After a protracted rally that raised Ethereum costs from beneath $3,800 to a brand new multi-year excessive earlier this month, it’s now steady above $4,750. Costs are presently rising on well-defined channels, staying on each VWAP and short-term EMA clusters through the day. The Bulls are presently contemplating a $4,870 resistance stage. It is a key liquidity zone from previous highs.

What would be the worth of Ethereum?

ETH Value Dynamics (Supply: TradingView)

On the 30-minute chart, ETH follows upward channels. The decrease restrict serves as dynamic help at almost $4,723, whereas the higher restrict is approaching $4,870. VWAP measurements ($4,746 to $4,770) are in the midst of the channel. In different phrases, there’s a stability of buying strain. The RSI is 59.69. Which means there’s a slight bullish bias, however there isn’t any indication that it will likely be over-acquired anytime quickly. If the momentum is powerful, this construction suggests there may be extra room for benefit.

ETH Value Dynamics (Supply: TradingView)

From a each day perspective, the idea of sensible cash reveals that ETH breaks a number of earlier equal highs and regenerates constructions with consecutive bullish chotches and BOS alerts. The newest liquidity sweep has pushed costs up from $4,866 to the $4,871 provide zone. Depart the bullish market construction intact, there isn’t any vital shortcoming break.

Why are Ethereum costs rising as we speak?

ETH Value Dynamics (Supply: TradingView)

The robust bullish tremendous development on the 4-hour chart helps the Ethereum worth rally, with present development flip help at $4,504.88. DMI checks energy, +DI comfortably outperforms Di at 33.88 at 52.91, and ADX rises at 6.50, indicating persistence of the development.

ETH Value Dynamics (Supply: TradingView)

The 4-hour time-frame Bollinger band is increasing, with a worth of $4,893 and driving on the highest band, informing patrons of an enlargement of volatility. The EMA stack (20 EMA for $4,524, 50 EMA for $4,253, 100 EMA for $4,013, and 200 EMA for $3,703) stays fully bullish, far under present worth motion and gives layered dynamic help.

ETH Value Dynamics (Supply: TradingView)

The weekly quantity profile highlights that ETH is presently buying and selling inside the extremely lively provide zone, with the primary resistance cluster near $4,869.47. This stage matches the higher channel goal.

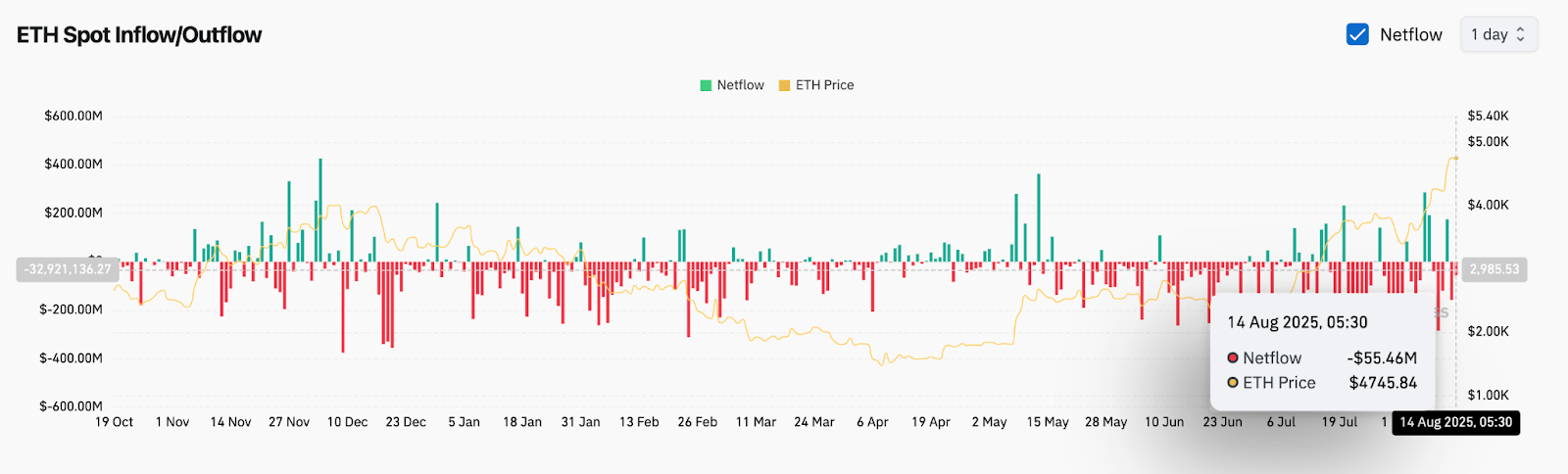

Chainflow sign reduces gross sales strain

ETH on-chain information (supply: Coinglass)

Spot Netflow information reveals a web movement of roughly $5546 million on August 14th, indicating a leaning in direction of a decline in alternate provide and accumulation. This coincides with current classes the place everlasting adverse Netflow helps upward momentum.

The mixture of sell-side decreased liquidity, robust technological construction and sustained demand means that the Bulls nonetheless retain the benefits heading for the following session.

Value indicators, alerts, and short-term setups

Momentum indicators discuss with persistent bullish management. RSI stays steady under the acquired stage, whereas Intray body MACD maintains a bullish histogram. The rising channel construction supplies a transparent framework. Breakouts above $4,870 may set off pushes to $4,950 and $5,000, but when this resistance fails, it may result in a retest of the VWAP zone between $4,720 and $4,746.

If mid-channel and VWAP should not retained, deeper pullback help approaches $4,504 (supertrend) and $4,485 (bollinger band midline), whereas the EMA20 approaches as secondary help.

ETH Value Forecast: Quick-term Outlook (24 hours)

Within the subsequent 24 hours, as we speak's Ethereum costs could have targeted on $4,870 in resistance. Should you see breakouts above this stage with costs in quantity, you would probably attain $4,950 and $5,000. If a denial happens, the first's draw back watch is $4,720, and a deeper pullback may check $4,504 earlier than the Bulls surpass one other leg.

The bias stays bullish, however ETH trades past the $4,500-$4,520 zone, with market construction and on-chain movement nonetheless favoring patrons.

Ethereum worth forecast desk: August 15, 2025

Disclaimer: The data contained on this article is for data and academic functions solely. This text doesn’t represent any type of monetary recommendation or recommendation. Coin Version shouldn’t be answerable for any losses that come up because of your use of the content material, services or products talked about. We encourage readers to take warning earlier than taking any actions associated to the corporate.