The whales had been in a rush to show plasma deposits into plasma safes as new chains rapidly supplied alternatives for defi. The Ethereum whales moved funds from their wallets for the primary time in 4 years to take part within the liquidity rush.

The Ethereum whales moved cash from their wallets for the primary time in 4 years and took half within the liquidity rush to the plasma vault. The chain, launched a day in the past, is at present pulling out lively sediments and increasing locked values to a number of Defi apps.

Early fowl Ethereum whales received ETH by means of mining and Bitfinex purchases. Arkham recognized the pockets and famous that the entity moved a complete of $800 million in ETH. The entity holds a complete of $20 billion in comparatively previous wallets, akin to a number of giant Treasury ministries.

The entity has moved its pockets's first exercise prior to now 4 years, 200k ETH.

Alert: $800 million {dollars} have simply moved for the primary time in 4 years

Particular person entities holding $2 billion in $ETH have moved $ETH over $800 million.

Their last transfer was 4 years in the past, and so they wakened and deposited themselves within the plasma. https://t.co/4xtnzkigly

– Arkham (@arkham) September 26, 2025

On-chain knowledge exhibits a pockets It’s tagged as doubtlessly belonging to Bitfinex. It additionally strikes the coin to one of many middleman addresses. The brokerage pockets then borrowed $200 million in USDT from Aave V3 and despatched some tranche funds to PlasmaUSD Vault.

Plasma attracts file values

Plasma is likely one of the quickest rising chains and competes with a number of the largest venues. Inside a day, Plasma USD Vault invited a rush of whale sediment.

The day after its launch, the Plasma USD Vault was equipped with over $212 million in USDT and acquired a continuing. Inflow From whale-sized strikes to retail $5 transactions.

USD vaults are a part of the rising defi sector of plasma. The chain has elevated its preliminary provide of $20 billion in USDT, including extra from whales and supporters. Consequently, it was fed to the plasma. $2.9 billion The whole worth is locked. The chain already hosts Aave and different variations of Defi apps.

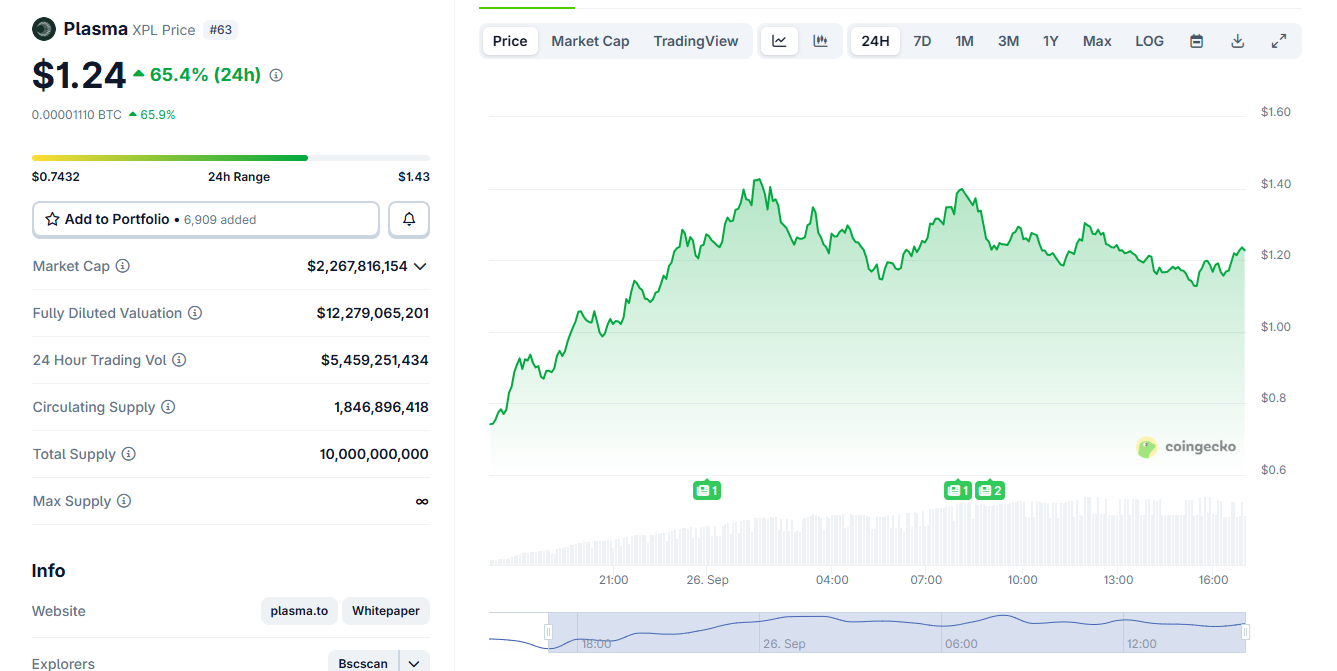

Plasma's XPL retains earnings on the primary day of buying and selling

Plasma's XPL token tapped its enthusiasm for the chain on the primary day of the transaction. The XPL peaked at $1.42, and later held most of its earnings at $1.25.

Plasma's native token XPL repeats at a peak of $1.42 and later retards at $1.25. Supply: Coingecko

The token additionally retained its bullish outlook regardless of even the smallest ICO depositors' bonuses and comparatively giant airdrops. Plasma's pre-sale has been drawn to each whales and retail, however it paid off all with a substantial aerop from XPL. So even retailers who spent as little as a greenback on gasoline and acquired about $10,000 in bonus rewards.

On the identical time, XPL didn't crash like another airdrop tokens, and on the primary day it went into “Up Solely” mode. The token additionally attracted much more consideration from everlasting Dex merchants. Excessive lipids had been larger early in XPL buying and selling Open curiosity In comparison with large-scale centralized exchanges.

Aster, the closest excessive lipid competitor, was unable to faucet the push into XPL as a result of its platform skilled a configuration error. The extraordinary degree of XPL costs was as much as $4, inflicting liquidation. Aster stated the issue is inner and never malicious; Compensate Losses of all affected merchants.