As we speak's Ethereum costs commerce at round $2,528, reflecting a gentle daytime rise after consolidating most of final week. Nevertheless, ETH continues to commerce inside deadlines, placing stress on resistance within the $2,580-$2,600 zone and supporting practically $2,500, so the Bulls stay cautious. The low Ethereum worth volatility throughout this era means that breakouts could also be approaching as momentum develops across the June twenty first choice expiration date.

Why are Ethereum costs rising in the present day?

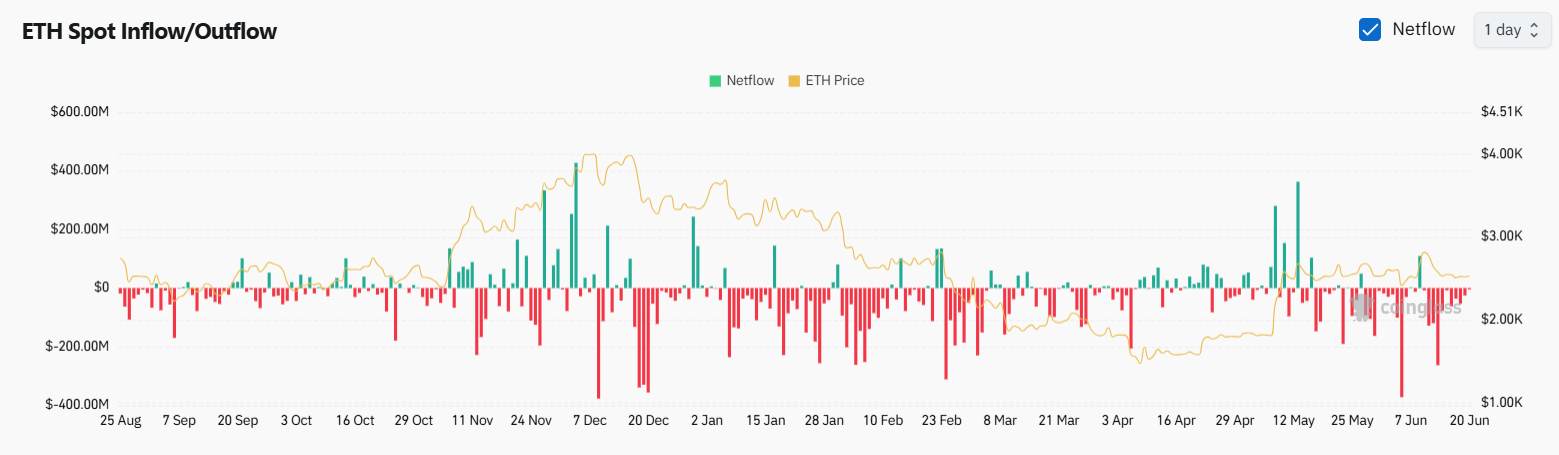

ETH Spot Influx/Outflow Information (Supply: Coinglass)

Over the previous 48 hours, Ethereum has seen internet circulation charges of over $82 million throughout spot exchanges, in keeping with Coinglass information. This sustained damaging Netflow is often seen as an indication of long-term accumulation as whales and establishments transfer refrigerated or impartial belongings. Costs haven’t but exploded upwards, however these spills assist clarify why Ethereum costs are not less than barely rising as trade provide turns into extra tight.

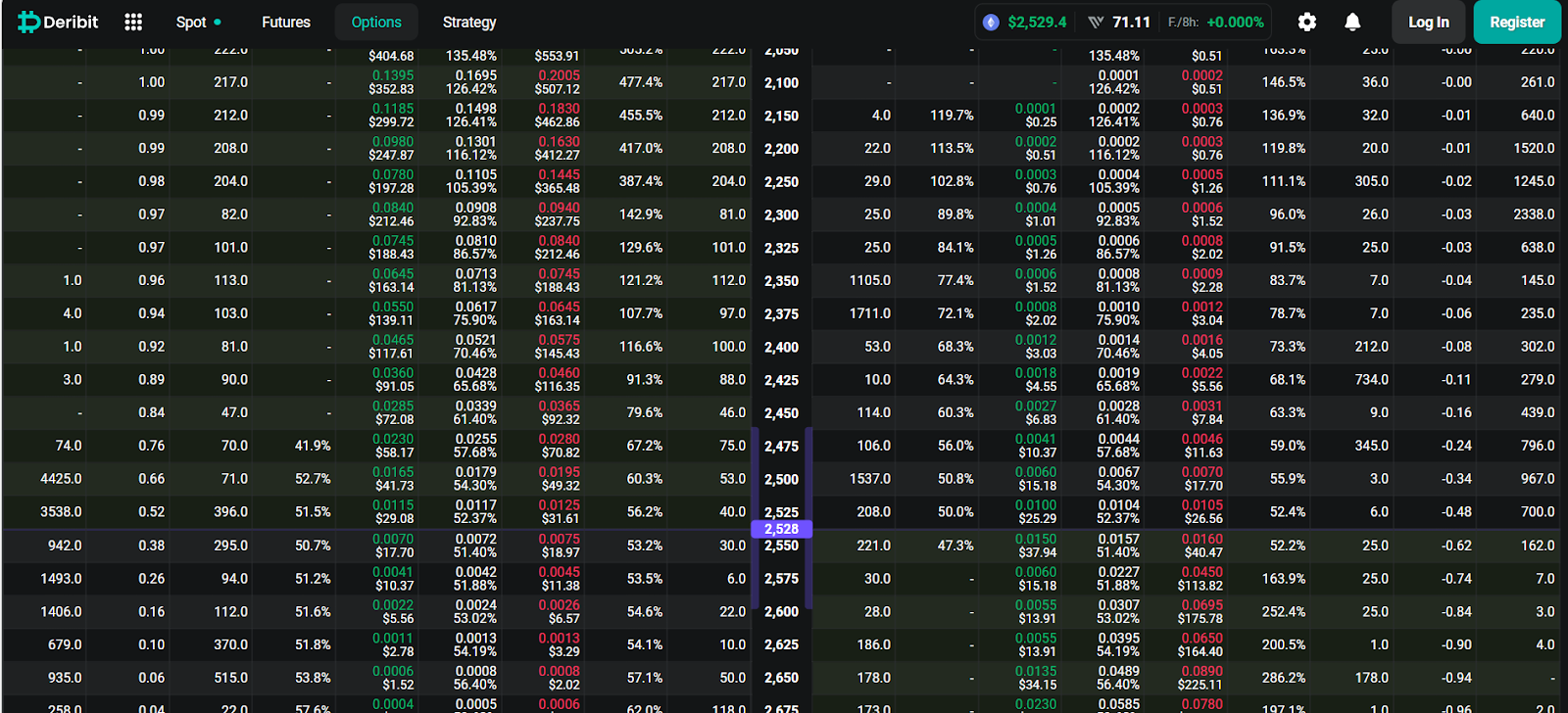

ETH choice chain information (supply: DELIBIT)

This on-chain pattern is additional supported by derived information. The June 21 choice chain reveals quite a lot of open earnings concentrated at strike ranges of $2,500 and $2,600, indicating that numerous merchants are positioned for potential strikes inside or inside this vary. If the Bulls are capable of maintain ETH over $2,500 than they expire, they may pressure a brief cowl or delta hedge exercise that raises costs by way of key resistance.

What would be the worth of Ethereum?

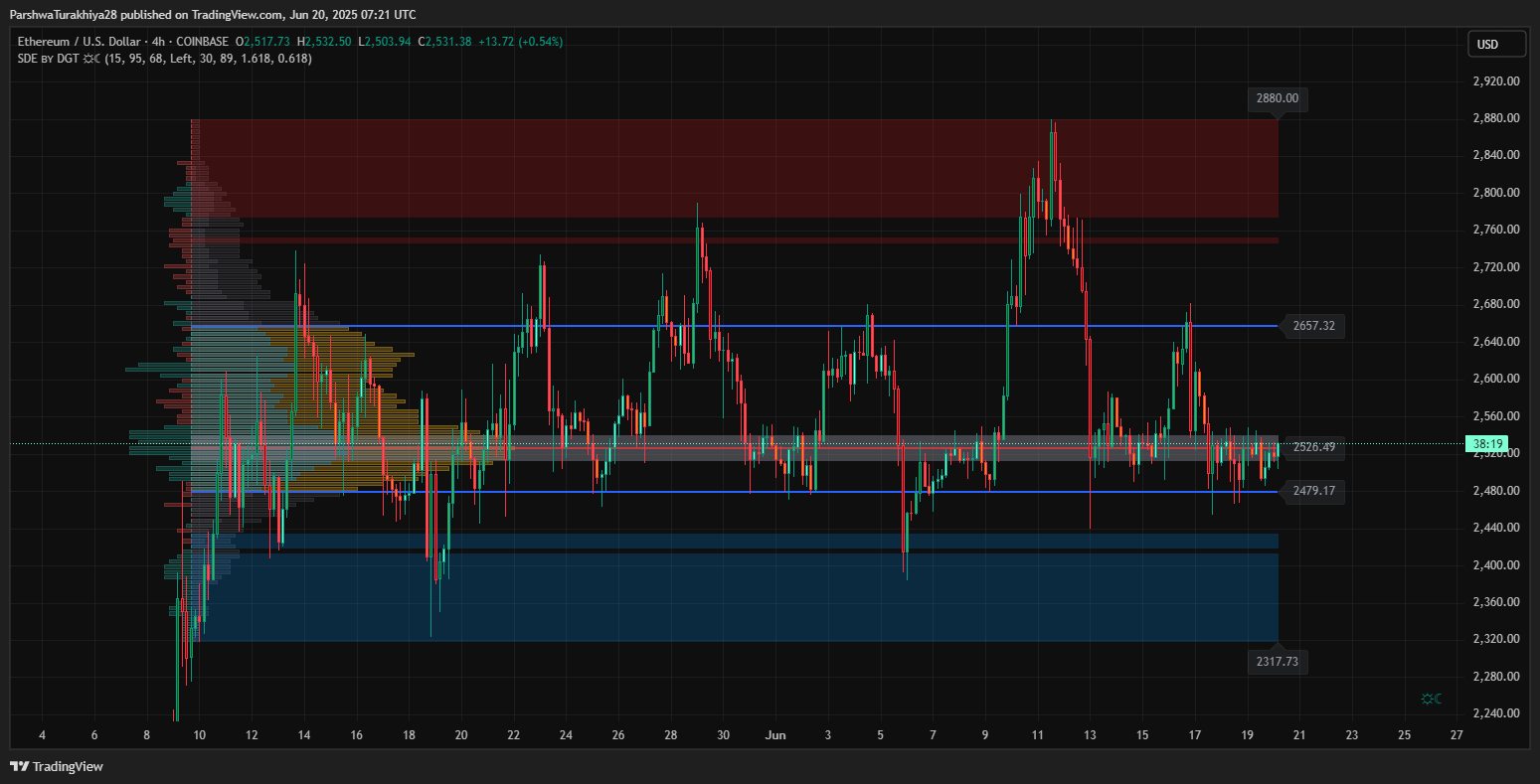

ETH Value Prediction (Supply: TradingView)

The Ethereum worth motion on the 4-hour chart reveals a definite compression sample fashioned between a assist rise of practically $2,457 and a downward resistance of $2,659. ETH stays locked inside this slim wedge after a number of failed breakout makes an attempt over the previous week. This harsh construction usually precedes volatility spikes, and present ranges counsel that the market is on the point of directional motion.

ETH Value Prediction (Supply: TradingView)

On the four-hour chart, Ethereum stays locked inside the tightening channel construction, with a number of low highs pointing to potential bear stress. Bollinger Band is contracted and reveals the interval of volatility suppression at Ethereum costs, which regularly precedes the suppression. The midline of the Bollinger Band is positioned at $2,526 alongside the present worth motion. This implies that the market remains to be undecided.

EMA clusters (20/50/100/200) from $2,504 to $2,565 will proceed to perform as dynamic resistance. The upward momentum stays within the cap till Ethereum Value has a powerful closure of over $2,580.

ETH Value Prediction (Supply: TradingView)

The 30-minute chart RSI reveals a modest restoration to 57.44, however the earlier bearish launch on June 17 nonetheless stays within the background. Plus, the 30-minute chart supertrend simply turned crimson once more at $2,530, indicating a lingering short-term gross sales stress.

Ethereum worth updates as volatility approaches the inflection level

ETH Value Prediction (Supply: TradingView)

Updates to Ethereum costs throughout the time-frame present coil construction. On the every day charts, ETH stays sure by vary, however is structurally bullish, holding a significant assist space far above, starting from $2,384 to $2,457. So long as this zone is retained, the bullish prospects for the medium time period stay intact, particularly given the low structural rise seen since late April.

ETH Value Prediction (Supply: TradingView)

From a sensible cash perspective, the 4-hour chart reveals repeated adjustments in character (choch) and structural breakdown (BOS) patterns, however no main liquidity grabs have been made to advertise breakouts. Volumes are clustered across the $2,520-$2,530 zones, and are recognized as management factors. With out a essential change in fluidity past this band, Ethereum costs may proceed to proceed its side-to-side integration.

ETH Value Prediction (Supply: TradingView)

Quantity profile evaluation additionally reveals key liquidity nodes starting from $2,500 to $2,530, serving as pivot zones for a number of weeks. This massive cluster strengthens its function as an essential battlefield. A essential closure above this band may pave the best way for the subsequent main zone of resistance at $2,700-2,750.

Quick-term Ethereum worth forecast and key ranges

In the interim, merchants ought to concentrate on $2,457 in assist and $2,580 in resistance ranges. As soon as ETH exceeds $2,580 in quantity, the subsequent upside goal is $2,657, intently adopted by $2,700 and $2,750. On the draw back, in the event you fail to carry $2,457, your ETH may very well be uncovered to a deep retracement of $2,384.

With constant spot spills, choices expired and stringent technical setups, Ethereum costs look poised for potential breakouts. The short-term path is dependent upon regaining the resistance zone, however the wider construction stays constructive. Merchants ought to monitor quantity checks and breakout momentum of practically $2,580 to measure whether or not Ethereum worth spikes are on the horizon or if integrations are additional forward.

Disclaimer: The data contained on this article is for info and academic functions solely. This text doesn’t represent any form of monetary recommendation or recommendation. Coin Version just isn’t accountable for any losses that come up on account of your use of the content material, services or products talked about. We encourage readers to take warning earlier than taking any actions associated to the corporate.