Ethereum (ETH) is at present beneath the important thing $2,000 mark and is struggling to seek out momentum after strain round $1,900 and days after integration. The broader crypto market is underneath heavy bear management, with ETH shedding greater than 57% of its worth, making it more and more tough for the Bulls to set their restoration.

At present, Ethereum is beneath multi-year help ranges, so this zone might reverse into robust resistance, additional complicating potential rebounds. The market is in a really unstable stage, with merchants fastidiously power and indicators of additional draw back danger.

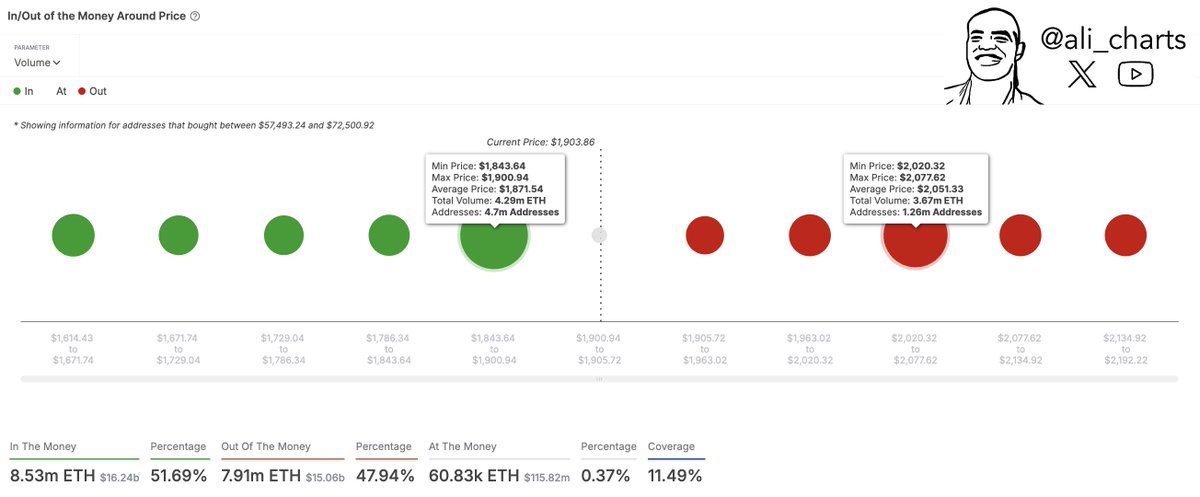

On-chain knowledge highlights two key worth ranges in Ethereum's rapid trajectory. Now, $1,870 is serving as a key help. In the meantime, $2,050 is at present essentially the most difficult resistance and serves as the principle barrier ETH should get better to substantiate a development reversal.

For now, Ethereum stays susceptible and promotes uncertainty worth motion. If the Bulls fail to defend their present help, ETH might drop even additional, however profitable reclamation of resistance might spark new belief available in the market. The subsequent few days are essential in figuring out the short-term route of ETH.

Ethereum is going through a important check as bulls battle to get again $2,000

Ethereum is at a important turning level, approaching its lowest stage since October 2023 because the Bears keep management. After promoting weeks of strain and uncertainty, the Bulls should regain the $2,000 mark as quickly as potential to forestall additional negatives and restore market confidence.

The broader macroeconomic panorama stays unsure, with the fears of commerce wars and international monetary instability being closely weighted in each the crypto and the US inventory market. These components set potential deeper correction levels and provides buyers the benefit. Nonetheless, some analysts consider that the market will be capable of get better within the coming months, particularly if Ethereum is ready to regain its main resistance ranges.

High analyst Ari Martinez lately shared on-chain metrics and recognized $1,870 as Ethereum's strongest help stage. Because of this if ETH breaks underneath this zone, an extra discount could also be imminent. In a bonus, $2,050 is now Ethereum's most difficult resistance and serves as an essential barrier the Bulls should overcome.

When Ethereum efficiently retrieves $2,050, it exhibits a powerful development reversal and units the stage for a doubtlessly highly effective restoration rally. ETH might be essential as buyers are intently monitoring worth actions, as ETH might want to retain its place and even maintain additional downsides.

ETH Bulls Ought to Maintain Over $1,900

Ethereum At present $1,920 dealcontinues Consolidation Days beneath the Essential $2,000 Degree. regardless of Makes an attempt to push it greaterBulls I had a tough time regaining the misplaced floordepart ETH In a susceptible place.

To see a restoration, the ETH should be broken by greater than $2,000 and exceed the 4-hour 200 Transferring Common (MA) and Exponential Transferring Common (EMA) to exceed round $2,400. Profitable regeneration of those ranges will reveal an up to date buying momentum and will set the stage for a robust gathering in direction of the next zone of resistance.

Nonetheless, if Ethereum is unable to regain these ranges, gross sales strain may very well be elevated and ETH might drive ETH in direction of a requirement zone of round $1,750. A breakdown beneath this stage can put extra strain on the bull and result in extra downsides and prolonged bearish emotions.

Because the market scenario remains to be susceptible, the short-term route of ETH stays unsure. The Bulls should intervene instantly to guard important ranges. Or Ethereum should lose extra floor and make fast restoration way more tough. The subsequent few days might be essential as ETH merchants watch breakouts or additional draw back actions in response to wider market tendencies.

Dall-E particular photos, TradingView chart