Ethereum (ETH), the second largest cryptocurrency by market capitalization, is a key participant in Crypto Market, driving innovation in distributed finance (DEFI), good contracts and blockchain purposes. Nonetheless, after reaching an all-time excessive of $4,878 in November 2021, ETH struggled to regain these heights, dealing with a number of value changes.

The ETH value, which at present trades round $1,967, has sparked concern amongst buyers. The query is because the crypto market exhibits indicators of restoration and institutional curiosity: Can Ethereum escape that bearish development and rally on its bold $7,000 purpose?

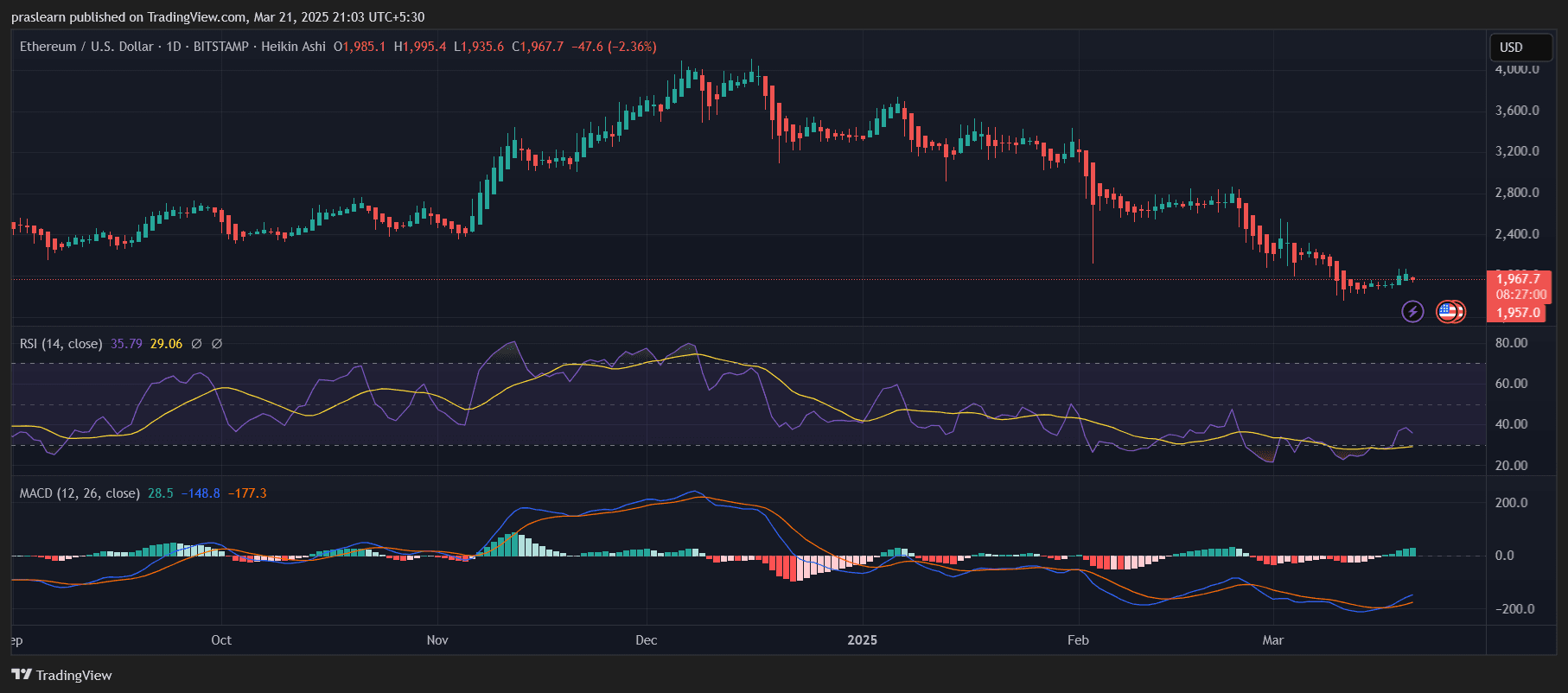

To reply this, we analyze ETH value actions, key resistance and assist ranges, technical indicators equivalent to RSI and MACD, and fundamental catalysts that may induce Ethereum to new highs. Dive into the chart and see in case your ETH may doubtlessly make parabolic actions in direction of $7,000.

Ethereum Worth Prediction: Is Ethereum prepared for an enormous breakout?

eth/usd every day charts – TradingView

Ethereum costs are underneath strain and battle beneath main resistance ranges. There’s a steady downtrend on the every day chart, with ETH at present exhibiting hovering of round $1,967 after not holding a better assist zone. An essential query arises. Will Ethereum overcome this bearish momentum and attain its bold $7,000 goal?

From a technical standpoint, market construction displays bearish sentiment, however potential patterns of reversal could also be shaped. The relative energy index (RSI) is at a really extreme stage, and the MACD exhibits early indicators of bullish divergence. These indicators recommend that Ethereum could also be approaching the short-term backside, which may set a stage of restoration.

What are the primary resistance and assist ranges?

Ethereum faces robust resistance at $2,100, with a number of rejections seen in previous value actions. As soon as ETH costs break this stage, their subsequent targets might be $2,500 and $3,000. In any other case, it may result in a retest of assist of round $1,800.

The important thing bull sign is an ETH that recovers $2,500 in assist, as it might present the momentum wanted for a long-term uptrend. On the draw back, if Ethereum misplaced $1,800 in assist, we may see an much more bearish transfer in direction of $1,500 earlier than a possible restoration.

What do RSI and MACD present concerning the subsequent transfer for Ethereum?

The RSI (14) is at present 35.79, which could be very near oversold territory (lower than 30). This means that gross sales strain could also be approaching fatigue and that reduction rally could also be on the horizon. Retaining the RSI above 40 confirms the start of bullish momentum.

Nonetheless, MACD (12, 26) stays wimpy because of the damaging histogram bar. The MACD line is beneath the sign line and checks for a downtrend, however the damaging momentum seems to be slowing down. Because the MACD line crosses the sign line, a bullish development shift is confirmed, signaling a possible gathering.

Ethereum Worth Prediction: Can Ethereum be promoted to $7,000?

To achieve the value of Ethereum of $7,000, it might want to expertise main macroeconomic adjustments and essential elementary catalysts.

- Bitcoin Rally Over $10,000 – ETH usually follows the BTC lead.

- Elevated adoption of Defi and Layer-2 – Ethereum ecosystem development, together with rollups equivalent to arbitrum and optimism, may improve the demand for ETH.

- World Liquidity Enlargement – Liquidity-led gatherings may push ETH to a brand new highest if central banks transfer in direction of coverage easing.

At the moment, ETH costs are removed from the $7,000 goal, however the break above $3,500 is an enormous bullish affirmation, setting a long-term stage of conferences in direction of a better value goal.

Are you shopping for Ethereum now?

At $1,967, Ethereum is buying and selling at an enormous low cost in comparison with its earlier highs. The indications recommend a possible backside formation, however require affirmation by way of costs regenerating main resistance ranges equivalent to $2,100 and $2,500.

For brief-term merchants, ready for a breakout of over $2,100 generally is a safer technique. For long-term buyers, accumulating ETH at present ranges may present a robust return as Ethereum fundamentals proceed to enhance.

$7,000 is an bold purpose, however not unimaginable. As soon as ETH breaks out above $3,500 and Bitcoin reaches a brand new excessive, Ethereum enters the parabolic part, reaching $7,000 within the subsequent bull cycle.