In keeping with the on -chain knowledge, Ether Leeum Whale has lately elevated the buildup, a sign that may be optimistic for asset costs.

Ether Leeum Whale is bought vastly

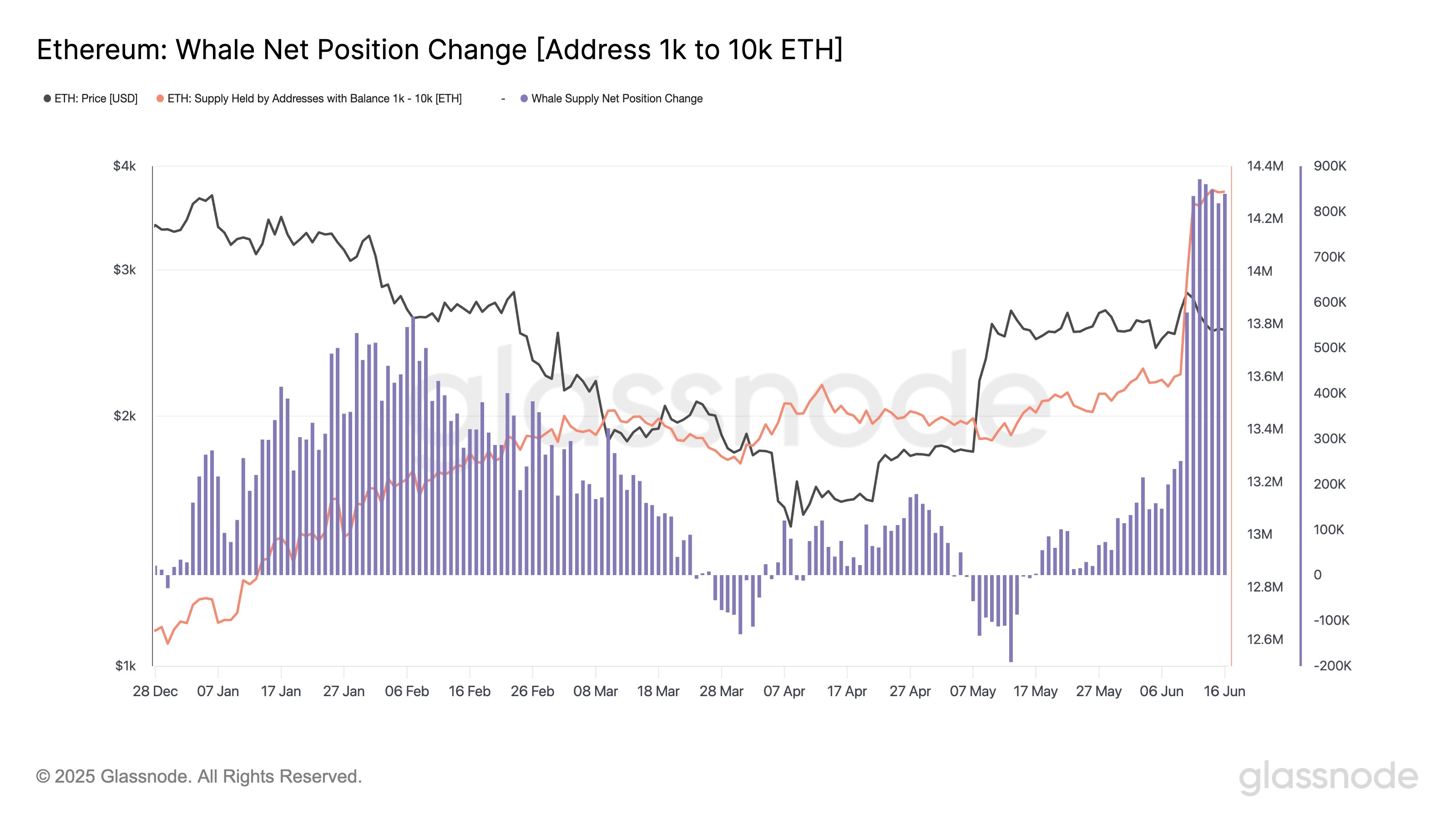

In keeping with the info from GlassNode, a thermal chain evaluation firm, Ethereum Whales participates in a big quantity of accumulation final week.

'Whale' represents an moral investor with 1,000 to 10,000 cryptocurrency tokens. Within the present alternate, this vary is about $ 2.5 million on the backside and $ 25 million from the highest.

This vary doesn’t take care of absolutely the finish of the market, however it accommodates an enormous investor that may nonetheless be thought-about a key a part of the ecosystem. Subsequently, contemplating this function, the motion associated to those holders is price monitoring.

One option to see the conduct of the whale is to by means of the overall quantity of Etherrium provide owned by the whale. Under is a chart shared by GlassNode, which exhibits the pattern of this metrics for the previous couple of months.

The worth of the metric seems to have seen a steep climb in current days | Supply: Glassnode on X

As you possibly can see within the graph, the provision of Ether Leeum Whales has lately been shot, and it’s a signal that enormous -money traders have amassed cryptocurrency. The analyst stated, “For nearly every week, the whale accumulation exceeded 800K ETH for nearly every week, selling a 1k ~ 10K pockets of 14.3m IT.

On the chart, on June 12, a big spike occurred. On this date, ETH Whales added greater than 871,000 ETHs to their retention, the best influx of Cohort.

The newest accumulation acts are usually not notable on this 12 months's viewpoint, but in addition spectacular in historic contexts. GlassNode stated, “This scale has not been seen since 2017. After all, this could be a potential signal that these particular purchases are satisfied of the way forward for the coin.

This highly effective accumulation was discovered within the chain, however in one other side of this sector, SPOT Alternate-Traded Funds (ETF) noticed demand. The SPOT ETF supplies a means for traders to be uncovered to Ether Lum with out traders instantly owned their belongings.

SPOT ETFs are traded on current exchanges, so holders who are usually not aware of cryptocurrency wallets and alternate could be extra simply invested by means of cash.

The Netflow chart shared by GlassNode within the X submit showcase was extremely demand for the US ETH spot ETF.

The pattern within the netflow of the US ETH spot ETFs since their inception | Supply: Glassnode on X

The analyst stated, “We noticed 195.32K ETH flowing in 195.32K ETH ETF final week.

ETH worth

Ether Lee has watched $ 2,700 on Monday, however because the worth has been traded for about $ 2,470 since then, the worth has been weak.

Appears to be like like the worth of the coin has plunged during the last 24 hours | Supply: ETHUSDT on TradingView

DALL-E, GlassNode.com's most important picture, TradingView.com chart

Editorial course of focuses on offering thorough analysis, correct and prejudice content material. We assist the strict sourcing normal and every web page is diligent within the prime know-how specialists and the seasoned editor's crew. This course of ensures the integrity, relevance and worth of the reader's content material.