Ethereum costs have risen steadily over the previous week, rising practically 10% as institutional gamers proceed to pour capital into key Altcoin.

This rising momentum lies in broader optimism within the crypto market and the strengthening correlation with Bitcoin. Collectively, these tendencies counsel that Ethereum could also be prepared for a significant breakout, however the acquainted obstacles are nonetheless in the way in which.

ETH/BTC correlation will increase

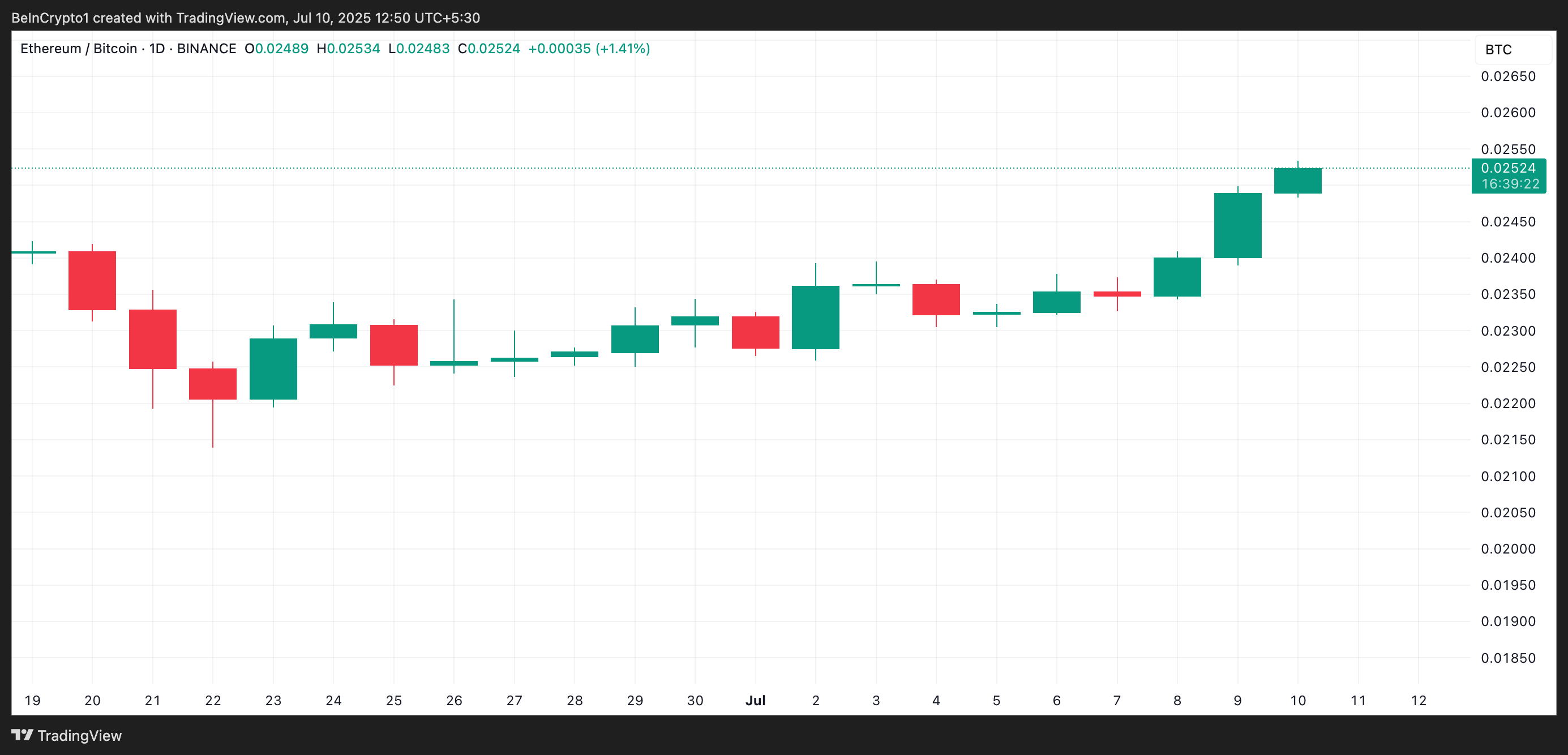

The correlation between Ethereum and Bitcoin has risen sharply since late June. The ETH/BTC correlation coefficient measures how ETH value actions monitor BTC value actions over a given interval and is presently situated at 0.02.

ETH/BTC correlation coefficient. Supply: TradingView

A price near 1 signifies that each property transfer in the identical path, whereas a price close to -1 signifies that they transfer in the other way.

As BTC is approaching an all-time excessive, ETH costs may comply with go well with and rallies. It’s because traditionally excessive correlations within the Bull Section precede the joint meeting of each property.

ETH targets $3,000 when the establishment masses

Ethereum institutional traders appear to be trapped in positions as they use the correlation of mountaineering ETH/BTC. As each property have been working collectively at a traditionally bullish stage, the group is more likely to be greater than $3,000.

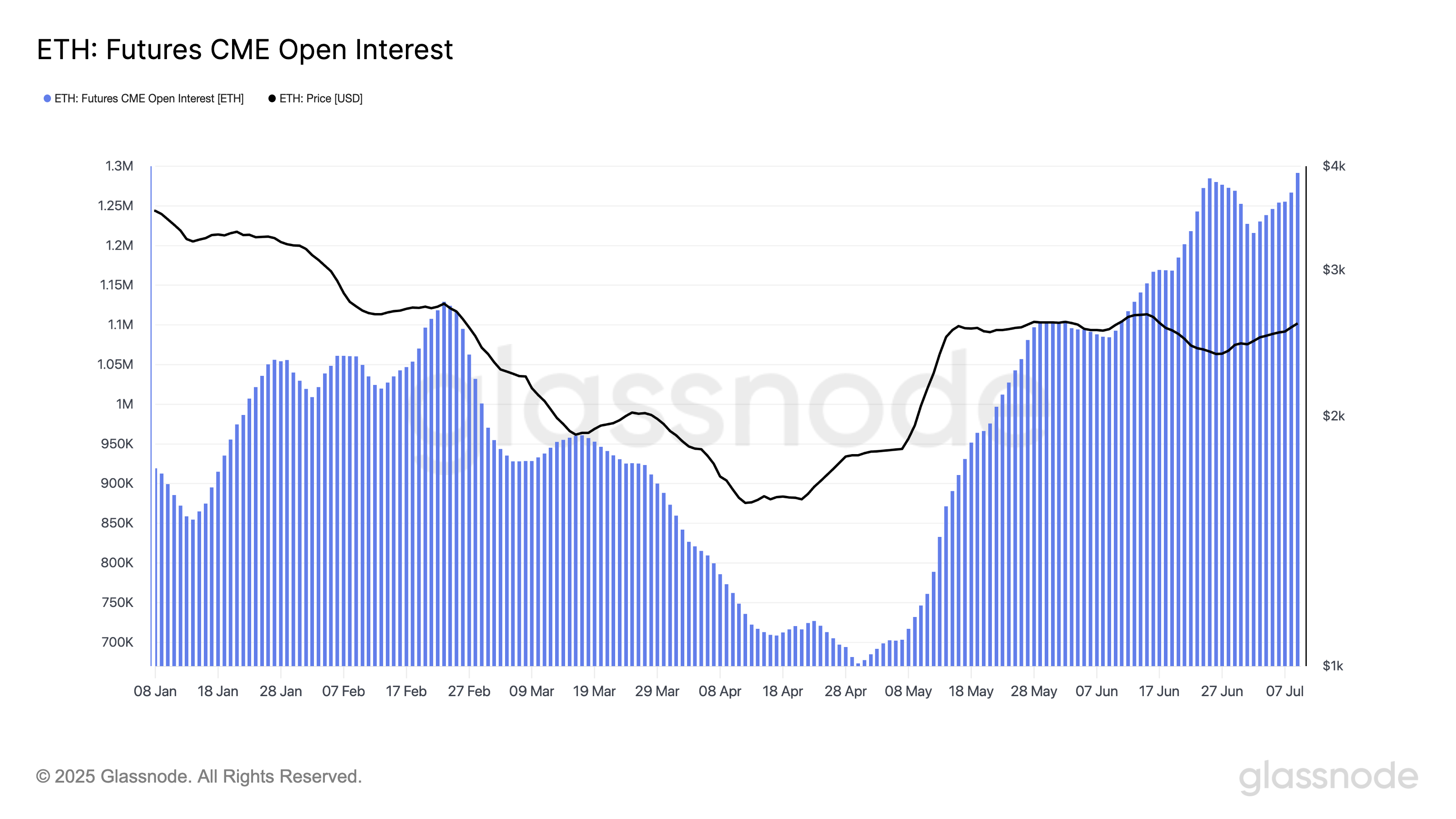

Open curiosity in ETH futures from Chicago Mercantile Trade (CME) measured on a easy seven-day transferring common has skyrocketed to a file $3.34 billion, in response to GlassNode's on-chain information.

This displays the rising institutional place as gamers in key markets transfer even additional the other way up to build up ETH.

Open revenue refers back to the whole variety of unresolved futures contracts that haven’t been resolved. Such a surge signifies a rise in buying and selling exercise and a rise in capital to the market.

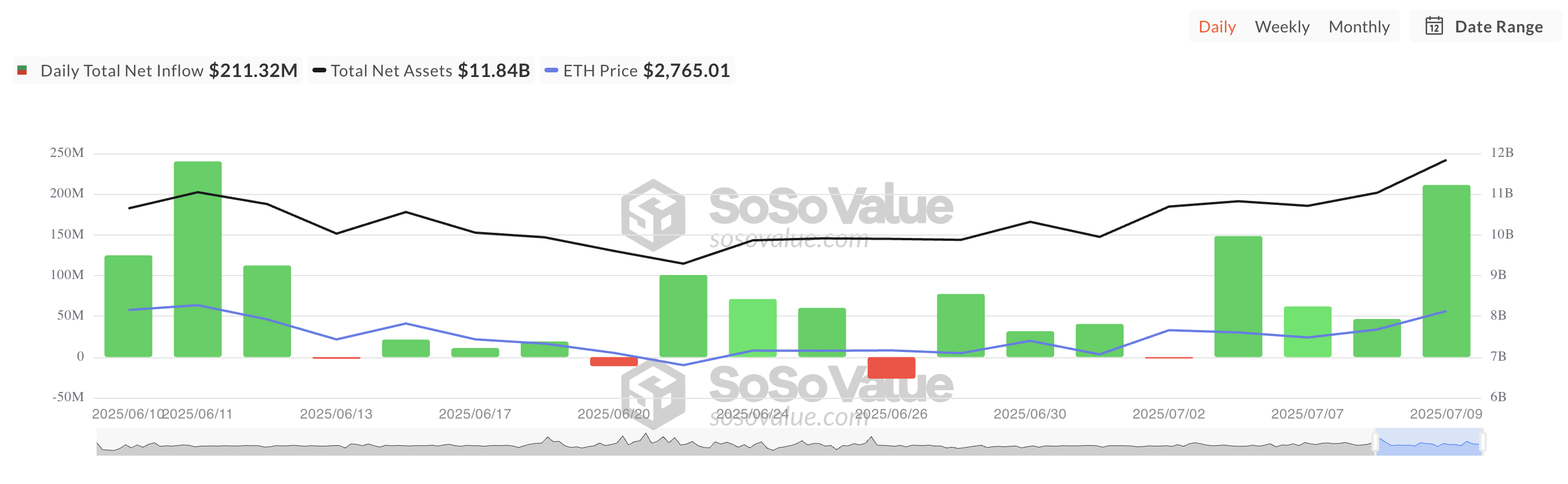

Moreover, the constant weekly inflow into Spot ETH ETFs highlights the strengthened belief in Altcoin amongst these key traders.

In accordance with SosoValue, ETH-backed funds have recorded uninterrupted weekly inflows since Might ninth. Over the past week alone, greater than $219 million in capital flowed into the ETH Spot ETF, regardless of the vast majority of Coin's side-facing value motion.

All Ethereum spot ETF web circulate. Supply: SosoValue

This sustained funding confirms elevated confidence in ETH's long-term worth as refined traders place forward of the anticipated breakout of over $3,000.

Nevertheless, there’s a catch.

When retail merchants tapped out, Eth Bulls was below $3,000

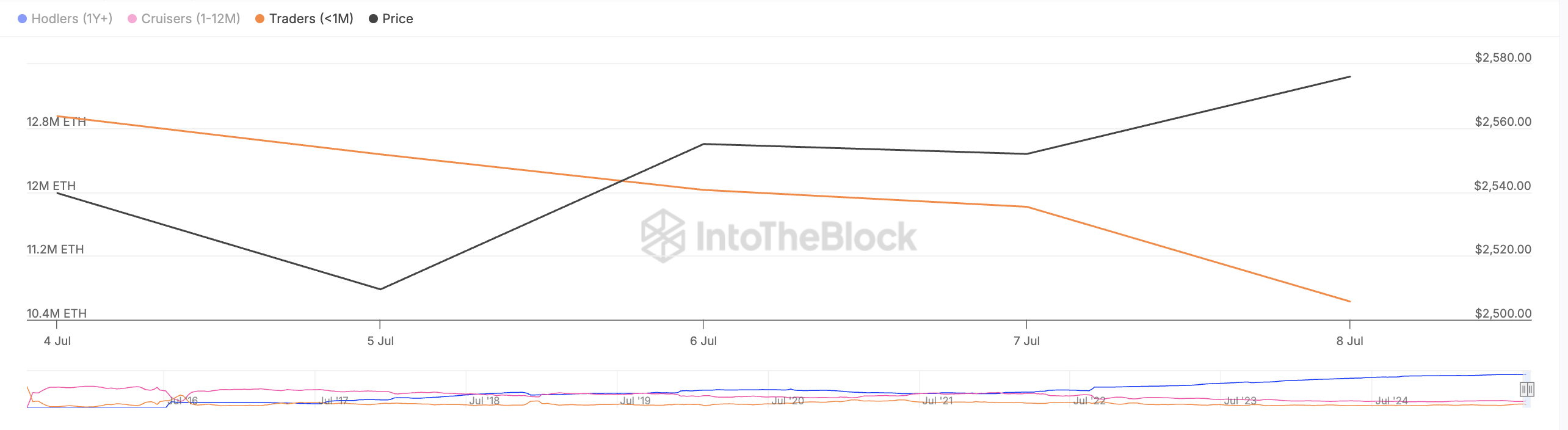

As key homeowners chase over $3,000 rallies, ETH's short-term value measures proceed to be oppressed by “paper hand.” These retailers have saved their cash below 30 days and are promoting their latest energy.

Knowledge from IntotheBlock reveals that the steadiness for this group has dropped by 16% since July 4th, slowing the expansion in coin costs amid sturdy institutional help.

Ethereum steadiness held at every hour. Supply: IntotheBlock

Retailers drive short-term value efficiency of their property by way of frequent and emotional gross sales and gross sales. In contrast to institutional traders who have a tendency to take care of volatility, retail members are extra conscious of information, sentiment and short-term value actions.

As soon as they begin promoting, the downward stress will enhance, stalling the rally or triggering corrections.

Whereas institutional curiosity in ETH is an efficient signal of long-term belief, retailers are wanted to catalyze gatherings that exceed $3,000 within the quick time period. In the event that they fall whereas remaining lonely, the coin may lose a few of its latest earnings and fall beneath $2,745.

ETH value evaluation. Supply: TradingView

Nevertheless, resulting from a revival of latest demand, ETH costs may exceed $2,851 and attain $3,067.