The Ethereum (ETH) market has elevated its current fortune by greater than 5% within the final 24 hours. Regardless of this worth rise, the outstanding Altcoin stays on a downtrend, as proven by its 11.17% loss final week. Nevertheless, the notable analytics platform GlassNode has found key pricing ranges that may present short-term assist.

Traders will enhance the buildup of 300,000 ETH on this worth area – what does that imply?

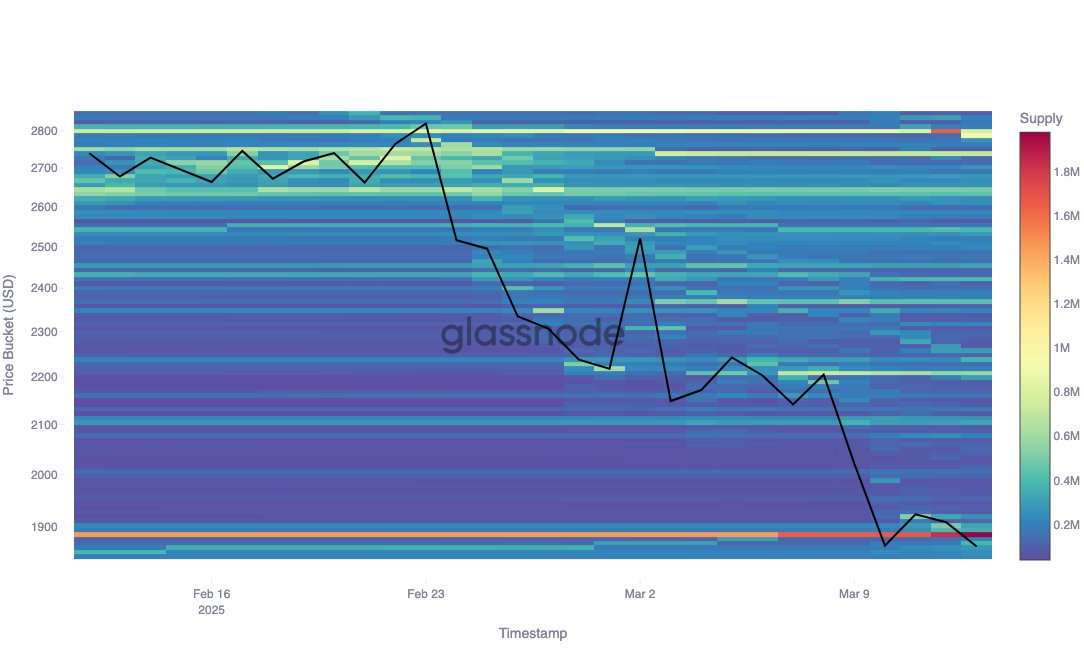

In a submit on March 14th, GlassNode supplied an attention-grabbing evaluation of the ETH market highlighting a robust potential stage of assist. Primarily based on cost-based distribution (CBD) metrics, these analysts imagine that if ETH is additional worth drops, they’re more likely to attain the primary assist zone at a worth stage of $1,886.

Within the crypto market, CBD represents a key on-chain metric that tracks the worth stage the token was final bought or bought. As soon as a big variety of cash are acquired inside a sure worth vary, the zone usually acts as a assist or resistance stage.

In accordance with GlassNode, Ethereum's CBD knowledge exhibits that the $1,886 investor provide has elevated from 1.6 million ETH to 1.9 million ETH. The event assumes that a good portion of traders think about $1,886 a key worth vary and is more likely to create a viable assist zone to extend possession within the area and stop additional declines.

Glassnode factors out that this assumption, per insights from customized yield metric designs, captures price-based yield occasions that exploit the weighted gross sales quantity and use of nonlinear financial ache skilled by traders. Nevertheless, it’s value noting that the $1,886 worth stage can solely present short-term assist, suggesting the opportunity of worth capitulation within the presence of overwhelming gross sales stress.

Ethereum worth overview

On the time of writing, Ethereum is buying and selling at $1,924, following a 5% improve on the final day, as talked about beforehand. In the meantime, every day buying and selling quantity available in the market fell 29.29%, value $129.1 billion. Curiously, the relative power index metric means that Ethereum might shortly enter the world the place it was bought and expertise a worth reversal.

Nevertheless, ETH Bull faces a number of zones of resistance, $2,249, $2,539 and $2,829. In the meantime, if the decisive worth falls beneath $1,886, it might result in low ranges, reminiscent of $1,650 or $1,132.

ISTOCK featured photographs, TradingView chart