- Ethereum value is dealing with renewed promoting stress on the $2,150 resistance stage, signaling the danger of an prolonged downtrend.

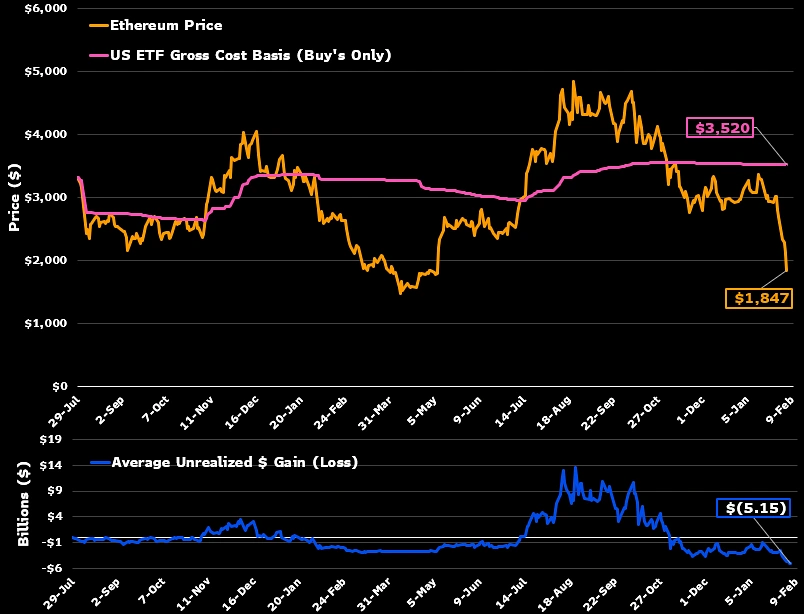

- US Spot Ethereum ETFs are below stress $ETH Buying and selling at a stage nicely beneath buyers' common entry value

- The 20-day exponential shifting common serves as the primary line of protection for sellers to keep up their benefit. $ETH value motion.

Ethereum’s latest rebound from final week’s plunge has already hit the $2,150 wall. The coin value is down 3.9% at the moment, indicating renewed promoting stress and the danger of a continued correction from right here. With market sentiment broadly bearish and spot ETFs buying and selling nicely beneath their common price foundation, Ethereum value is more likely to fall to $1,600 earlier than discovering appropriate help.

Bearish sentiment prevails $ETH ETFs are sinking deep beneath the floor.

In response to social information supplied by Santiment, bears continued to dominate all through the cryptocurrency debate in early February 2026, with bearish posts considerably outnumbering bullish ones. Retail buyers are exhibiting nice concern and hesitation in buying at costs as little as practically $2,000. $ETH BTC is between $68,000 and $70,000 as volatility continues. In distinction, key stakeholders and establishments seem like buying provides with little resistance.

Traditionally, durations of excessive FUD and pessimism are sometimes an indication of capitulation, which will increase the probability of sturdy value rebounds in subsequent market cycles.

Nevertheless, the U.S. Spot Ethereum ETF is below important stress, with the cryptocurrency buying and selling at a value beneath $2,000 and nicely beneath the estimated common price foundation of $3,500 for inflows into the car. In response to Bloomberg ETF analyst James Seifert, this disparity $ETH ETF buyers are in a harder place than Bitcoin ETF buyers. It is because holders participated in these cash at costs near or beneath the present value.

Seifert's evaluation exhibits the drawdown is greater than 57%, with heavy losses piling up by way of most of 2025 and persevering with into early 2026. Web inflows peaked at $15 billion in late 2025, however have since declined to round $11.7 billion to $12 billion, in comparison with internet outflows of solely $3 billion through the recession. Property nonetheless complete about $12 billion, and up to date transactions replicate small every day fluctuations quite than massive liquidations.

Seifert famous that almost all contributors have been holding agency regardless of massive unrealized losses (billions of {dollars} on common). That is much like previous Ethereum cycles, for instance, in April 2025, there was a drawdown of over 60%. Whereas volatility persists and the state of affairs stays tough to achieve confidence in, the resilience is outstanding given its severity.

Ethereum value anticipated to fall 17% earlier than hitting key help

Since final month, Ethereum value has proven a major correction from $3,400 to a low of $1,700, registering 48.8%. Over the weekend, the coin value rebounded following a broader market reduction rally, however failed to offer fast resistance at $2,150.

Immediately's value drop signifies new lows forming highs. $ETHThe every day chart exhibits that the promoting from buyers is rebounding in the identical means. The momentum indicator ADX at 51% highlights the sturdy bearish momentum within the value and suggests the danger of a chronic draw back.

If the promoting continues, Ethereum value might drop one other 17% and relaxation on the long-term help trendline at $1,630.

Since March 2020, $ETH Patrons have managed to regain bullish momentum on this uptrend line, indicating that there’s enough help to reverse the present downtrend.

$ETH/USDT – 1D chart

Consequently, the coin value is poised to enter a short-term consolidation pattern round $1,600 to verify the sustainability of the bullish rebound.

Additionally learn: Pepecoin value close to breakout as whales enhance throughout financial downturn