Ethereum (ETH) worth forecasts present potential breakout indicators as a number of components present bullish momentum will increase. The rise in technological patterns and institutional funding recommend that Ethereum might enter a brand new part of progress.

Ethereum (ETH) worth chart reveals bullish sample formation

In accordance with current technical evaluation, Ethereum's present worth motion reveals a downward wedge sample. Downward wedges are often bullish patterns that seem after downtrends, indicating gross sales stress and potential reversals.

Supply | x

The chart reveals Ethereum, which mixes two downward pattern strains to type a narrowing vary. Analysts notice that intraweedge worth consolidation typically precedes sharp breakouts. The inexperienced arrows on the chart level upwards, suggesting {that a} breakout is predicted quickly.

Marketwatchers are paying shut consideration to the Ethereum (ETH) motion close to the highest pattern line. Breakouts seen above this line validate bullish setups, particularly when buying and selling volumes are excessive. Nonetheless, analysts warn that merchants should monitor for potential false breakouts. There, costs could quickly outweigh resistance, however will not be held.

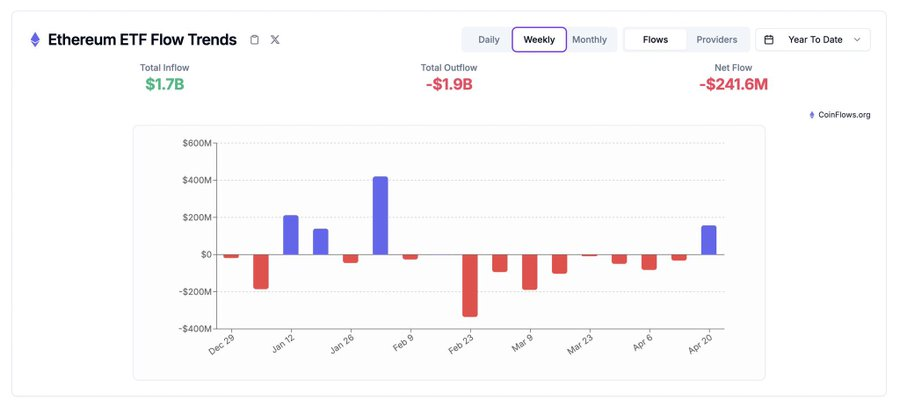

ETF inflows suggests elevated investor belief

Investor desire views may be recognized by an evaluation of the lately revealed weekly Ethereum ETF Circulation Traits chart. Ethereum ETF recorded a complete of $1.7 billion inflows in April 2025, with a web lack of $1.9 billion inflows that generated $241.6 million.

The weekly inflow through the newest interval marks the most important since February 2025 regardless of unfavourable netflow statistics yearly. The large blue bars within the chart present a contemporary inflow of Ethereum ETFs for the week ending on April 20, 2025.

Ethereum ETF suffered from persevering with capital outflows from April 2025 till the beginning of enormous asset deposits. Analysts say the substantial monetary motion seems to point that institutional buyers are switching stances to Ethereum. The group will observe upcoming weekly stream knowledge to find out whether or not this present sample of progress stays robust and due to this fact justifies a long-term market restoration.

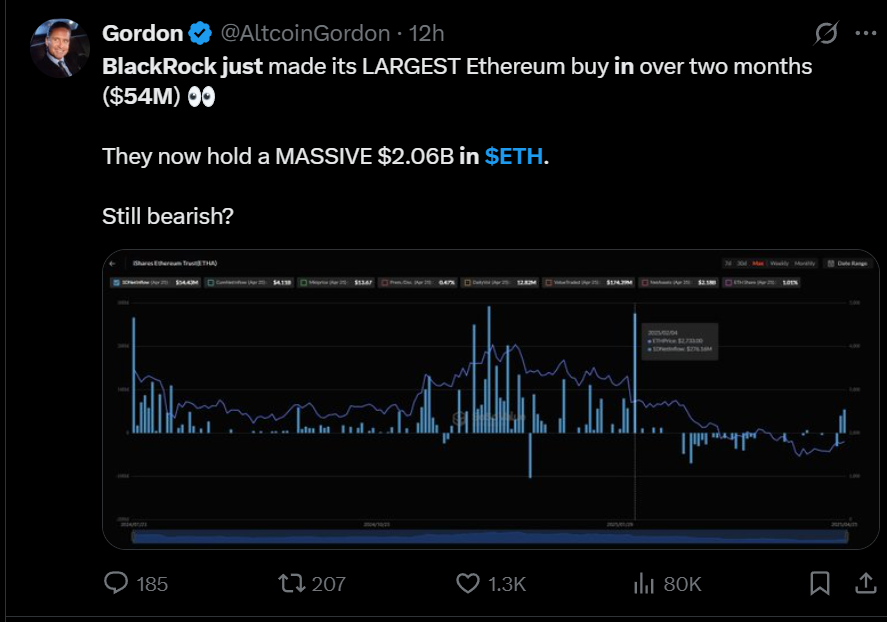

BlackRock will improve its holdings to over $2 billion

BlackRock has elevated its holdings of Ethereum (ETH) by $54 million value of over-the-counter (OTC) transactions resulting from its standing as one of many largest asset administration firms. By means of this current motion, BlackRock has made its largest Ethereum buy because the final two months.

Supply | x

The acquisition has led BlackRock to personal $2.06 billion value of Ethereum (ETH). A BlackRock spokesman mentioned the corporate is actively keenly wanting into potential digital asset alternatives to broaden its crypto portfolio.

Giant establishments akin to BlackRock have invested by appreciable purchases, together with President Trump's substantial Ethereum portfolio, serving to to construct stronger belief in associated property. Traders typically see these actions actively as they happen through the setup of robust expertise markets and improve ETF inflows.

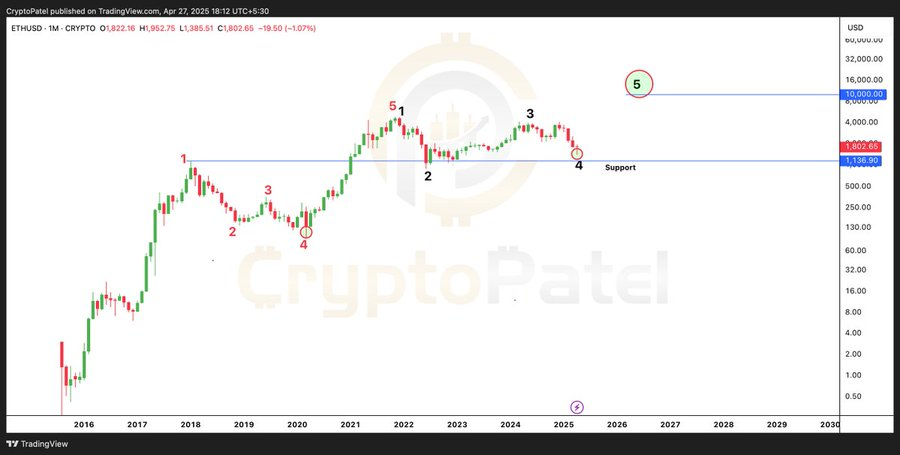

Elliott Wave Analysts recommend that Ethereum (ETH) will transfer to a worth stage of $10,000

Technical Crypto analyst Crypto analyst Cryptopatel's worth forecast and evaluation revealed that ETH signifies the event of a 1-2-3-4-5 Elliott wave sample throughout the value motion. Market costs replicate the emotional conduct of buyers, and due to this fact present repeated wave actions beneath Elliott's Wave idea.

This diagram identifies 5 potential waves, with 1, 2, 3, and anticipated waves 5 displayed within the upward route. Waves 2 and 4 symbolize corrective downward motion. Cryptopatel's mannequin reveals that Ethereum can generate a worth of as much as $10,000 if 5-wave 5 is efficiently developed.

To confirm patterns inside Elliott wave idea, sure retracement restrictions should exist between the waves and sure guidelines have to be met. Analysts clarify that targets can solely be reached if Ethereum (ETH) worth switch is adopted by wave buildings that require it.