Ethereum has proven resilience amid the latest wave of market volatility and uncertainty. The broader crypto market has been pulled again over the previous few weeks, however ETH continues to carry companies past its key psychological and technical help zone of $2,500. This power has attracted the eye of merchants and analysts who view Ethereum's present value motion as a possible launchpad for shifting into increased territory.

Regardless of main altcoin-wide retracements, Ethereum stays structurally intact, with the Bulls defending the low boundary of present vary. The shortage of panic gross sales at these ranges suggests elevated confidence within the long-term trajectory of ETH, whilst macroeconomic pressures, together with harsher liquidity and geopolitical uncertainty, proceed to squeeze feelings.

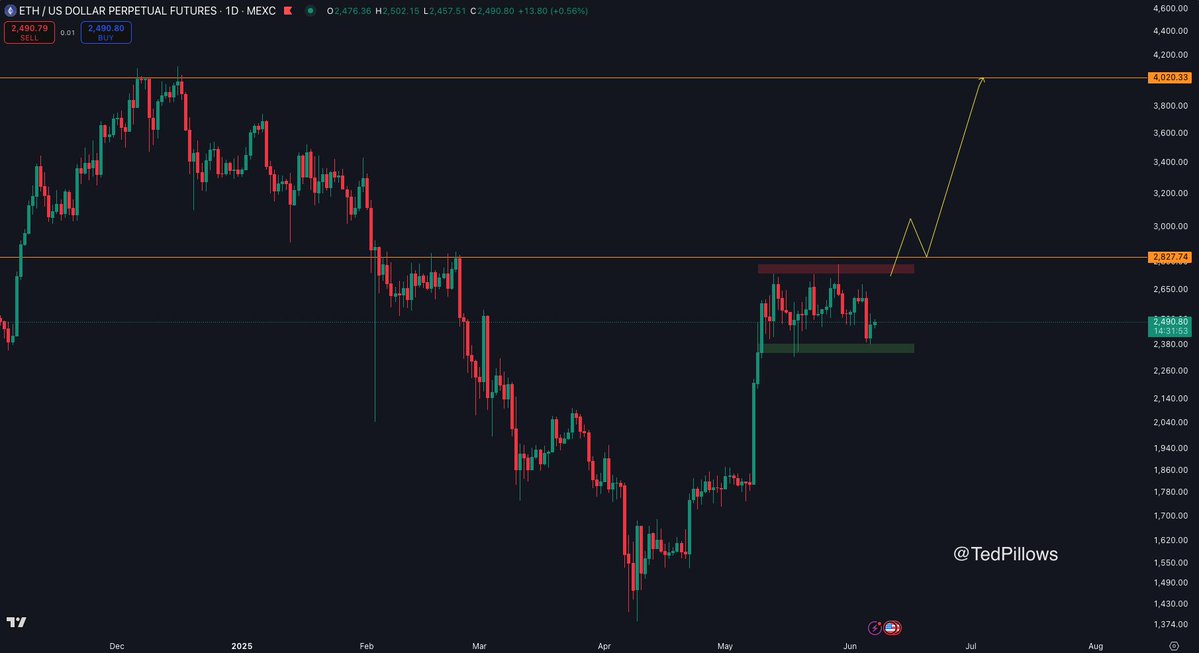

Prime analyst Ted Pillows not too long ago shared a technical replace highlighting that ETH continues to be buying and selling inside a well-defined vary. Based on his view, Ethereum's means to combine with out shedding crucial help is an indication of elementary power. Breakouts above the vary highs might trigger up to date momentum in direction of areas starting from $2,800 to $3,000, whereas breakdowns under $2,500 will disable present setups.

Ethereum approaches a crucial zone amid uncertainty

The crypto market navigates a unstable setting, and Ethereum is not any exception. Nonetheless, regardless of the turbulence, ETH was in a position to preserve scaffolding of over $2,500. This is a crucial stage of help that continues to behave as a buffer for deeper downsides. As Bitcoin holds robust and Altcoins prepares for a possible breakout transfer, the approaching weeks may very well be decisive for Ethereum's subsequent main development.

ETH is at present 48% under its all-time excessive, however value motion suggests the Bulls are gaining momentum. Ethereum has absorbed the latest volatility properly, regardless of being shaken up by rising geopolitical tensions, significantly by the rising battle between Elon Musk and US President Donald Trump. These headlines added uncertainty, however Ethereum's means to stay sure by scope displays the rising confidence amongst traders.

Pillow factors out that Ethereum continues to be traded inside a well-defined vary and the construction stays intact. His evaluation exhibits that regaining the $2,800 stage is a key breakout set off, doubtlessly opening up a beautiful rally as much as $4,000. Till then, ETH will stay in built-in mode, however with Bitcoin displaying management and the market coming into a pivotal stage, Ethereum might save them from catching up.

If the Bulls can preserve management and push resistance via, ETH might ultimately get away of its vary and re-enter the bullish price-discovery section. Nonetheless, if resistance is the case, merchants can see the foot of one other integration. In any case, Ethereum enters a key window the place market route is more likely to be outlined, and the way ETH behaves across the $2,800 mark can decide the outlook for Altcoin for the remainder of the summer season.

Eth Weekly Chart exhibits a momentum construct that’s near resistance

Ethereum has stabilized almost $2,500, as seen on its weekly charts, displaying indicators of promising power regardless of latest market total volatility. After a pointy bounce from the $1,800 stage in Could, ETH is at present consolidating a $2,707 resistance (a 50-week easy shifting common (SMA). This stage coincides with the boundary above the present vary and nonetheless the keylines the Bulls have to retrieve to unlock it the other way up.

ETH is at present buying and selling past the 34-week EMA ($2,501) and the 200-week SMA ($2,450) and each function dynamic help. Holding these ranges reinforces the concept consumers are entering into the dip and offers a powerful basis for potential continuity. Nonetheless, costs are nonetheless restricted by a 100-week SMA at $2,610, making the area between $2,700 and $2,800 a key zone of resistance.

Nearer to as soon as every week on this shifting common cluster can set off a breakout and pave the best way for over $3,000. Quantity stays growing throughout this integration, suggesting sustained curiosity from each merchants and traders.

Dall-E particular pictures, TradingView chart