- Ethereum value is driving a short-term consolidation development that resonates inside a symmetrical triangle sample formation.

- The notable spike in open curiosity related to Ethereum futures contracts signifies that the speculative energy of the worth is rising once more.

- ETH value is buying and selling beneath its 100-day and 200-day exponential shifting averages, suggesting that the asset's long-term development is bearish.

Ethereum value fell 3.94% throughout US market hours on Wednesday and is presently buying and selling at $3,168. The promoting strain seemingly got here as a reset after the broad market restoration witnessed by buyers in the course of the first seven days of 2026. Whereas this low cost alerts the danger of a protracted value correction, it additionally signifies that institutional buyers have excessive confidence in ETH. Will the highest altcoin maintain $3,000?

ETH value volatility will increase as institutional shopping for offsets short-term weak spot

Within the first seven days of 2026, Ethereum value made a exceptional restoration from $2,902 to its latest excessive of $3,307, registering a rise of 13.26%. This rise coincided with a restoration within the broader crypto market, with Bitcoin trying to regain the $90,000 stage.

Nevertheless, the rebound after the restoration has seen ETH rise to $3,169, elevating considerations that the correction development remains to be within the minds of outlets. Regardless of Ethereum’s worth falling by 3.88% to round $3,148, main monetary establishments are rising their holdings of the asset.

On-chain monitoring revealed that World Liberty Monetary withdrew 162.69 wrapped Bitcoin models value $14.98 million from the Aave lending protocol and altered focus. A portion of it, on this case 27.12 WBTC value $2.5 million, was exchanged for 770.6 ETH cash.

In the meantime, asset administration agency BlackRock participated within the cryptocurrency celebration for the third day in a row, buying 9,619 Bitcoin value $878 million and 46,851 Ethereum models value $149 million. This exercise displays sustained curiosity from massive consumers regardless of market fluctuations.

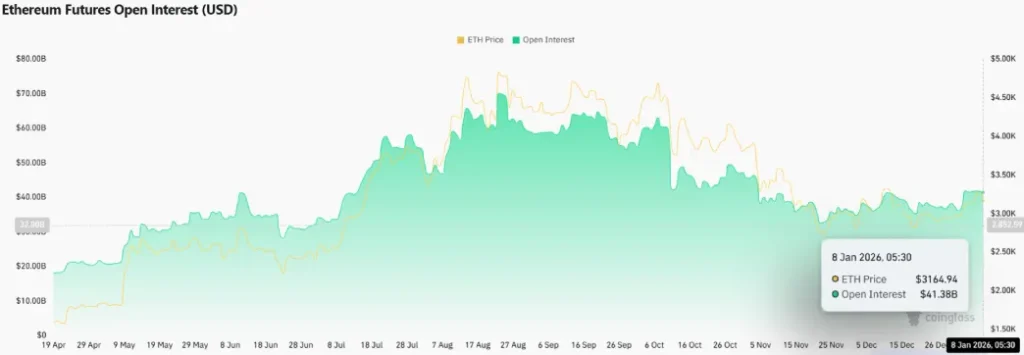

Moreover, the open curiosity related to ETH futures contracts recorded a notable spike in early 2026. Since final week, OI worth has rebounded from $36 million to $42 billion, in keeping with Coinglass information.

This means that capital inflows into the derivatives market is rising, indicating that value volatility is predicted to extend sooner or later.

Key breakout failure prolongs Ethereum value consolidation

Over the previous two months, Ethereum value has proven a consolidation development that resonates inside two reversal development traces. This dynamic resistance and assist fashioned the acquainted steady sample of symmetrical triangles.

Chart setups usually emerge after a directional development, permitting market contributors to regain depleted momentum earlier than making the subsequent leap. On Tuesday, Ethereum value tried a bullish breakout from the highest of the sample. Nevertheless, the breakout failed and the worth re-entered the triangle zone.

The Relative Energy Index (RSI), which measures momentum, has fallen to 56%, highlighting a slight slowdown within the bull market's momentum.

This false breakout ought to speed up the promoting strain and trigger the ETH value to say no by 7.15% to achieve the underside trendline at $2,939. A possible bearish break beneath this assist will additional strengthen the breakdown and Ether will problem $2,600.

Conversely, an upside breakout from the 200-day EMA overhead will sign a bullish reversal for ETH coin.

Additionally learn: Trump-backed World Liberty Monetary (WLFI) seeks banking license