The Ethereum (ETH) worth lastly broke the $2,000 barrier and traded for round $2,300 after critical previous resistance. We hope this may convey us as much as $3,000 and $4,000.

A sudden transfer started after the Federal Open Market Committee's resolution to stabilize rates of interest on Could seventh led to a full-scale risk-on digital asset.

The stage is about for a giant rise as the highest Altcoin costs clear crucial ranges and on-chain metrics flash bullish indicators.

Eth Value breaks the important thing and breaks the $1,860 and $2,300 resistances

In keeping with Ali Martinez, Ethereum costs have not too long ago surpassed the $1,860 resistance. This is a vital zone the place 4.54 million wallets maintain 5.58 million ETH. The highest altcoins have lastly damaged off from the crucial provide barrier that had stifled progress over the previous few weeks, indicating a significant shift in market sentiment.

With costs rebounding past this degree and nonetheless sturdy now, Ethereum might collect in the long run with a possible objective of $3,000 and $4,000.

Supply: Ali Martinez, X

Moreover, Crypto analyst Incomesharks highlighted that ETH costs cleared the second indirect resistance and confirmed a broader development reversal. The chart confirmed that ETH was steadily rising after a number of buy indicators alongside the decrease trendline.

The subsequent main resistance zones are $3,000 and $4,000, so merchants are potential months of gatherings if present momentum applies.

Supply: Incomesharks, x

Bullish divergence and on-chain information assist ETH gatherings

Specifically, Javon Marks famous that the large bullish divergence on the Ethereum worth chart is a traditional inversion sample that marks a significant worth restoration sooner or later.

In keeping with his evaluation, ETH has a double base with momentum indicators such because the relative power index (RSI), which begins to extend, indicating bullish divergence.

This technical association was an indication of a brand new development, normally beginning with worth targets which are a lot increased than present ETH costs.

Supply: Javon Marks, x

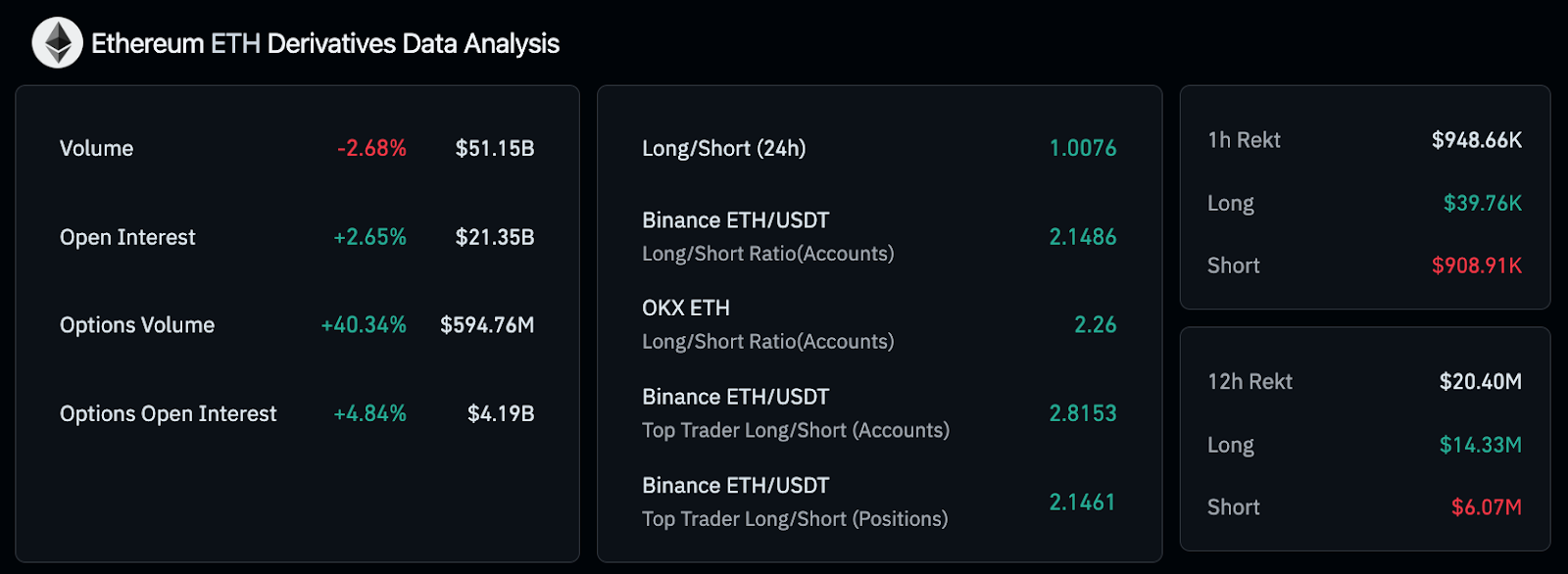

In the meantime, on-chain information additionally supported this bullish outlook. In keeping with current figures, Ethereum's public curiosity has elevated 2.65% to round $213.5 billion over the previous 24 hours, as new capital price $400 million jumped into ETH futures. The elevated open revenue meant that merchants had been positioned for better actions.

Derivatives market exhibits sturdy bullish sentiment

The derivatives market additionally displays Ethereum's sturdy bullish bias. Binance's ETH/USDT Lengthy/Brief ratio is 2.1486, whereas OKX Merchants are taking an much more aggressive stance at a 2.26 ratio. Which means that greater than twice as lengthy merchants are shorter and exhibits even stronger beliefs.

Supply: Coinglass

For Binance's high merchants, the lengthy/brief place ratio has risen to 2.8153, indicating a rise in reliability for Ethereum's upward slides. That is in keeping with market sentiment as merchants set it upside additional. Longer publicity and elevated open income counsel that the market is anticipating a major ETH worth motion within the coming weeks.

Moreover, liquidation information additionally helps this bullish development. Within the final 12 hours, ETH shorts have accounted for $14.33 million in lengthy liquidation and $6.07 million briefly ETH liquidation. This confirmed that Ethereum merchants who had been betting on a worth restoration had been squeezed out.

ETH costs are $4,000 as a notable necessary degree

Specifically, Ethereum costs are struggling to commerce above $1900, as the subsequent main resistance line is at $1950 and the subsequent is on the $2000 degree.

Nonetheless, Ethereum (ETH) costs are anticipated to proceed their current momentum to keep away from pullbacks to the $1,860 assist zone.

At a close to stage, if the Fed charge pauses as a catalyst, this will likely simply be the start of Ethereum's restoration. As technical metrics enhance and market sentiment turns into bullish, Altcoin's outlook strengthens, suggesting a possible breakout within the coming months.