In a market replace on October 10, technical analyst Nick Patel (@OstiumLabs) argued that Ethereum is approaching a win-lose zone, and the subsequent few classes will decide whether or not the rally resumes or a deeper unwind unfolds. With spot ETH going for round $4,000, Patel pinned his thesis on a decent cluster of withdrawal and invalidation ranges for each ETH/USD and ETH/BTC, emphasizing that decrease timeframe motion must match greater timeframe construction to maintain the bullish path open.

Present Ethereum predominant worth ranges

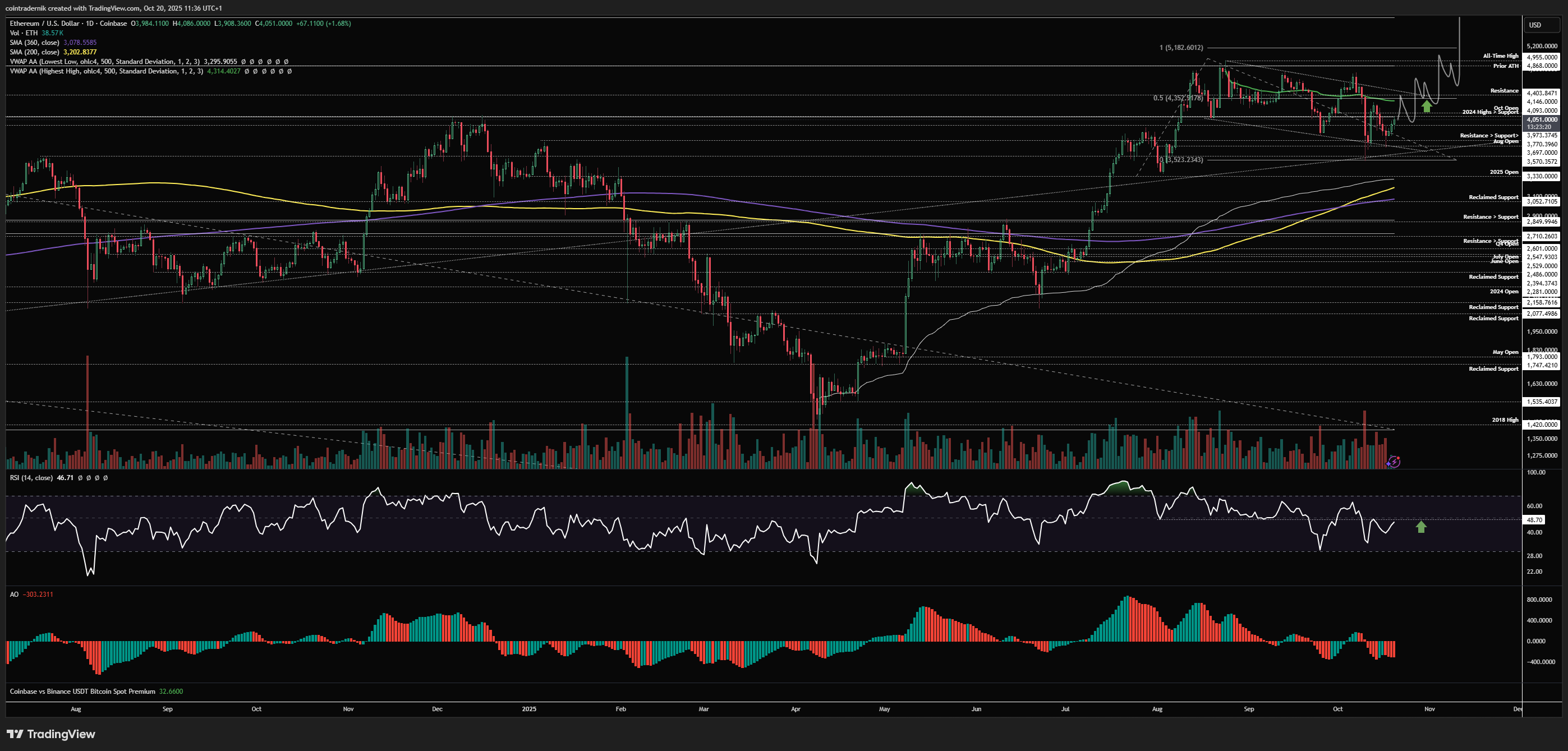

Relating to the weekly chart for ETH/USD, Patel stated the market “had fallen considerably final week to the August trough, but it surely rose above the earlier weekly low and trendline help,” leading to an inside week that ended “barely beneath the foremost pivot.” This pivot is evident. “We hope that this pivot $4,093 is shortly redeemed and doesn’t flip into resistance right here on the decrease time-frame. If not, we might anticipate one other flush of lows in direction of the 2025 open.”

Patel expects final week's transfer to be a quarterly low if patrons power collections. “If we will get well $4,093 right here, which is what I anticipate, the quarterly low needs to be in now and we might hope $4,400 turns into help for a rally to all-time highs and past.”

He set the weekly void worth at $3,700 and warned that if the value closes beneath $3,700, he’ll watch the 12 months's open worth as “final help” for the bullish construction. If it fails there, there’s a danger of “a fair greater reversal to $2,850.” Mr. Patel's base case remained constructive. “Over the subsequent week, acceptance rose above $4,093, adopted by an October shut of above $4,400, resulting in new highs of $5,000 in early November, making it a really robust month for ETH.”

The every day ETH/USD studying connects its excessive timeframe blueprint to momentum and market construction. Patel famous that final week “the momentum to the low dried up after which the rally from the excessive to the low” and stated this formation should now be defended. He wish to see the sequence reaffirmed with a rally above the mid-range after which a high-low above the weekly pivot. “We completely hope that this construction is now protected and we see the value type a excessive and excessive above the mid-range at $4,352, then a excessive low above $4,093 earlier than breaking out additional and pushing the value in direction of new highs.”

As a affirmation of the impulsive leg, he flagged a break within the pattern line, a reversal to help for VWAP anchored at ATH, and an RSI regime shift. “If a trendline breakout happens and the value reverses to help at ATH VWAP with the every day RSI above 50, we anticipate it to rise in a short time to $4,950 after which discover out the value in November.” The every day invalidation mirrors the weekly logic. If $4,093 acts as resistance and the market falls beneath $3,700 after which closes beneath it, “we might be retesting the complete 12 months open,” he sees.

ETH vs BTC

Relating to Bitcoin, Patel argues that relative Bitcoin has seemingly hit a fourth-quarter low. On the weekly chart of ETH/BTC, the value rejected the trendline resistance, then sustained again to the 12 months's open worth, and ended within the “barely inexperienced” whereas respecting the trendline help from the 2025 low.

“My view is that the This fall low for the pair shaped right here,” he wrote, including {that a} retest and breakout of the downbound boundary into early November would set the stage for a cautious enlargement. “Whether it is accepted above 0.0417, the subsequent bar might transfer greater to 0.055,” it added. He had a weekly invalidation of 0.0319.

The every day ETH/BTC map refines these alerts to an actionable degree. The worth “hit a low between 0.0319 and the 12 months's open earlier than rebounding strongly to regain help at 0.036.” Ideally, 0.036 would function a place to begin. If not, Patel is open to greater highs and lows with “an extra rally above the 0.0319 degree.”

A tactical resolution could be to reverse close by provides. “If we will regain help right here and reverse 0.0379, it will be encouraging for the view {that a} breakout of the pattern line is imminent. After that, we anticipate costs to maneuver greater by means of a breakout of 0.0417, however there can be small resistance above it at 0.049 earlier than 0.055.” He additionally recognized a confluence band beneath. “The confluence of help is 0.0293 to 0.0319, so a reversal of that vary into resistance would make ETH/BTC very bearish.”

In abstract, Patel's October 10 blueprint hinges on three synchronizations. ETH/USD must get well and defend $4,093 shortly. Clearing the runway for the earlier excessive would require a ceiling-to-floor conversion of $4,400, with a possible extension of $4,950. ETH/BTC ought to then transfer by means of 0.0379 after which 0.0417 to substantiate the vary of relative power beneath the greenback breakout.

The draw back is equally clear. A failure to get well $4,093, a weekly shut beneath $3,700, and a subsequent lack of the 12 months's open worth would justify the danger of Ethereum “unwinding again to $2,850,” in Patel's phrases.

On the time of writing, ETH was buying and selling at $3,872.

Featured picture created with DALL.E, chart on TradingView.com