Information reveals that Ethereum funding charges have fallen into unfavorable territory. Right here's what has typically adopted this development over the previous two months:

Ethereum funding charges counsel merchants are actually bearish.

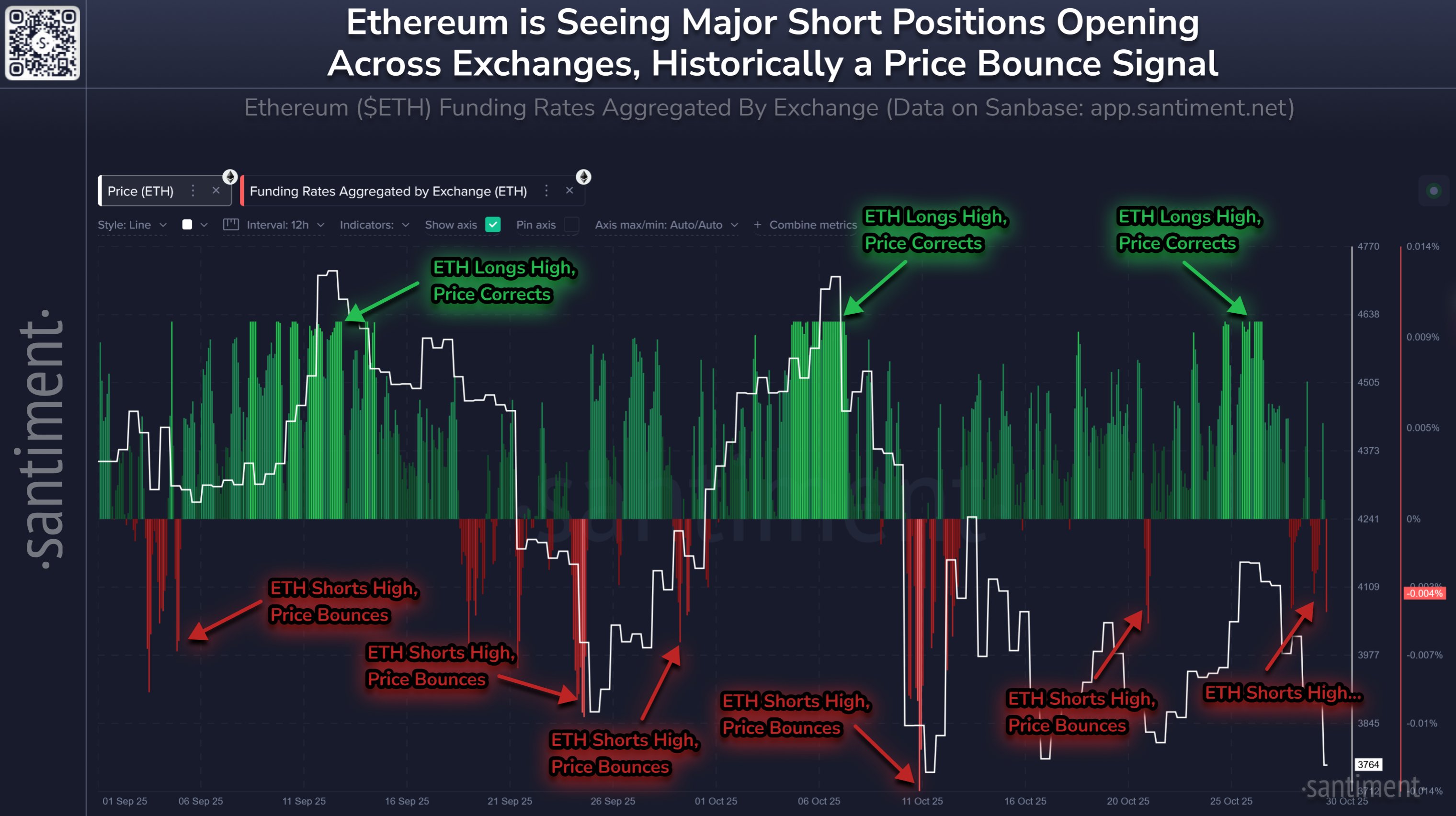

As analytics agency Santiment explains in a brand new submit on X, the Ethereum derivatives market is at present dominated by quick promoting. The indicator of relevance right here is the “funding ratio,” which measures the quantity of normal charges that merchants alternate with one another on varied derivatives platforms.

A constructive worth for this metric implies that long-term holders are paying a premium to short-term bettors to keep up their positions. This development implies that bullish sentiment is dominant.

However, indicators under zero counsel that derivatives merchants as a complete might have a bearish mindset, as quick positions are bigger than lengthy positions.

Now, a chart shared by Santiment reveals the development of Ethereum funding charges throughout all exchanges over the previous few months.

Seems like the worth of the metric has been unfavorable in latest days | Supply: Santiment on X

As you possibly can see within the graph above, we’ve got just lately seen Ethereum funding charges fall into unfavorable territory. Which means that derivatives market balances have moved downward.

Nonetheless, market sentiment turning crimson might not truly be unfavorable for cryptocurrency costs. Within the chart, the analytics agency highlights the patterns the asset has adopted by this indicator over the previous two months.

On this window, ETH seems to be trending towards the funding fee. That’s, noteworthy constructive ranges led to cost corrections, whereas unfavorable ranges led to cost rebounds.

The reason behind this development might lie in the truth that the dominant facet of the market is extra prone to get caught up in liquidation pressures. Such occasions are usually violent, involving a sequence of liquidations that once more result in worth volatility.

Though the Ethereum funding fee has gone into the crimson, its worth continues to be not as unfavorable because the earlier lows that led to the quick squeeze, so it stays to be seen whether or not it will comply with swimsuit.

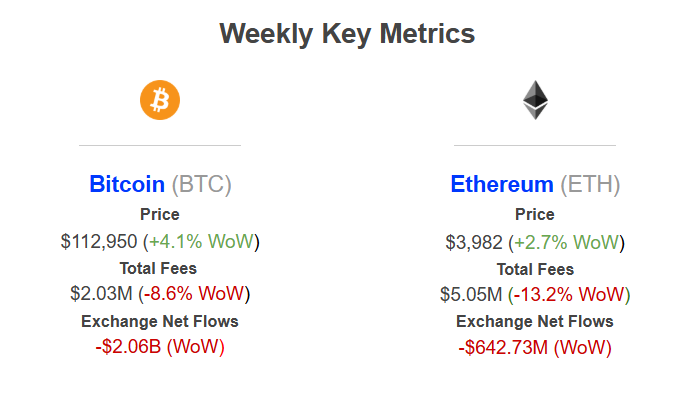

In different information, Ethereum skilled important web alternate outflows of roughly $643 million final week, as institutional DeFi options supplier Sentora revealed in an X submit.

The outflows BTC and ETH have seen in the course of the previous week | Supply: Sentora on X

Bitcoin has recorded alternate withdrawals of over $2 billion. “This can be a robust bullish sign regardless of market uncertainty as traders are transferring their cash into self-storage for long-term holding,” Sentora defined.

ETH worth

As of this writing, Ethereum is buying and selling at round $3,850, up greater than 2% within the final 24 hours.

The value of the coin seems to have been taking place over the previous couple of days | Supply: ETHUSDT on TradingView

Dall-E, Santiment.web, featured picture from Sentora.com, chart from TradingView.com

modifying course of for focuses on offering totally researched, correct, and unbiased content material. We adhere to strict sourcing requirements and every web page undergoes diligent assessment by our group of prime expertise consultants and seasoned editors. This course of ensures the integrity, relevance, and worth of the content material for readers.