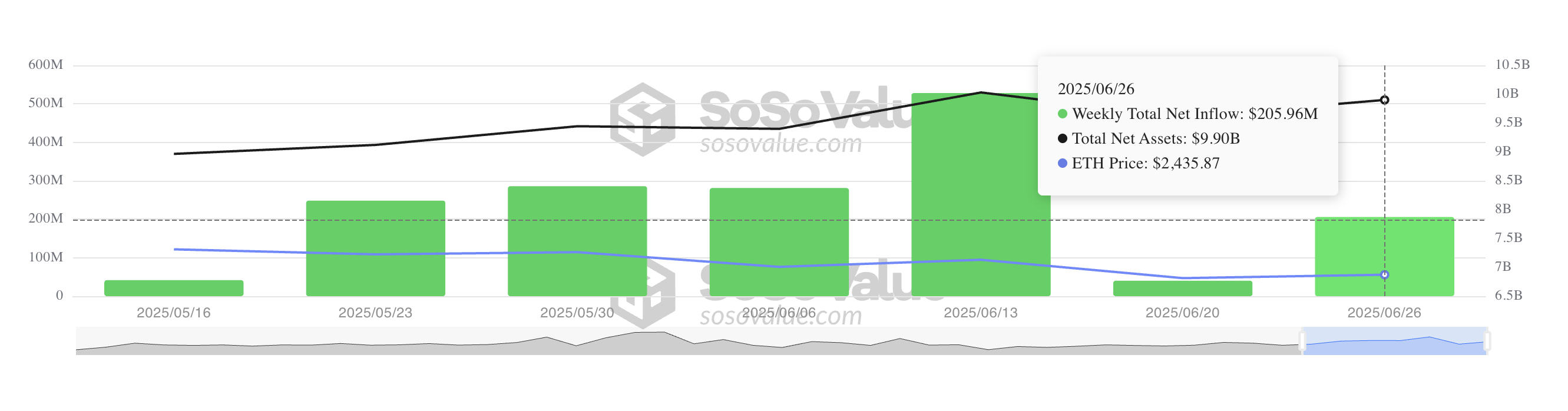

In accordance with Sosovalue Demand for ETH change funds is rising quickly this week. The weekly influx into these funds is $206 million on the press convention.

All Ethereum spot ETF internet move. Supply: SosoValue

On the time of this writing, the newest every day figures haven’t but been recorded, however the cumulative internet influx for the week was over 400% greater than the full of $40.24 million final week, indicating a pointy rise in institutional urge for food.

This surge in ETFs exhibits skilled traders are positioning themselves for potential advantages, betting that ETH might get better strongly in July.

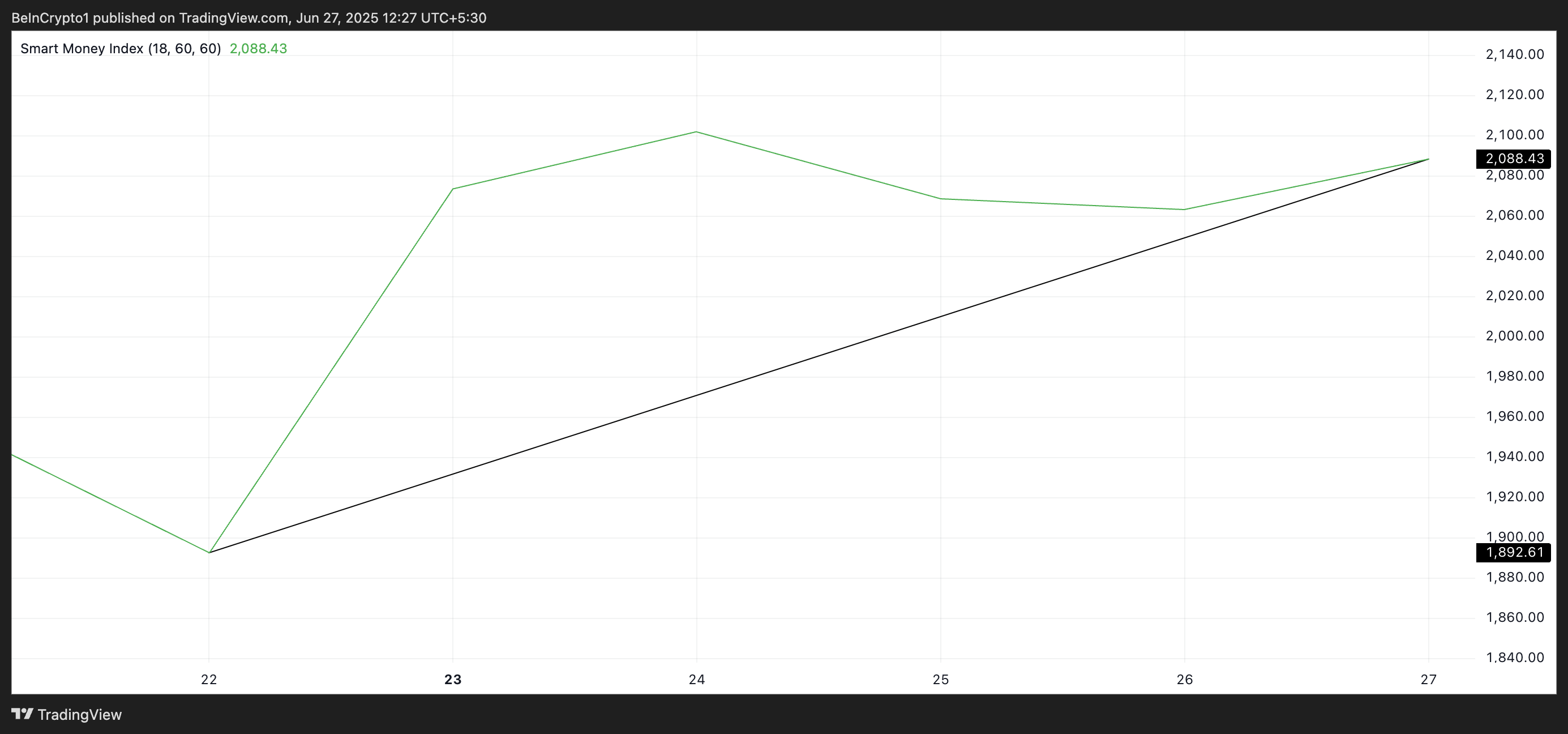

Moreover, ETH's Good Cash Index (SMI) rose this week, confirming the expansion of bullish bias in opposition to main Altcoin. On the time of press, the metric monitoring buying and selling actions of key market contributors was 2,088, up 1% since Monday.

The rise in SMI in ETH coincides with a surge in ETF inflows, reinforcing the rising bullish sentiment amongst subtle traders.

Ethereum's destiny is determined by new demand

The mix of rising ETF inflows, sensible cash accumulation and a broader market restoration might assist ETH escape from the present stagnation that marks July.

If Altcoin sees a resurgence in demand within the coming days, its worth might rise to $2,569. This violation of resistance might ship cash to $2,745.

ETH worth evaluation. Supply: TradingView

Nevertheless, as soon as demand craters and the Bears regain management, ETH costs could possibly be breached by the draw back and drop to $2,185.