Ethereum briefly fell for greater than 4 hours on Monday morning earlier than recovering the $3,100 worth stage. The restoration comes amid an uptick in exercise from wallets for a decade and large-scale liquidations by distinguished market figures.

Latest volatility has highlighted two contrasting market forces: the re-emergence of long-term holders and the discount in publicity of influential gamers.

ETH worth pattern and market sentiment

Ether fell beneath $3,100 for the primary time since November 4, 2025, and was buying and selling at $3,066 as of 9:36 pm UTC on November 16, down 3.4% in 24 hours. The decline displays the broader weak spot in digital belongings and the notion that ETH carries extra threat than Bitcoin.

One dealer at

ETH worth for 90 days. Supply: BeInCrypto

Regardless of the non permanent drop, Ethereum confirmed exceptional resilience, rallying above $3,100 inside hours. Market members are carefully monitoring ETF flows for any indicators of continued promoting or reversal, as ETH could possibly be oriented round this vital assist.

In keeping with Coinalyze information, ETH’s long-short ratio is above 3.0, indicating robust dealer engagement. Latest highs point out a interval of elevated exercise, and rising open curiosity displays elevated participation and the potential for continued bullishness. However, a pointy rise within the ratio additionally alerts the chance of short-term volatility.

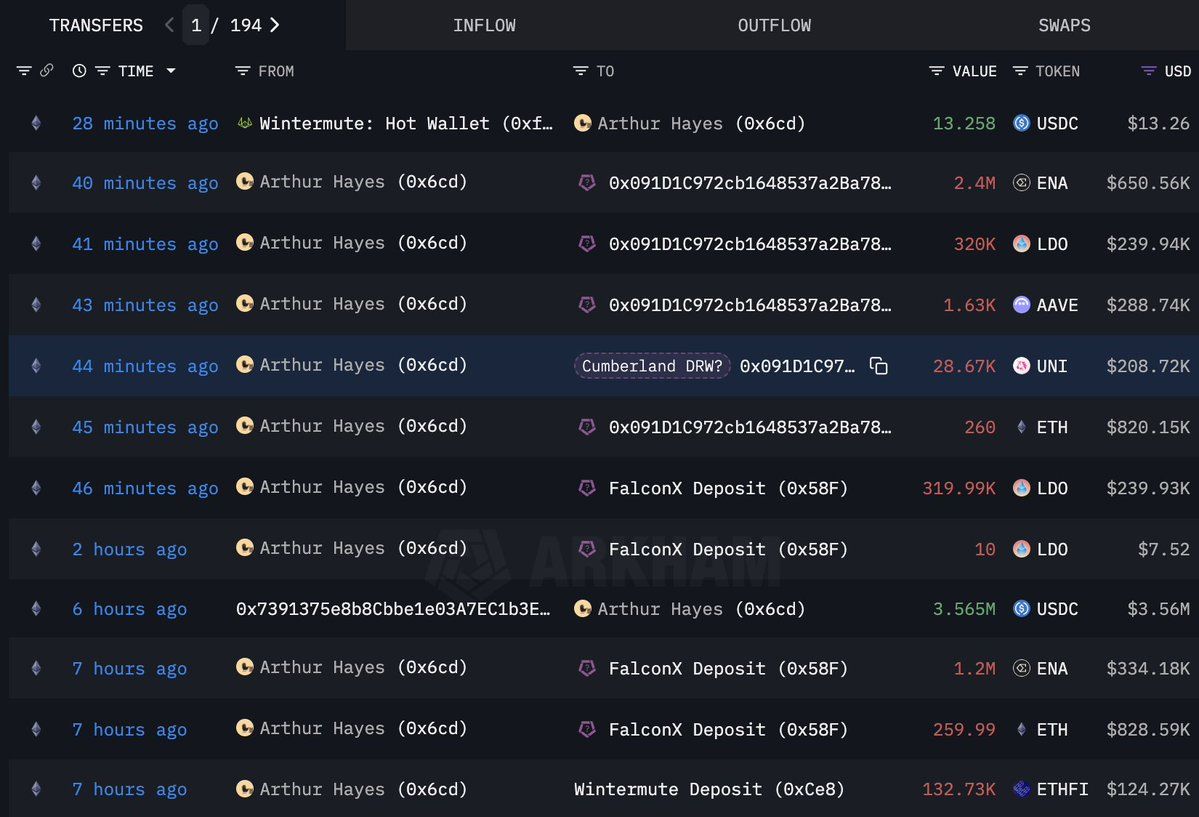

Arthur Hayes liquidates Cryptocurrency Holdings

BitMEX co-founder Arthur Hayes has launched a collection of large-scale cryptocurrency gross sales totaling roughly $4.1 million. On-chain analytics platform Lookonchain reported that Hayes offered 520 ETH (value $1.66 million), 2.62 million ENA (value $733,000), and 132,730 ETHFI (value $124,000) on Sunday.

Arthur Hayes’ On-Chain Transaction Exercise – Lookonchain

Hours later, Hayes expanded on the liquidation. In keeping with one other Lookonchain publish, he additionally offered 260 ETH value $820,000, 2.4 million ENA value $651,000, 640,000 LDO value $480,000, 1,630 AAVE value $289,000, and 28,670 UNI value $209,000. These belongings had been despatched to institutional desks corresponding to Flowdesk, FalconX, and Cumberland, which usually deal with excessive quantity liquidations.

Arthur Hayes Persevering with Asset Gross sales – Lookonchain

These sell-offs occurred as Ethereum fell to $3,100 and Bitcoin fell to $94,000. Hayes' actions could replicate a defensive rebalancing or profit-taking strategy amid uncertainty, which may enhance promoting strain on ETH and associated belongings.

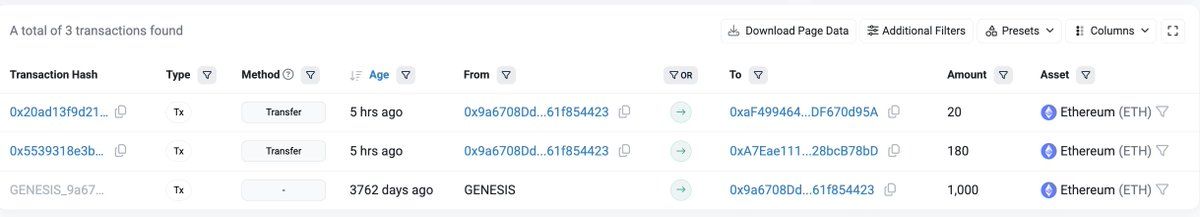

Dormant Ethereum pockets is again for the primary time in 10 years

In a uncommon transfer, a dormant Ethereum ICO pockets has transferred 200 ETH value $626,000 after greater than a decade, based on Lookonchain. This pockets obtained 1,000 ETH for a $310 funding throughout Ethereum's early days, however at present costs that's a ten,097x return.

Ethereum ICO Pockets Wakes Up After 10 Years – Lookonchain

Actions like this are vital as a result of they exhibit early adopters' continued perception in Ethereum's long-term worth and potential. These strikes may additionally enhance market provide. Wallets related to Ethereum's early and pre-mining phases are uncommon and carefully tracked by the cryptocurrency neighborhood as indicators of whale exercise and shifts in sentiment.

The reactivation of the 10-year-old pockets reveals the maturation of the Ethereum ecosystem. Early buyers who’ve weathered a number of bear markets and unstable cycles at the moment are transferring belongings, maybe for revenue taking, diversification, or new funding methods.

Consultants disagree on the way forward for Ethereum

Distinguished analysts are divided on the way forward for Ethereum. BitMine Chairman Tom Lee in contrast Ethereum to Bitcoin's earlier supercycle and conveyed robust bullish sentiment. In a current assertion, Lee identified that Bitcoin has skilled six declines of greater than 50% and three declines of greater than 75% up to now eight and a half years, however has risen 100 instances by 2025.

Mr Lee emphasised that to revenue from the supercycle, we have to overcome volatility and uncertainty. He argued that Ethereum is at the moment on an analogous trajectory and urged buyers to climate the turbulence in preparation for the potential for exponential beneficial properties.

$1,800 appears like the proper spot to purchase Ethereum $ETH! pic.twitter.com/sDZiga5XQy

— Ali (@ali_charts) November 16, 2025

Analyst Ali Martinez, however, took a cautious view, suggesting that ETH may fall to $1,800. His outlook displays considerations about ETF outflows, dangers related to Bitcoin, and broader market challenges. The disagreement amongst specialists highlights continued uncertainty about Ethereum's near-term motion.

The stress between long-term optimism and short-term warning displays the present sentiment in direction of Ethereum. Whereas institutional buyers are exhibiting hesitation, on-chain actions and energetic buying and selling by early members counsel a posh atmosphere. The approaching weeks could resolve whether or not ETH can maintain onto the assist above $3,100 or take a look at decrease ranges with additional decline.