The foremost Altcoin Ethereum has been driving a wave of broader market restoration with costs rising 5% over the previous week. This worth development has rekindled demand for Altcoin, significantly amongst US-based ETH retailers, as proven in present chain information.

Nevertheless, institutional traders seem to stay skeptical. They proceed to attract capital from Ester-backed funds, demonstrating a insecurity in short-term worth rebounds.

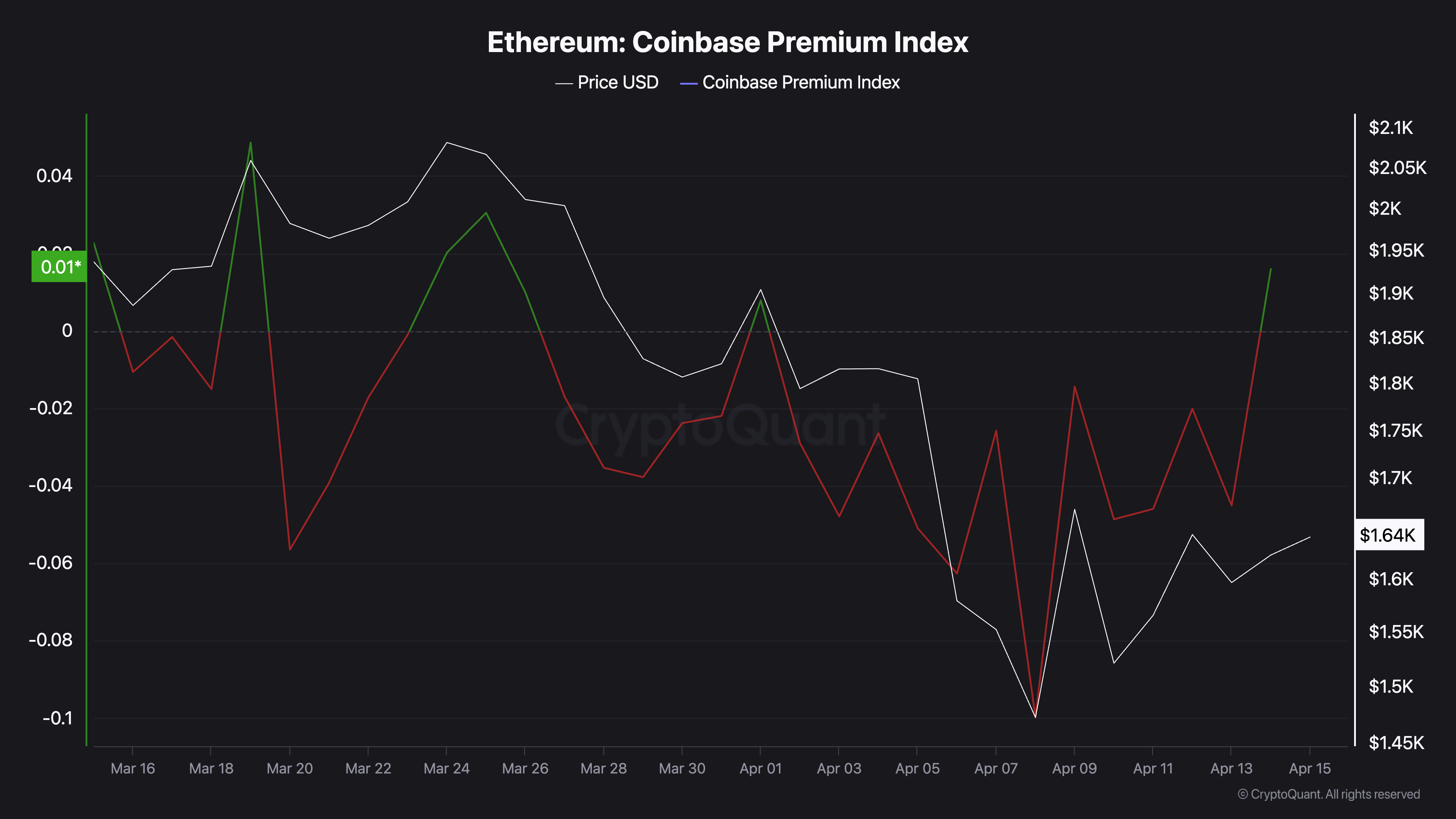

Retail curiosity in Ethereum will improve to purchase Coinbase premium alerts

The rising curiosity in retail is obvious at ETH's Coinbase Premium. It has returned above zero, indicating a rising shopping for exercise from US traders. At press, that is 0.016.

Ethereum Coinbase Premium Index. Supply: Cryptoquant

Eth's Coinbase Premium Index measures the distinction between Coinbase's Coin worth and Binance. When its worth exceeds zero, it suggests Coinbase's vital buying actions by US-based traders.

Conversely, if it drops and immerses in damaging territory, it signifies much less buying and selling exercise on US-based exchanges.

Eth's Coinbase Premium Index displays the bullish sentiment of the market as merchants are prepared to pay premiums to purchase cash at Coinbase. Within the quick time period, this exhibits superior investor curiosity, which may improve the worth of Altcoin.

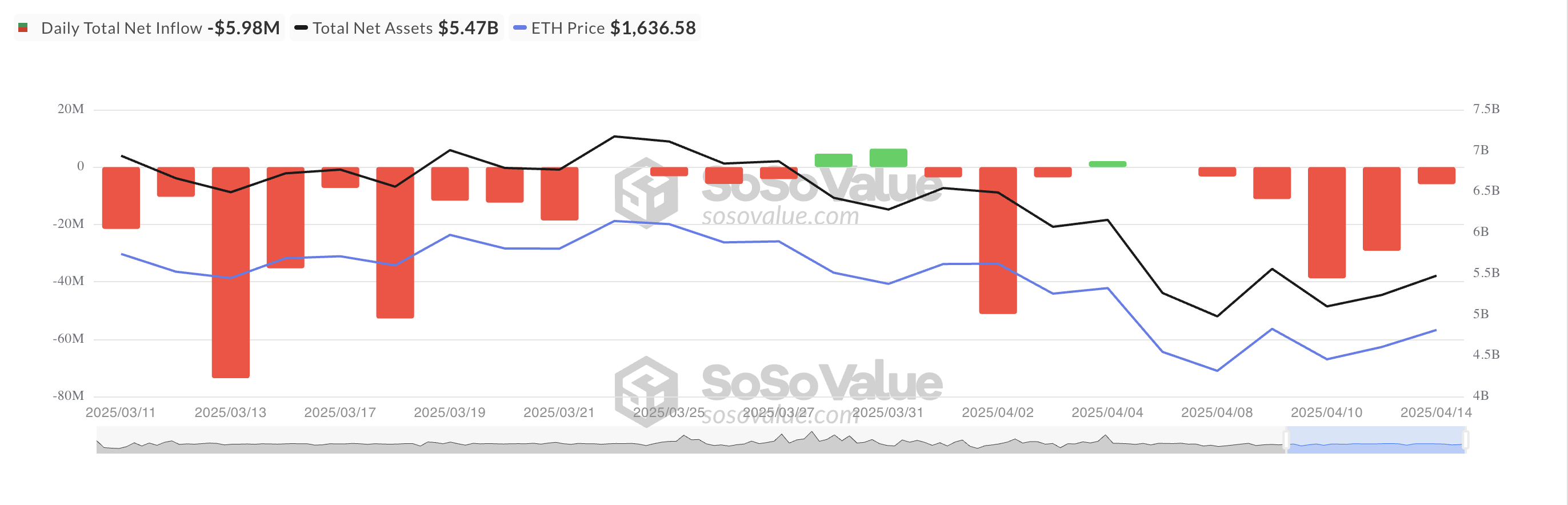

Nevertheless, US institutional traders are cautious. That is evident in an ongoing spill from the US-based Spot ETH Alternate Commerce Fund (ETF), marking Altcoin's seventh consecutive day of withdrawal.

All Ethereum spot ETF web stream. Supply: SosoValue

The continued exit of the ability's capital is in stark distinction to the rising enthusiasm of outlets. This distinction means that US retail traders have gotten more and more optimistic about ETH's short-term outlook, however institutional gamers are extra cautious, maybe on account of macroeconomic uncertainty.

ETH exhibits sturdy capital inflows, however bearish sentiment can see costs fall

ETH's Stability of Energy (BOP) is a constructive throughout press time, reflecting immediately's market restoration. This indicator, which measures buying and selling strain, is on an upward development at 0.57.

Such constructive BOPs present a extra capital influx into ETH than outflow, indicating accumulation development. If this continues, it might push the Altcoin worth to $2,114.

ETH worth evaluation. Supply: TradingView

Nevertheless, if market sentiment turns into bearish and esthetic merchants scale back demand for Altcoin, they might lose latest income and drop to $1,395.