Ethereum (ETH) enters week with blended alerts for potential macrocatalysts of macrocatalysts that would have an effect on threat property as merchants will probably be chargeable for the announcement of tomorrow's “liberation day” tariffs. The BBTREND indicator stays very unfavourable, however it’s starting to ease, suggesting that it could decelerate with bearish momentum.

On-chain information reveals a slight rise in whale accumulation, suggesting cautious optimism from massive house owners. In the meantime, Ethereum's EMA setup reveals early indicators of a pattern reversal, however costs nonetheless want to interrupt essential resistance ranges to see modifications in course.

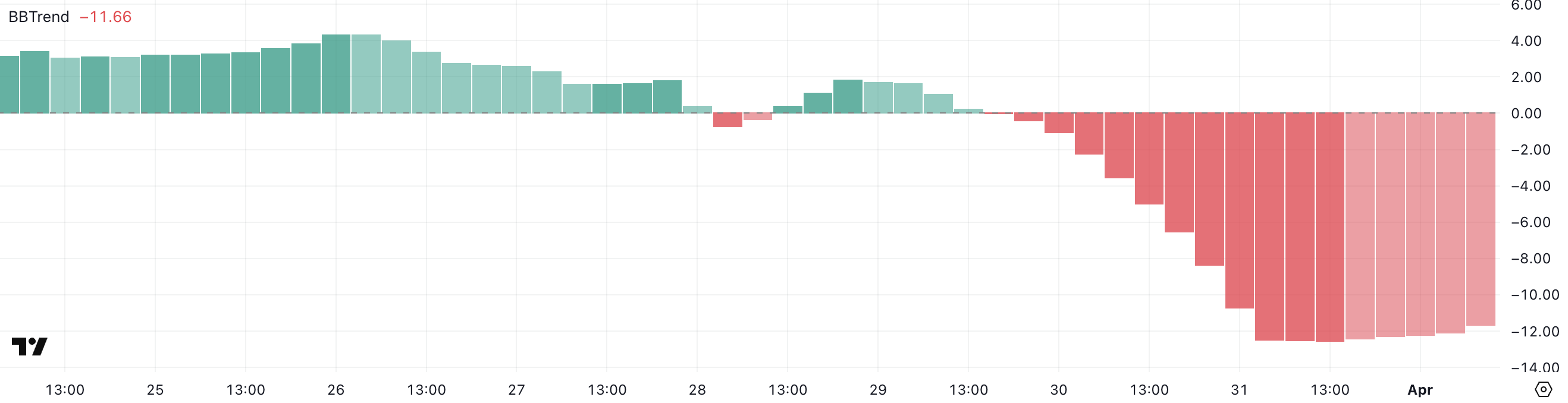

Eth Bbtrend is relaxed, however nonetheless very unfavourable

Ethereum's BBTREND indicator at the moment reads -11.66, a slight enchancment from -12.54 from the day gone by, however has been in unfavourable territory for the second day in a row.

Bollinger Band Pattern (BBTREND) measures the energy and orientation of tendencies based mostly on how costs work together with the Bollinger bands above and under.

Optimistic bbtrends recommend that costs are increasing in the direction of the higher band, unfavourable bbtrends present bearish momentum, and costs are leaning in the direction of the decrease band. Usually values above 10 are thought-about sturdy pattern alerts, with the present -11.66 studying indicators of steady draw back strain.

ETH BBTREND. Supply: TradingView.

The persistent unfavourable bbtrend means that Ethereum stays in a short-term bearish stage, with sellers nonetheless dominating worth motion.

The slight enhance yesterday means that downward momentum could also be slower, however the indicator is nicely under the impartial zone. In different phrases, regardless of the primary in six months of flipping Solana with DEX buying and selling quantity, the reversal continues to be unclear.

Merchants might interpret this as a warning to maintain it cautious, particularly if the ETH continues to hug the decrease Bollinger band. For now, worth motion stays weak, and bounces should be supported by crucial modifications in quantity and sentiment to point out significant reversals.

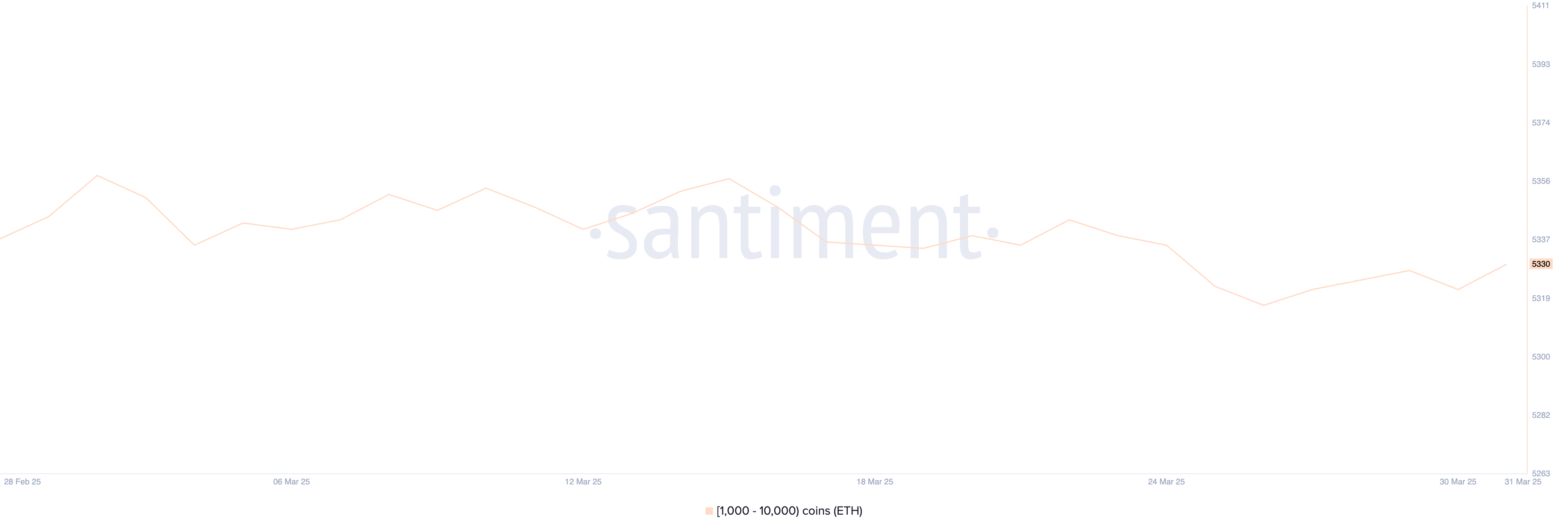

Ethereum whales are accumulating once more

The variety of Ethereum whales holding ETH between 1,000 and 10,000 was marked barely, rising from 5,322 to five,330 within the final 24 hours.

Though it is a modest enhance, whale exercise is among the most typical chain indicators in chains, as these massive holders usually affect the market course. Whale accumulation can display long-term outlook for elevated confidence in Ethereum's medium, notably in periods of worth uncertainty or integration.

Conversely, a lower in whale addresses normally suggests a weakening of conviction or advantages.

Ethereum whale. Supply: Santiment.

Whereas latest rises are constructive indicators, you will need to notice that present Ethereum whales numbers are nonetheless under the degrees noticed in earlier weeks.

Because of this whereas some massive holders might have re-entered the market, the broader cohort of whales has not but been totally dedicated to the buildup stage.

A sustained upward pattern in whale numbers might help bullish modifications in sentiment and worth. However for now, the info factors to cautious optimism slightly than a decisive reversal.

Will Ethereum be over $2,100 anytime quickly?

Ethereum's EMA line reveals early indicators of a possible pattern reversal, with worth motion trying to surpass the essential short-term common.

If Ethereum costs might push resistance at $1,938, it might point out a broader begin of restoration, probably concentrating on the subsequent resistance degree at $2,104, and particularly with supportive macrocatalysts, it will be $2,320, and even $2,546.

ETH worth evaluation. Supply: TradingView.

Conversely, if Ethereum can not preserve its upward thrust and bearish momentum, the main focus will return to the minus facet degree.

The preliminary key help is $1,823. A break under that would expose Ethereum to an extra loss to $1,759.