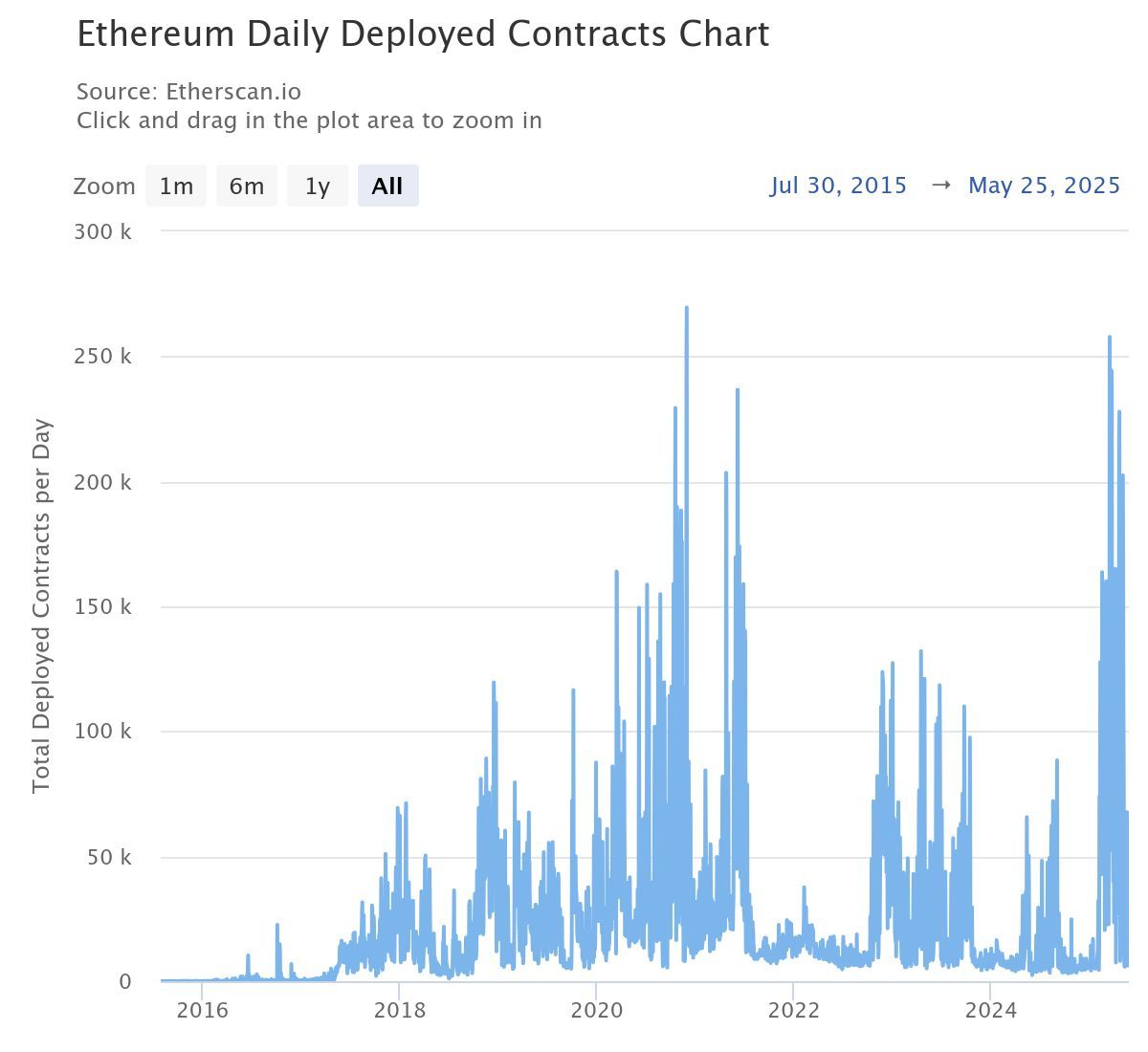

In 2025, Ethereum (ETH) skilled a major surge in sensible contract deployment actions. The variety of contracts unfolding daily has reached ranges not seen since 2021.

This marks a robust revival of the Ethereum ecosystem, one of many world's main blockchain platforms. It additionally strengthens bullish forecasts for ETH costs and raises questions. Will Ethereum have the ability to retrieve the best ever since 2021?

What drives Ethereum to $10,000?

In keeping with Etherscan knowledge, the variety of sensible contracts deployed every day on Ethereum has been rising sharply for the reason that starting of the 12 months. The chart exhibits that within the first quarter of 2025, ETH reached its highest stage of every day improvement since 2021, the best ever ever, with ETH above $4,800.

This surge within the first quarter was largely anticipating an improve for Pectra. Moreover, the variety of sensible contracts is rising, reflecting the rise in Ethereum utilities, which will increase demand for ETH.

Ethereum Each day Deploymed Contracts. Supply: Etherscan

Nevertheless, ETH costs don’t totally replicate this optimistic development. It fell from $3,700 to $1,400 earlier than recovering on the time of writing.

Regardless of costs lagging behind the expansion of sensible contracts, Crypto Investor Ted stays optimistic. He believes ETH may quickly surpass the 2021 excessive.

“Ethereum's every day contract improvement has hit a stage not seen for the reason that Bull Run in 2021. Builder exercise is rising and a transparent sign that on-chain momentum has returned. Costs proceed to the fundamentals.

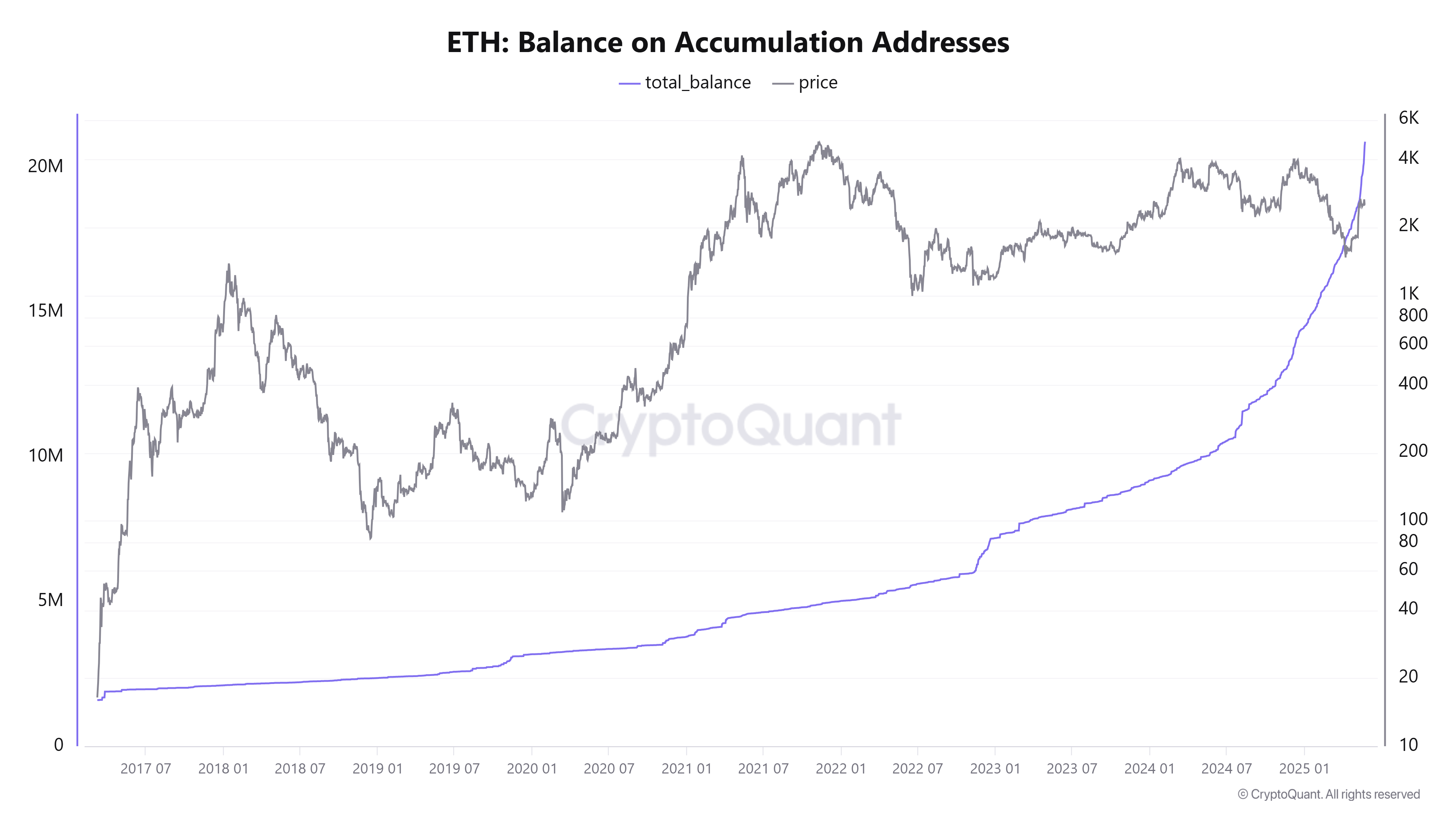

On the similar time, Cryptoquant's knowledge is much more optimistic. The quantity of ETH flowing into the storage pockets has hit a document excessive. These wallets often belong to massive buyers, also called “whales.” The elevated inflow suggests robust long-term belief within the potential of ETH.

In consequence, the ETH stability within the accumulation pockets reached a brand new excessive, particularly 21 million ETH, or 17.5% of the circulation provide. In 2025, the upward development on this chart highlights robust ETH demand.

ETH stability of gathered addresses. Supply: Cyptoquant.

The document highs of sensible contract deployment and ETH accumulation reinforce the view that Ethereum appeals to builders and buyers regardless of the risky crypto market.

Previous value efficiency suggests a short-term return of $4,000

Analysts additionally make bullish value forecasts based mostly on ETH chart patterns.

Analyst Cas Abbe used a two-week Gaussian channel indicator to evaluate Ethereum value developments. By evaluating previous value behaviors, Abbe predicts that ETH may attain $4,000 within the third quarter of 2025.

Ethereum costs and a couple of weeks of Gauss channel. Supply: CasAbbé

“ETH is attempting to regain its 2W Gaussian channel. ETH has solely recovered this channel twice since 2020. Each have gathered collectively strongly. In 2020, ETH rose from $300 to $4,000. In 2024 it rose from $2,400 to $4,100.

One other essential issue is the efficiency of ETH in comparison with Bitcoin (BTC) in 2025. Coinglass knowledge exhibits that ETH above BTC in Q2 exhibits. At the moment, ETH's Q2 return is +40%, whereas BTC's return is +33%.

Historic Coinglass knowledge additionally reveals that ETH exceeds BTC in regular Q2. ETH's common second quarter returns are 64.22% in comparison with BTC's 27.30%.

Nevertheless, latest chain evaluation from Beincrypto highlights the rising consideration of buyers. Many buyers are dealing with income after ETH has rebounded greater than 80% for the reason that starting of final month. This gross sales strain may very well be throughout the highway to greater value ranges for ETH.